Spot Bitcoin ETF Hits $5B Volume as Bitcoin Surpasses $120K

TLDR

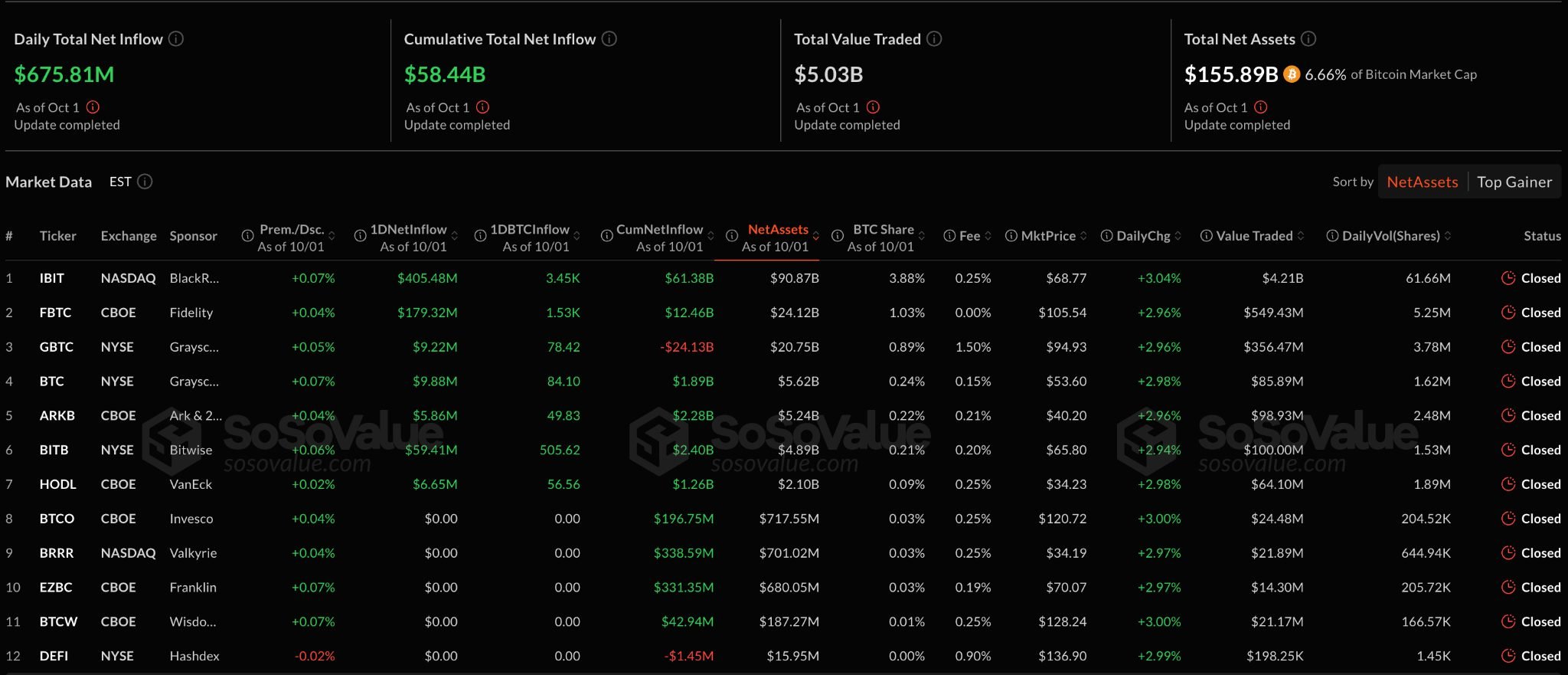

- Spot Bitcoin ETFs surpassed $5 billion in trading volume on October 1, driven by strong demand from institutions.

- Bitcoin’s price surged past $120,000, marking a 10% weekly gain from late September lows.

- BlackRock and Fidelity made significant contributions to the rally, with BlackRock’s Bitcoin Trust seeing $405 million in inflows.

- Vanguard is reevaluating its position on crypto ETFs, considering access for its 50 million customers.

- BlackRock’s Bitcoin and Ethereum ETFs generated over $260 million in annual revenue, reinforcing its dominance in the digital asset space.

