$291M Institutional Inflows Boost Solana Toward $300 — Snorter Token Presale Skyrockets

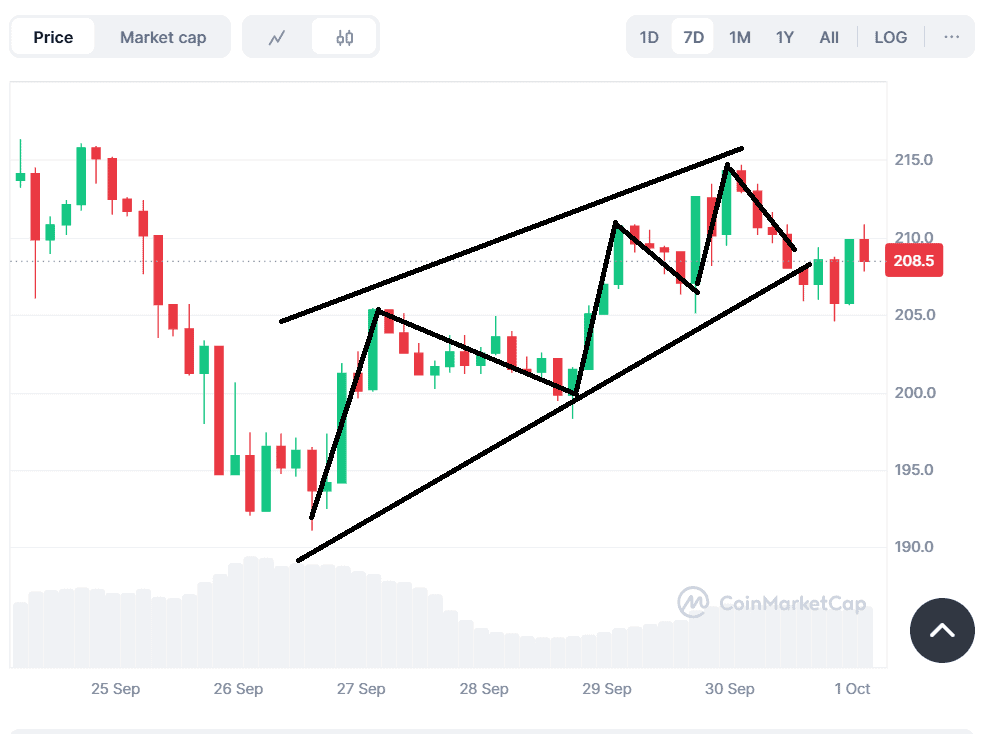

At $208, $SOL’s price is pushing toward a critical resistance zone of $245-$250. With favorable market conditions and sustained demand, $SOL could break higher. A major catalyst for this price action is the approval of spot SOL ETFs, with analysts expecting key decisions to be made in October.

The surge in large institutional inflows has not only boosted investor confidence in Solana itself but has also spilled over to newer SOL-based projects. One standout is the Snorter Token ($SNORT) presale, which is rapidly gaining traction as it capitalizes on Solana’s growing momentum.

Solana’s Momentum Builds: Can ETF Approvals and Network Upgrades Push SOL Higher?

As digital-asset funds across the broader market still show weakness, with approximately $812M in outflows during the past week, according to the latest report from CoinShares, Solana bucked that trend. Institutions poured fresh money into SOL, highlighting the coin’s growing appeal and resilience.

From a technical perspective, $SOL faces a critical resistance zone between $245 and $250, an area where profit-taking could emerge. The coin will require firm conviction and high trading volume to break above this level.

Source: CoinMarketCap

What could fuel Solana’s next leg of momentum? For starters, if regulators approve spot Solana ETFs, that will open the doors for substantial institutional and retail inflows from investors who prefer regulated fund structures.

To add to the fuel, several key developments over the past month have helped shape Solana’s narrative:

- ETF regulatory shifts: The SEC’s streamlining of crypto ETF rules has fueled expectations. With the spot SOL ETF decisions expected to arrive in October, there is a lot of positive buzz not just around Solana, but across digital assets as a whole.

- Relative strength vs. majors: Institutional inflows into Solana have outpaced those into Ethereum and Bitcoin, underscoring a shift in institutional preference.

- Protocol Upgrade: The next exciting upgrade for Solana, Alpenglow, aims to enhance block finality, improving transaction speed from over 12 seconds to 150 milliseconds, which has put Solana back in the spotlight.

- Strategic alliances – Solana’s newer partnerships are expanding Solana’s ecosystem and its practical use cases, raising excitement around $SOL.

Additionally, Solana’s TVL continues to rise, with its ecosystem expanding at a significantly faster pace compared to Ethereum.

Overall, with institutional inflows, spot ETF anticipation, network upgrades, and expanding partnerships, things are looking brighter, not only for $SOL but also for the broader ecosystem of Solana-based projects.

Sub-Second Swaps & RugPull Radar: Snorter Token Redefines Meme Utility

Snorter Token ($SNORT) was launched in May 2025 to raise funds for the development of the Snorter Bot, a Solana meme coin trading bot.

Snorter Bot is a Telegram-based bot that enables lightning-fast, low-fee swaps. As the project’s aardvark mascot represents, Snorter Bot is on a never-ending mission to dig through market data in search of opportunities to deliver to you. It can even take action on your behalf, based on your preset parameters.

Snorter Bot will also:

- Allow you to explore upcoming tokens

- Provide access to copy trading tools for easy and profitable trading strategies

- Offer honeypot and rug pull detection through automated anti-fraud systems

- Facilitate direct and seamless trading within the Telegram app

- Limit orders to protect your trades and schedule buys

The project’s tokenomics and roadmap look promising. 45% of the token supply has been allocated to marketing and rewards, which signals an aggressive push to build visibility through targeted campaigns, influencer partnerships, exchange listings, and community growth.

For early backers, this can translate into stronger demand and liquidity as the project gains more awareness with scaling.

The project has already turned heads by raising $4.1M in presale so far. Whales have demonstrated strong conviction, with noteworthy purchases of $107.1K and $91.1K.

If our expert $SNORT price prediction of $1.92 by 2026 holds, a $500 investment today could be worth roughly $9,014 in one year. Factoring in staking rewards, the value could climb to around $19,2K in just a year. With the next price rise set in just a few days, locking in tokens at the current price could set you up for significant upside.

Don’t wait — Join the Snorter Token presale today.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

China Bans Nvidia’s RTX Pro 6000D Chip Amid AI Hardware Push