FTX Recovery Trust Sues Genesis Digital for $1.15 Billion

FTX Recovery Trust sues Genesis Digital Assets for $1.15B, alleging Sam Bankman-Fried misused customer funds before collapse.

The FTX Recovery Trust has launched a major lawsuit against crypto mining company Genesis Digital Assets (GDA), as part of its ongoing effort to recover lost funds for creditors.

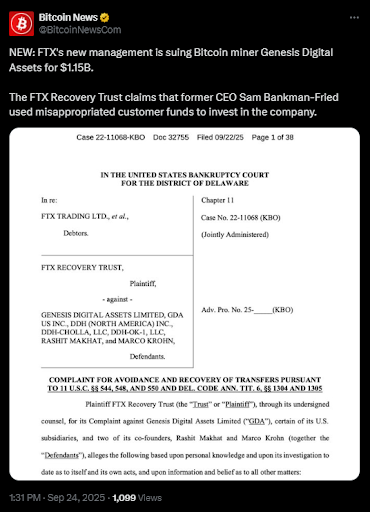

The complaint, filed in the US Bankruptcy Court for the District of Delaware, seeks to claw back $1.15 billion that former FTX CEO Sam Bankman-Fried allegedly diverted into GDA at inflated prices.

FTX Recovery Trust Targets Genesis Digital in New Case

The lawsuit is the latest attempt by the FTX Recovery Trust to recoup money tied to FTX’s collapse in 2022. According to the filing, Bankman-Fried used both Alameda Research and direct transfers to funnel more than $1 billion into GDA between 2021 and 2022.

FTX is attempting to claw back $1.15 billion from Genesis Digital

FTX is attempting to claw back $1.15 billion from Genesis Digital

Court documents also allege that Alameda, under CEO Caroline Ellison, spent over $500 million on 154 preferred shares of GDA at “outrageously inflated prices.”

On top of that, Bankman-Fried reportedly sent another $550.9 million directly to GDA co-founders Rashit Makhat and Marco Krohn for additional shares.

The complaint argues that these transfers were not legitimate investments. Instead, they were designed to benefit Bankman-Fried personally as the 90% owner of Alameda.

By overstating GDA’s valuation, he stood to capture nearly all possible upside while passing losses onto FTX customers and creditors.

Alleged Misuse of Customer Funds

The filing paints a picture of reckless spending at the expense of users. By 2021, Alameda had already borrowed billions in customer deposits from FTX.com. Despite its rising debt, Bankman-Fried continued to push for high-priced GDA purchases.

Court records also claim Bankman-Fried ignored obvious red flags when backing GDA. At the time, the company was operating in Kazakhstan during a nationwide energy crisis.

Its financial statements were allegedly unreliable and “bore no relation to reality.”

The trust argues that these actions show a pattern of fraud against both customers and creditors. The transfers, it says, were not just poor decisions but deliberate misuse of funds.

Recovery Efforts Already Returning Billions

This lawsuit is part of a series of recovery moves by the FTX Trust. Since FTX’s bankruptcy, the trust has been working through settlements and clawback cases to return funds to creditors.

In 2023, Genesis Global Trading, which is unrelated to GDA, agreed to a $175 million settlement with FTX. Other cases have targeted recipients of loans, political donations, and sponsorship deals tied to FTX’s collapsed empire.

So far, creditors have received over $6 billion. Payments began with a $1.2 billion distribution in February of this year, followed by $5 billion in May. Another $1.6 billion release is scheduled for September 30.

Challenges for Creditors

While repayments have provided some relief, they are still a point of tension. Most creditors are recovering only a fraction of their original assets.

To make matters worse, repayments are calculated based on crypto prices at the time of FTX’s collapse in November 2022.

Bitcoin was valued at around $20,000 when the exchange failed. Since then, its price has surged to between $90,000 and $112,000. That means many creditors are receiving far less than the current value of the assets they lost.

Some creditors argue this approach is unfair, but bankruptcy law typically requires valuation at the date of filing. As a result, debates are still ongoing over whether creditors should be compensated based on the current or present-day prices.

The post FTX Recovery Trust Sues Genesis Digital for $1.15 Billion appeared first on Live Bitcoin News.

You May Also Like

When is the flash US S&P Global PMI data and how could it affect EUR/USD?

BetFury is at SBC Summit Lisbon 2025: Affiliate Growth in Focus