On October 1, Spot Bitcoin ETFs saw a dramatic surge, surpassing $5 billion in trading volume. Bitcoin’s price surged above $120,000, marking a 10% weekly increase from the previous month’s low of $109,000. Institutional investors, including BlackRock and Fidelity, played a key role in driving this rally with significant inflows.

Bitcoin ETF Sees Record Inflows and Strong Institutional Interest

The rally was fueled mainly by institutional investors, who contributed $676 million in net inflows on October 1 alone. BlackRock’s iShares Bitcoin Trust recorded a substantial $405 million in net inflows. In addition, Fidelity made an impressive acquisition of 1,570 BTC, valued at $179 million, in a single day.

With Bitcoin’s price surpassing $120,500, trading volume across all markets reached over $50 billion. This surge represents a significant shift in investor behavior, with Spot Bitcoin ETFs increasingly becoming a primary vehicle for institutional players. BlackRock now holds a substantial 773,000 Bitcoin, worth around $93 billion, making it the largest institutional custodian of Bitcoin, with a 3.88% share of the total supply.

Spot Bitcoin ETFs, launched in January 2024, have seen impressive net inflows of $58.44 billion. As of now, total net assets have reached $155.89 billion, representing 6.66% of Bitcoin’s total market capitalization. These numbers underscore the growing interest from institutional investors, who are increasingly turning to Bitcoin ETFs as their primary investment vehicle.

Vanguard’s Changing Stance on BTC ETFs Raises Questions

Vanguard, the world’s second-largest asset manager, is reconsidering its stance on cryptocurrency ETFs. The firm recently removed a key blog post that dismissed Bitcoin as lacking “inherent economic value.” Under the leadership of new CEO Salim Ramji, who has prior experience at BlackRock, Vanguard is now reportedly evaluating whether to allow its 50 million customers access to Bitcoin and Ethereum ETFs.

This potential shift in Vanguard’s stance is significant, given the firm’s size and influence in the investment space. A small percentage of Vanguard’s vast customer base could have a substantial impact on Bitcoin ETF demand. If just 1% of its customers, around 500,000 people, decide to invest, it could bring significant new liquidity into the market.

Vanguard’s reevaluation of its position highlights the increasing significance of Bitcoin ETFs in the investment landscape. It remains to be seen whether the firm will fully embrace crypto ETFs, but its changing approach signals a broader trend in institutional interest.

BlackRock’s Bitcoin and Ethereum ETFs Continue to Lead the Market

BlackRock’s continued dominance in the Bitcoin ETF space highlights its commitment to digital assets. The firm’s Bitcoin ETFs have already generated more than $260 million in annual revenue. Of this, $218 million comes from Bitcoin products, while Ethereum ETFs contribute $42 million.

BlackRock recently filed for a Bitcoin Premium Income ETF, designed as a covered-call strategy to provide yield on Bitcoin holdings. The firm’s total digital asset custody now exceeds $101 billion, comprising investments in Bitcoin and Ethereum. Last week, BlackRock’s Ethereum fund alone recorded $512 million in net inflows, showcasing the growing interest in both major cryptocurrencies.

With $14.1 billion in digital asset inflows in Q2, BlackRock’s digital asset offerings have become one of the fastest-growing sectors within the firm. The firm’s continued expansion into Bitcoin ETFs signals a strong belief in the long-term potential of the cryptocurrency market. Its dominance in this space reflects growing institutional confidence in Bitcoin as a legitimate asset class.

As Bitcoin’s price continues to climb, with technical analysts forecasting potential levels of $128,000 to $135,000, Spot Bitcoin ETFs are likely to remain a crucial component of the crypto investment ecosystem. Despite potential pullbacks, Bitcoin’s trend exhibits a consistent pattern of consolidation followed by breakouts, which supports continued upward momentum.

The post Spot Bitcoin ETF Hits $5B Volume as Bitcoin Surpasses $120K appeared first on CoinCentral.

You May Also Like

Trump’s cyber strategy vows to ‘support the security’ of cryptocurrencies and blockchain

Gold continues to hit new highs. How to invest in gold in the crypto market?