Nvidia (NVDA) Stock: Partnership with Intel Drives $150 Billion Market Value Surge

TLDR

- Nvidia invested $5 billion in Intel to create a partnership for custom x86 CPUs and integrated GPU-CPU designs

- Nvidia’s market value jumped $150 billion following the announcement, 30 times larger than its Intel investment

- William Blair analyst maintains Buy rating, citing incremental revenue opportunities and $50 billion TAM expansion

- Partnership targets 220 million AI PC shipments expected by 2028 using x86 architecture

- Deal pressures AMD while giving Intel new data center customers and foundry funding

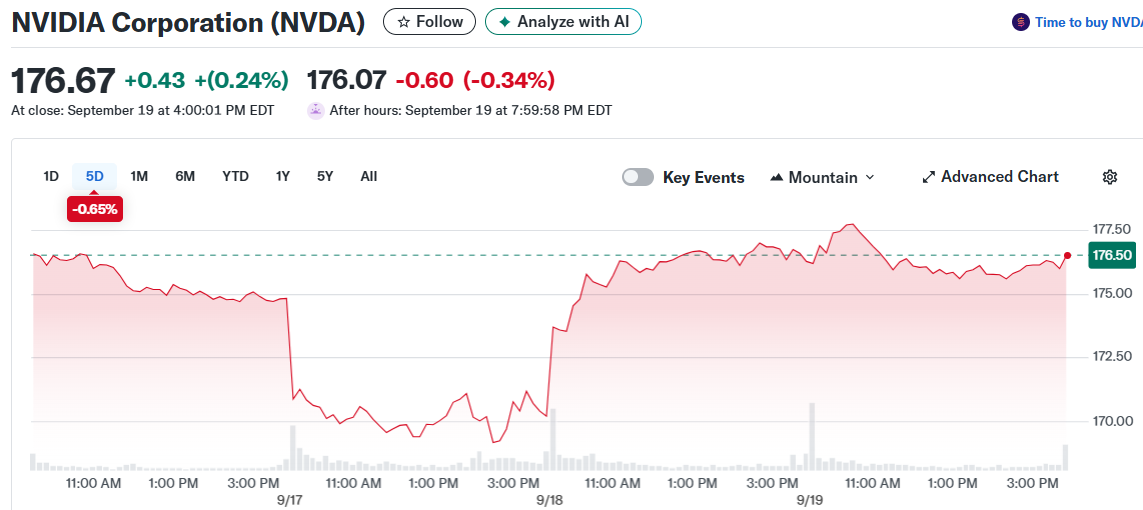

Nvidia’s $5 billion investment in Intel has created waves across Wall Street. The chip giant’s market value jumped from $4.13 trillion to $4.28 trillion in just one day.

NVIDIA Corporation (NVDA)

NVIDIA Corporation (NVDA)

The partnership will see Intel build custom x86 CPUs for Nvidia’s data center platforms. It also includes plans for chips that combine Intel processors with Nvidia RTX GPU chiplets for personal computers.

The deal spans both data center and consumer markets. Huang pointed to the massive scale of potential demand in the notebook market alone.

Analyst Sees Revenue Growth Potential

William Blair analyst Sebastien Naji maintained his Buy rating on Nvidia stock. He views the Intel partnership as a win for both companies.

Naji noted that Intel gains a new customer in the data center market. The partnership also provides funding for Intel’s foundry goals.

For Nvidia, the deal expands access to the large x86 ecosystem. It also enhances the company’s potential in the integrated GPU PC market.

Market Expansion and Competitive Pressure

The partnership boosts Nvidia’s total addressable market by roughly $50 billion according to CEO Huang. This expansion puts additional pressure on rival Advanced Micro Devices.

IDC projects about 220 million AI PC shipments in 2028 using x86 architecture. This represents a massive incremental market opportunity for Nvidia.

Naji expects Nvidia to sustain robust growth backed by hyperscaler spending. The company also benefits from accelerating momentum from neocloud, sovereign, and enterprise customers.

The investment reflects confidence in long-term market trends. Both companies see the partnership as addressing future computing needs.

Products from the collaboration are not expected to arrive for several years. However, investors are already pricing in the potential benefits.

The partnership represents a turning point for both companies’ approaches to AI and consumer computing. Intel gets much-needed support while Nvidia expands its market reach.

Wall Street maintains a Strong Buy consensus on Nvidia stock based on 35 Buy ratings. The average price target of $211.69 suggests 20% upside potential from current levels.

The post Nvidia (NVDA) Stock: Partnership with Intel Drives $150 Billion Market Value Surge appeared first on CoinCentral.

You May Also Like

Sumitomo Mitsui Plans JGB Portfolio Expansion Amid Yield Changes

Federal Reserve Lowers Interest Rates Again