Shiba Inu Team Unveils Transformative Privacy Upgrade for Shibarium & BONE

- Zama and the Kohaku upgrade enable Shibarium to offer private, quantum-resistant smart contracts.

- The TokenPlay AI deal turns SHIB into a real in-app currency.

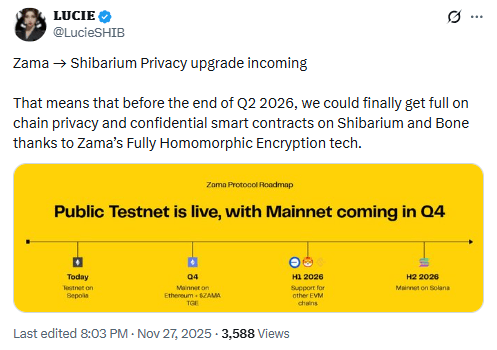

According to Zama’s updated roadmap, the public testnet is now live on Sepolia, and the team is aiming to launch on Ethereum in the fourth quarter. After that, they’re looking to roll out support for other EVM chains in the first half of 2026, followed by an expansion to Solana’s mainnet in the second half of the year.

Source: X

Source: X

Against this backdrop, Shiba Inu ecosystem team member Lucie wrote on X that Zama’s technology will power a Shibarium privacy upgrade. She said that before the end of the second quarter of 2026, Shibarium and Bone could gain full on-chain privacy and confidential smart contracts through Zama’s fully homomorphic encryption stack. If the timeline holds, Shibarium would align its privacy rollout with Zama’s broader multi-chain expansion.

Kohaku Upgrade Lays the Crypto Foundations for Shibarium

Meanwhile, the Kohaku upgrade, unveiled by Vitalik Buterin at Devcon 2025, as noted in our earlier post, introduces a modular privacy framework for Ethereum that Shibarium can inherit. It brings quantum-resistant signatures based on Dilithium schemes and a new stealth-address standard so wallets can receive funds without exposing public identity. Ethereum researchers argue this shift is needed before quantum computers can break today’s ECDSA signatures, which they tentatively place around 2028.

Kohaku also changes Shibarium’s economics once it plugs into the framework. Privacy transactions that rely on zero-knowledge proofs use far more gas than standard transfers, with benchmarks suggesting workloads equivalent to roughly 15–20 normal token moves. On Shibarium, that extra computation is paid in BONE, which turns the token into fuel for heavy cryptographic processing instead of only serving as a basic gas asset.

The higher gas load then feeds into Shibarium’s burn contracts, where accumulated BONE is swapped for SHIB and permanently removed from circulation, potentially accelerating the burn cycle if private volume grows.

Regulatory design is part of Kohaku as well. The framework bundles “Privacy Pools”, which let users prove their funds are not tied to sanctioned or hacked wallets without disclosing full transaction histories. For Shibarium, adopting these tools would offer what the Shib team calls “clean privacy,” aimed at institutions that need confidentiality but must follow anti-money-laundering rules.

Shibarium’s sidechain architecture cannot rely on automatic inheritance. Developers must manually adapt the privacy SDK to Heimdall and Bor nodes and optimize wallets and validators for data-heavy private blocks.

Shiba Token’s TokenPlay AI Deal Adds Utility for SHIB

Moreover, Shiba Token announced a new partnership with TokenPlay AI. The deal, as highlighted in our previous article, connects SHIB to a “token OS” that can run Shiba-themed apps inside chat, gaming, and interactive dashboards.

Source: X

Source: X

Through this integration, SHIB can move from passive holding to active in-app use. Users will be able to earn and spend SHIB inside the first Shiba-branded miniapp and then cycle it through repeat gameplay and rewards.

]]>You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

USDT-Driven AI IPO Race: Anthropic and OpenAI Eye $300B Valuation in AI+Crypto Play