Hypervault Finance Loses $3.6 Million in Suspected Rug Pull

TLDR

- Hypervault Finance had $3.6 million drained from its platform in suspicious withdrawals that were routed through Tornado Cash

- The project’s website, social media accounts, and Discord server all disappeared after the incident occurred

- Security firms PeckShield and CertiK flagged the transactions as an “abnormal withdrawal” with classic rug pull patterns

- Hypervault had recently announced crossing $5 million in total value locked before the funds vanished

- The incident adds to 2025’s costly rug pull trend, including MetaYield Farm’s $290 million drain and Mantra’s $5.5 billion investor losses

Hypervault Finance faces allegations of a rug pull after $3.6 million in cryptocurrency was drained from the platform through suspicious transactions. Security firm PeckShield detected the abnormal withdrawals on September 26, 2025.

The funds were first bridged from Hyperliquid to Ethereum before being converted into ETH. Approximately 752 ETH was then deposited into Tornado Cash, a cryptocurrency mixing service used to obscure transaction trails.

Web3 security provider CertiK identified the specific wallets linked to the suspected withdrawals. The transaction pattern matches common rug pull schemes in decentralized finance.

Following the incident, Hypervault’s website became inaccessible. The project’s official X account, Discord server, and other social media profiles were all deleted.

Platform Background and Claims

Hypervault Finance marketed itself as a decentralized vault protocol offering cross-chain liquidity and yield opportunities. The platform promised annualized yields of over 76% on stablecoins and up to 95% for HYPE liquidity.

The project gained popularity among yield farming investors within the Hyperliquid ecosystem. Hyperliquid is a decentralized exchange specializing in perpetual futures trading on its own layer-1 network.

Just days before the incident, Hypervault announced it had surpassed $5 million in total value locked. The project claimed this milestone showed it was becoming a core liquidity aggregation layer within the HyperEVM ecosystem.

According to DefiLlama data, Hypervault had $6.01 million in total value locked as of Thursday. The platform has since added a “rug pull” notice for the project.

DeFi Rug Pull Trends

The incident highlights ongoing risks in decentralized finance platforms. Rug pulls occur when developers drain liquidity pools and abandon projects, leaving investors with worthless tokens.

Several major rug pulls have occurred in 2025. MetaYield Farm drained $290 million from investors in February before disappearing entirely.

The Mantra protocol collapse represented another major incident. Insider wallets moved $227 million in tokens, causing OM’s price to crash over 90% and resulting in $5.5 billion in total investor losses.

These schemes often target retail investors through aggressive marketing campaigns. Founders typically exit once liquidity reaches peak levels.

Current Status

No statement has been issued by Hypervault’s team regarding the missing funds. The use of Tornado Cash to obscure transaction trails is commonly associated with exit scams.

The broader Hyperliquid ecosystem remains operational with $2 billion in total value locked. Recent proposals include USDH, a Hyperliquid-aligned stablecoin that has attracted attention from traditional finance companies like VanEck and StateStreet.

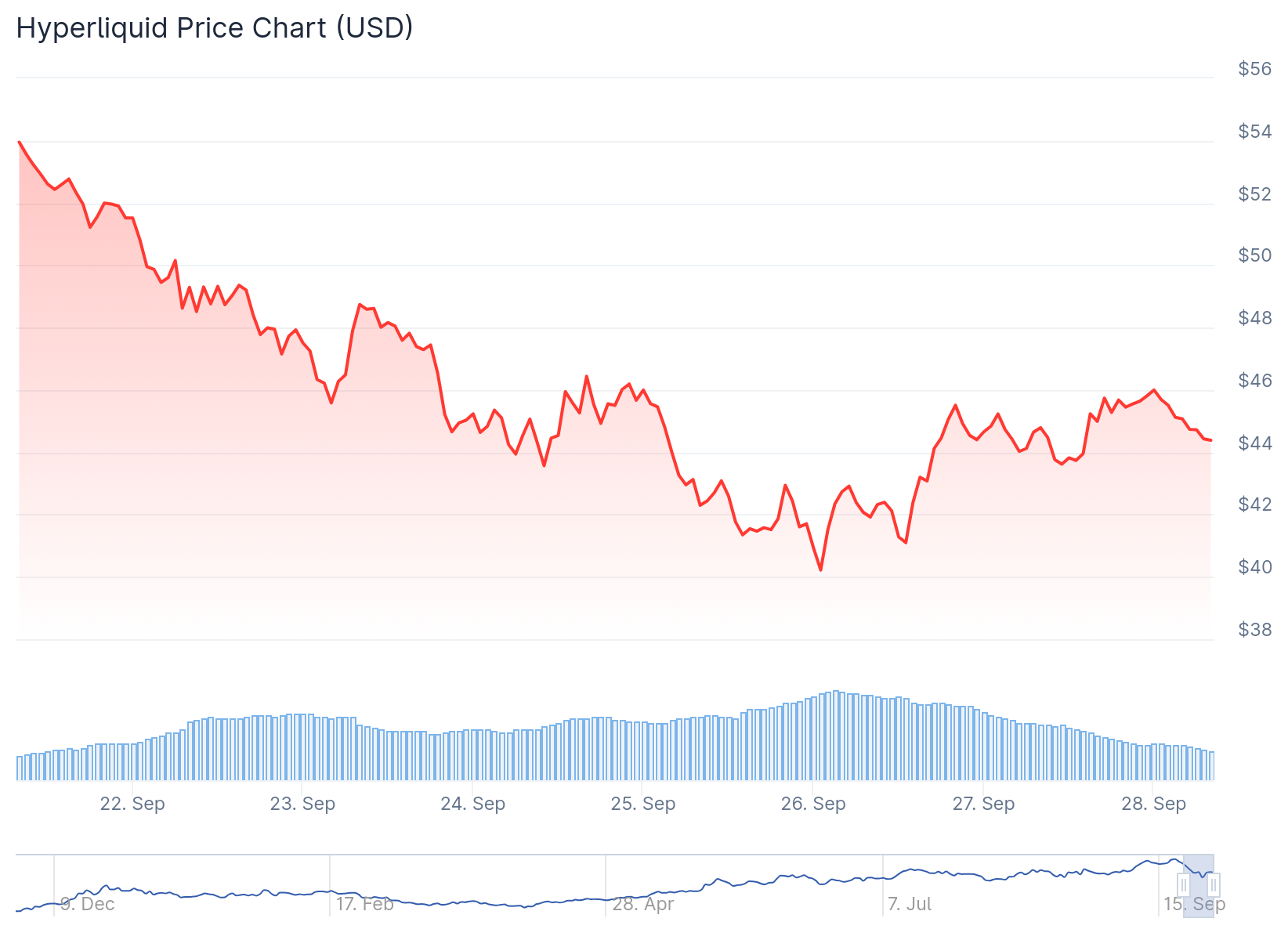

Hyperliquid (HYPE) Price

Hyperliquid (HYPE) Price

HYPE token currently trades at $44, up 0.9% on the day according to CoinGecko data, despite the Hypervault incident.

The post Hypervault Finance Loses $3.6 Million in Suspected Rug Pull appeared first on CoinCentral.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

China Bans Nvidia’s RTX Pro 6000D Chip Amid AI Hardware Push