Coinbase (COIN) Stock Falls 6% as Mizuho Raises Price Target to $300. Time To Buy?

TLDR

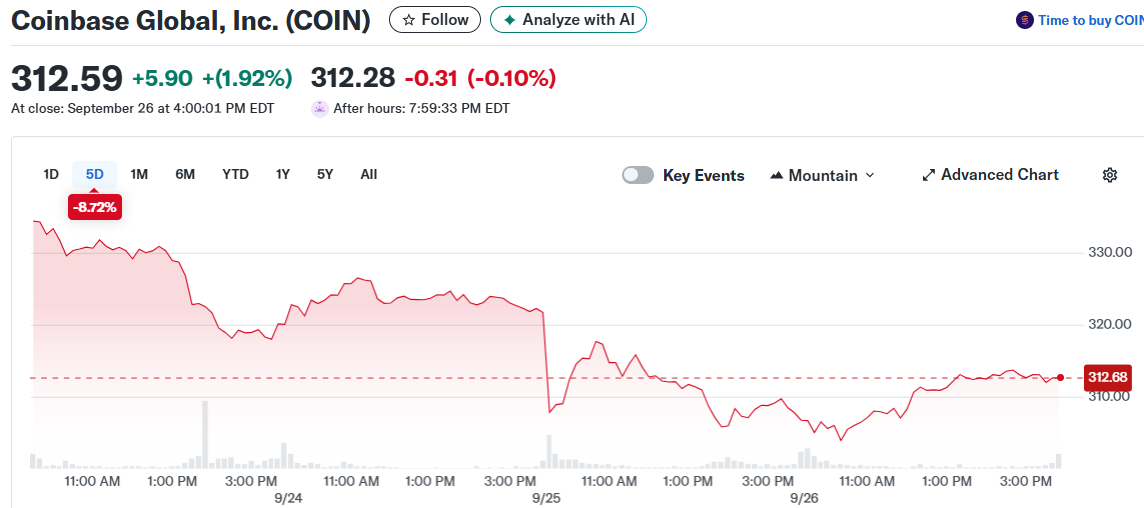

- Coinbase stock dropped 6% this week to $312.59 as crypto market sell-off reduced trading volumes

- Q2 earnings disappointed with transaction revenue down 39% quarter-over-quarter and higher operating costs

- Mizuho raised price target to $300 from $267, citing benefits from potential interest rate cuts

- Security concerns and regulatory scrutiny continue to weigh on investor sentiment

- Trading activity expected to increase when interest rates are lower, boosting commission revenue

Coinbase shares have had a rough week, falling 6% to $312.59 as the broader cryptocurrency market experienced another sell-off. The exchange operator’s stock continues to move in lockstep with Bitcoin and Ethereum prices, making it vulnerable to crypto market swings.

Coinbase Global, Inc. (COIN)

Coinbase Global, Inc. (COIN)

Recent liquidations in digital assets have slashed trading volumes across the platform. This directly impacts Coinbase’s bottom line since transaction fees make up a large portion of their revenue stream.

The company’s Q2 earnings report didn’t help matters either. Transaction revenue plummeted 39% from the previous quarter, while subscription and services revenue also came in below expectations.

Operating expenses climbed higher during the quarter. The company disclosed one-time costs related to a data breach, which further squeezed profitability margins.

Analyst Upgrade Provides Some Relief

Despite the recent weakness, Mizuho analyst Dan Dolev upgraded his price target on Coinbase to $300 from $267. The firm maintained its Neutral rating but highlighted several positive factors.

Dolev pointed to the company’s cost management efforts and potential secular growth trends. He believes exchanges like Coinbase are well-positioned to benefit from interest rate cuts.

Lower rates typically drive more trading activity as investors seek higher returns. This increased volume would boost Coinbase’s commission-based revenue model.

The analyst noted that consumer lenders, bank processors, and exchanges stand to gain the most from a lower rate environment. Trading commissions tend to rise when borrowing costs decrease.

Regulatory Headwinds Persist

Security vulnerabilities remain a concern for investors. Past cyberattack reports continue to hang over the company’s valuation.

The SEC’s ongoing oversight adds another layer of uncertainty. Investors worry that tighter regulations could limit Coinbase’s ability to expand its product offerings.

These regulatory risks make the stock particularly sensitive to negative news cycles. When weak earnings combine with broader market uncertainty, Coinbase shares tend to see deeper swings.

The company has been working to transform itself into a comprehensive crypto “super app.” CEO Brian Armstrong has outlined plans to compete more directly with traditional banking services.

Other brokerage stocks showed mixed performance this week. Robinhood closed near $122 despite some volatility, while Interactive Brokers held steady around $66.

Charles Schwab gained modestly to about $95.50, supported by steady client asset inflows. The wealth management giant continues to benefit from its diversified revenue streams.

Coinbase’s correlation with crypto prices makes it more volatile than traditional brokers. The company’s transaction-based model amplifies both gains and losses during market cycles.

Current trading volumes remain below peak levels from earlier crypto bull markets. This cyclical pressure continues to weigh on the exchange operator’s near-term prospects.

Mizuho’s upgraded price target suggests some optimism about the company’s long-term positioning despite current headwinds.

The post Coinbase (COIN) Stock Falls 6% as Mizuho Raises Price Target to $300. Time To Buy? appeared first on CoinCentral.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

China Bans Nvidia’s RTX Pro 6000D Chip Amid AI Hardware Push