Ethereum (ETH) News Today: SWIFT Teams Up With Consensys to Build Blockchain Prototype on Ethereum Network

The trial involves more than 30 global institutions, including BNP Paribas, BNY Mellon, Bank of America, Citi, Deutsche Bank, JP Morgan, and Wells Fargo. The focus is on using Ethereum’s ecosystem — particularly Linea, a Layer-2 scaling solution developed by Consensys — to bring on-chain messaging and payments closer to mainstream banking.

Linea, built as a zkEVM rollup, allows transactions to be processed at lower cost and higher speed while still benefiting from Ethereum’s security.

A Convergence of TradFi and Blockchain

Consensys described the partnership as “a defining moment” for both traditional finance and decentralized finance. According to the company, the project is about merging strengths rather than competing systems.

SWIFT partners with major banks to test Ethereum Layer-2 Linea for on-chain settlement, marking a major step in ETH adoption. Source: @TheValueThinker via X

SWIFT echoed this idea in its own comments, saying the prototype could act as “a secure, programmable ledger” that records and validates payments in real time. The use of smart contracts would allow rules to be enforced automatically, reducing settlement risks and delays.

Why Ethereum Was Chosen

Ethereum’s role in the pilot is significant. While Ripple’s XRP was once promoted for cross-border settlements, the selection of Ethereum shows how institutions are leaning toward its infrastructure. Consensys data indicates that enterprise projects on Ethereum have increased by more than 300% since 2022, underscoring its dominance.

The pilot also ties back to SWIFT’s presentation at Sibos 2025, where it highlighted interoperability as a key focus. A 2023 study from the Bank for International Settlements revealed that 90% of central banks are exploring digital currency interoperability, placing Ethereum at the center of future financial experiments.

Scale of Potential Adoption

The impact of this move could be dramatic if even a fraction of SWIFT’s traffic shifts on-chain. The network handles around 53 million financial messages daily, representing about $7.5 trillion in value.

SWIFT’s $150 trillion payment network is piloting Ethereum’s Linea L2 with over 30 global banks, signaling a seismic shift toward Ethereum as the backbone of cross-border finance. Source: @CryptoGucci via X

For context:

- Ethereum mainnet processed 1.4 million transactions yesterday. Just 6% of SWIFT’s daily volume would double that activity.

- Linea, which recorded 145,000 transactions, would only need 0.51% of SWIFT’s traffic to double its throughput.

If scaled, this could increase demand for ETH as settlement fuel, a factor that analysts often link to long-term Ethereum price predictions.

Broader Implications for Ethereum

The timing of this pilot is notable. With investors closely watching the current ETH price, stories of institutional adoption tend to support the argument that Ethereum is well-positioned for future growth.

Some analysts expect Ethereum to test higher levels in the coming years, with ETH price prediction 2025 scenarios already factoring in stronger institutional interest.

Final Thoughts

SWIFT does not directly handle funds but instead provides the backbone for global financial communication. Its decision to test Ethereum-based infrastructure signals a clear shift — traditional finance is not ignoring blockchain anymore.

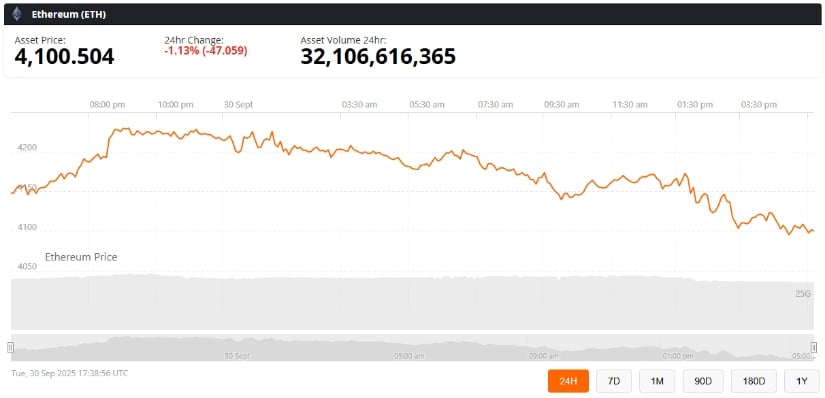

Ethereum (ETH) was trading at around $4,100, down 1.34% in the last 24 hours at press time. Source: Ethereum Price via Brave New Coin

Consensys summed it up: “This is convergence, not competition.” If the prototype develops into a full-scale system, Ethereum could move closer to becoming a standard part of international banking.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

SEC dismisses civil action against Gemini with prejudice