Solana (SOL) Price: Corporate Giants Stack Tokens as New All-Time High Approaches

TLDR

- Solana (SOL) is trading 19% below its all-time high of $294, with technical analysis targeting $300-$400

- Corporate demand is growing with Forward Industries holding the largest SOL stash and establishing a $4 billion buying program

- SOL broke out of an ascending channel pattern and is testing key resistance at $243-$262

- Fibonacci extension levels suggest potential targets of $363 and $473 if price discovery begins

- Social dominance has reached 11% while institutional backing includes new ETF listings and corporate treasury adoption

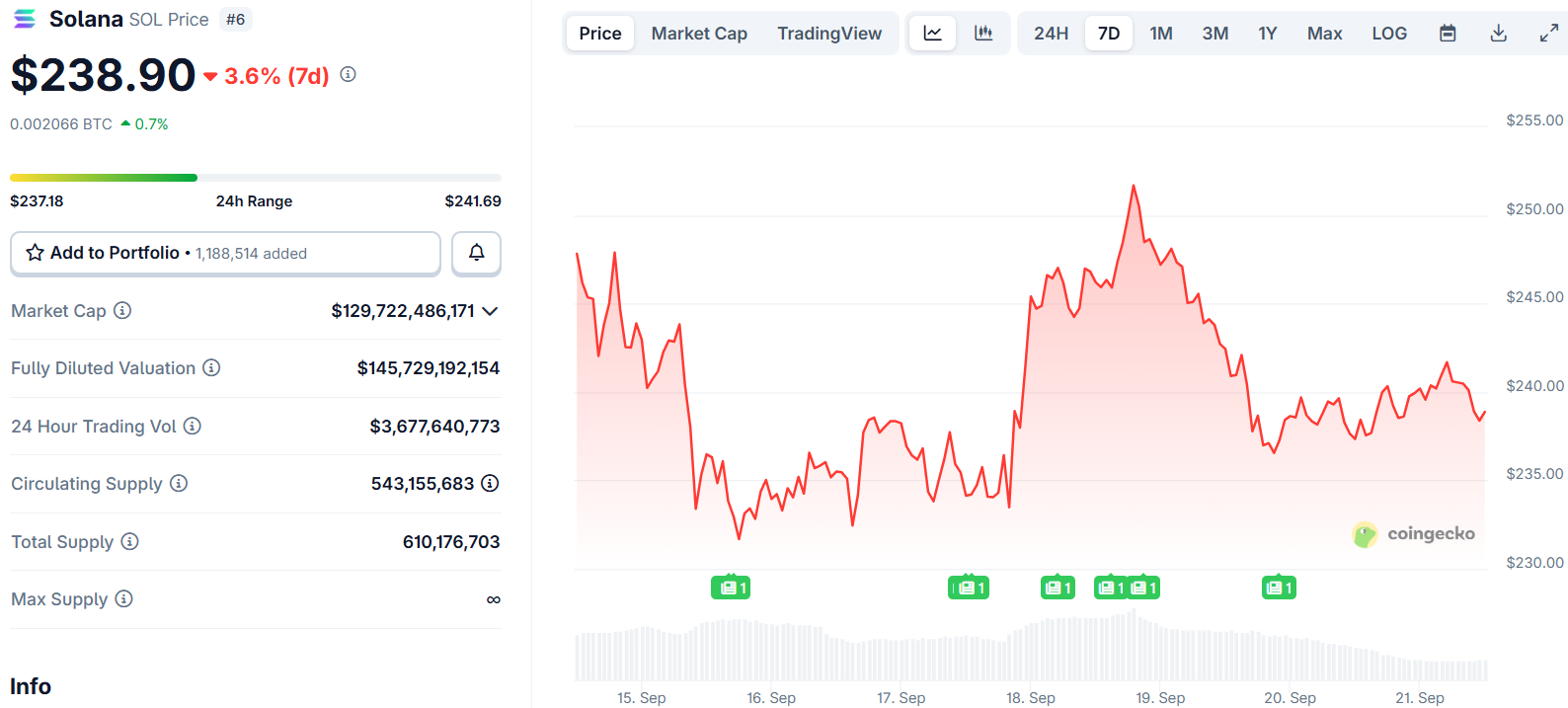

Solana has recovered strongly in September, positioning the altcoin within reach of its record high. The cryptocurrency is trading just 19% below its all-time high of $294 at current levels.

Solana (SOL) Price

Solana (SOL) Price

Technical analysis shows SOL has broken out of an ascending channel pattern on the daily chart. Bulls are now testing a key resistance band near $243, which aligns with recent swing highs and rejection wicks.

The altcoin is trading above its 20, 50, and 200-day exponential moving averages. The 20-day EMA has provided dynamic support for nearly a month, cushioning pullbacks during the recent rally.

A daily close above $243 could trigger a volatile move toward the mid-$240s and the psychological $250 level. This resistance area has relatively low historical trading volumes, which could amplify price movements.

Source: TradingView

Source: TradingView

SOL’s momentum has cooled in the near term. The daily Relative Strength Index dropped from overbought territory to around 61. The MACD indicator is trending lower and threatening a bearish crossover.

If bulls defend the 20-EMA around $226, the path to a $250 retest remains open. Technical analysts have identified a rounded bottom pattern formed earlier this year, supporting the $300 target.

Corporate Treasury Adoption Accelerates

Forward Industries now holds the largest stash of SOL among public companies. The firm has established a $4 billion at-the-market program to continue adding to its holdings.

This corporate mandate could translate into steady demand over time. Brera Holdings recently rebranded to “Solmate” alongside a $300 million investment round led by UAE-based Pulsar Group.

The investment round included participation from ARK Invest and the Solana Foundation. The announcement initially sent Brera’s shares higher before volatility set in.

Treasury company reserves have seen steady accumulation of SOL tokens. This corporate adoption trend provides fundamental support for long-term price appreciation.

Grayscale’s CoinDesk Crypto 5 ETF has begun trading on NYSE Arca. The fund offers regulated exposure to five top digital assets, including Solana with a single-digit weighting.

Price Discovery Targets Emerge

Fibonacci extension levels indicate potential targets of $363 and $473 if SOL enters price discovery mode. The rounded bottom formation suggests these levels are achievable in the coming months.

After bottoming at $8, the two-year rally included periods of slow consolidation and explosive upward movement. SOL reached $295 in late 2024 before retracing to $95.2 in April.

The April drop fell just below the 61.8% retracement level at $117.95. Since breaking above this key Fibonacci level, Solana has rallied consistently higher.

In an extreme scenario where Bitcoin reaches $150,000-$160,000, SOL could potentially reach $583. This target depends on continued capital rotation from Ethereum into Solana.

Social dominance data shows Solana commanding 11% of Web3 conversations. This represents more than one in ten crypto discussions mentioning SOL.

The altcoin’s high daily token volume and outperforming Ethereum could drive continued gains into Q4 2025. Spot flows have shown strong outflows while taker CVD moved to neutral from seller-dominant territory.

The post Solana (SOL) Price: Corporate Giants Stack Tokens as New All-Time High Approaches appeared first on CoinCentral.

You May Also Like

New Zealand RBNZ Interest Rate Decision in line with expectations (2.25%)

Mississippi holds hearing on xAI data center amid environmental lawsuit threat