Thinking about Ethereum block builder Titan’s monopoly with Flashbots: How chain abstraction can unlock development opportunities?

Author: Austin King , Co-founder and CEO of Omni Network

Compiled by: Felix, PANews

Few people know that just two companies create 90% of Ethereum blocks. However, even fewer people know the story behind this monopoly.

Here’s the untold story of Titan, over $40M in hidden profits, and how chain abstraction will usher in even greater opportunities.

beginning

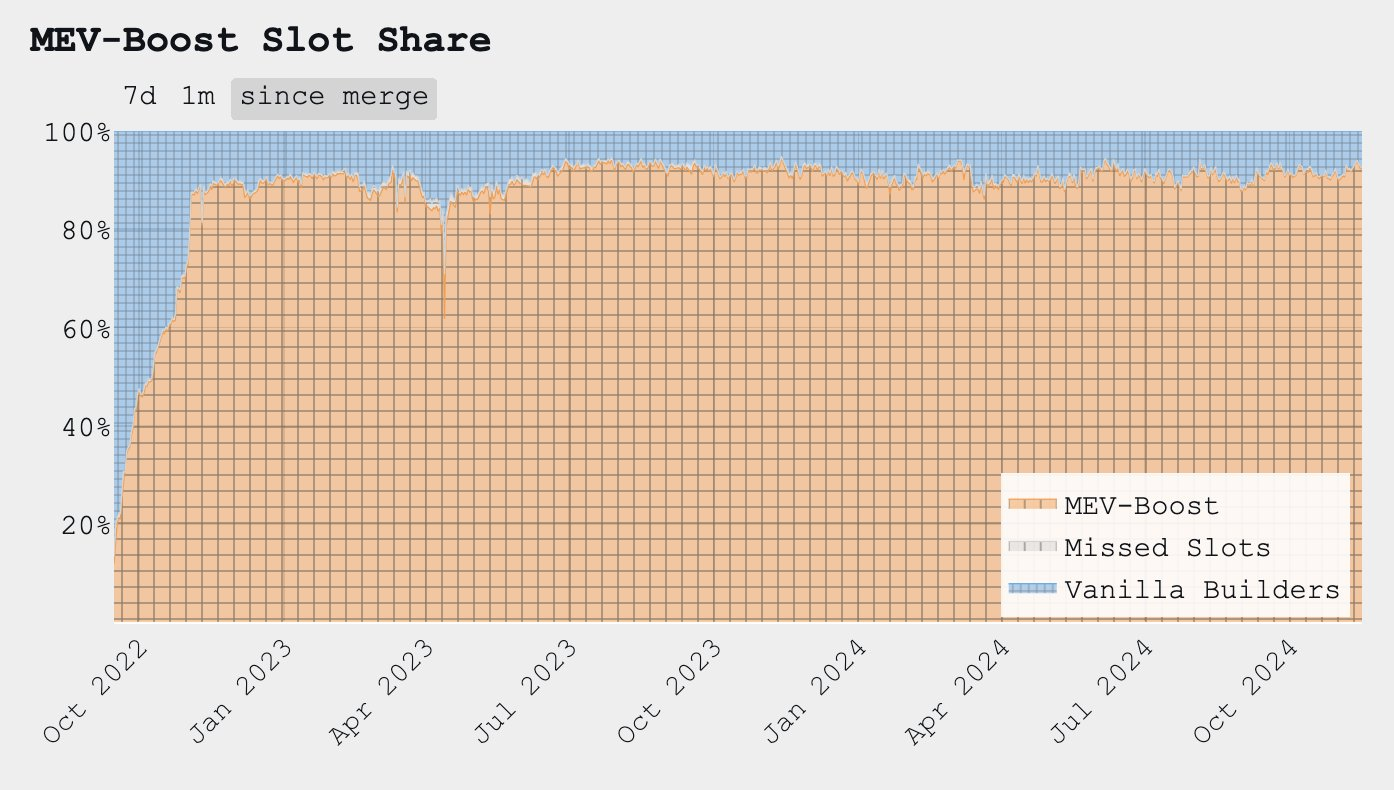

It all started at the end of 2022, when Flashbots created MEV-Boost, a software that allows Ethereum L1 validators to obtain transaction blocks from third parties (called builders, which specialize in MEV extraction), which allows validators to make more money. After this, almost all Ethereum L1 validators quickly started running this software:

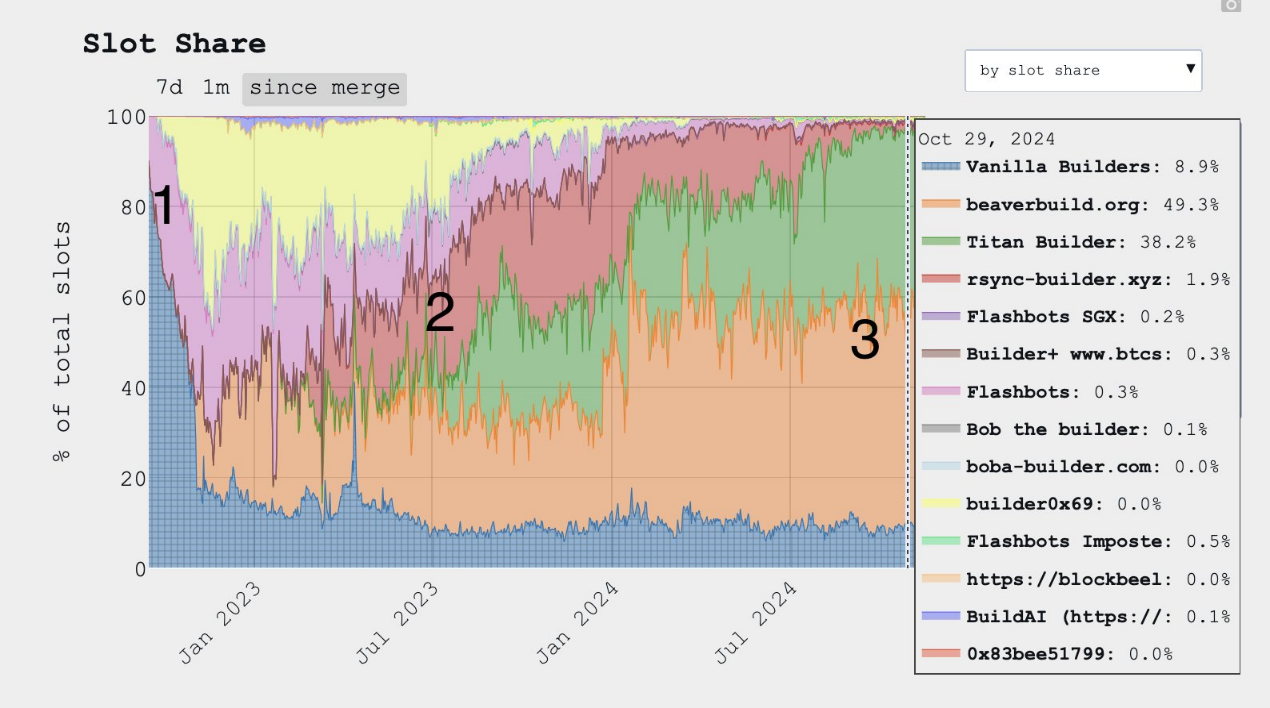

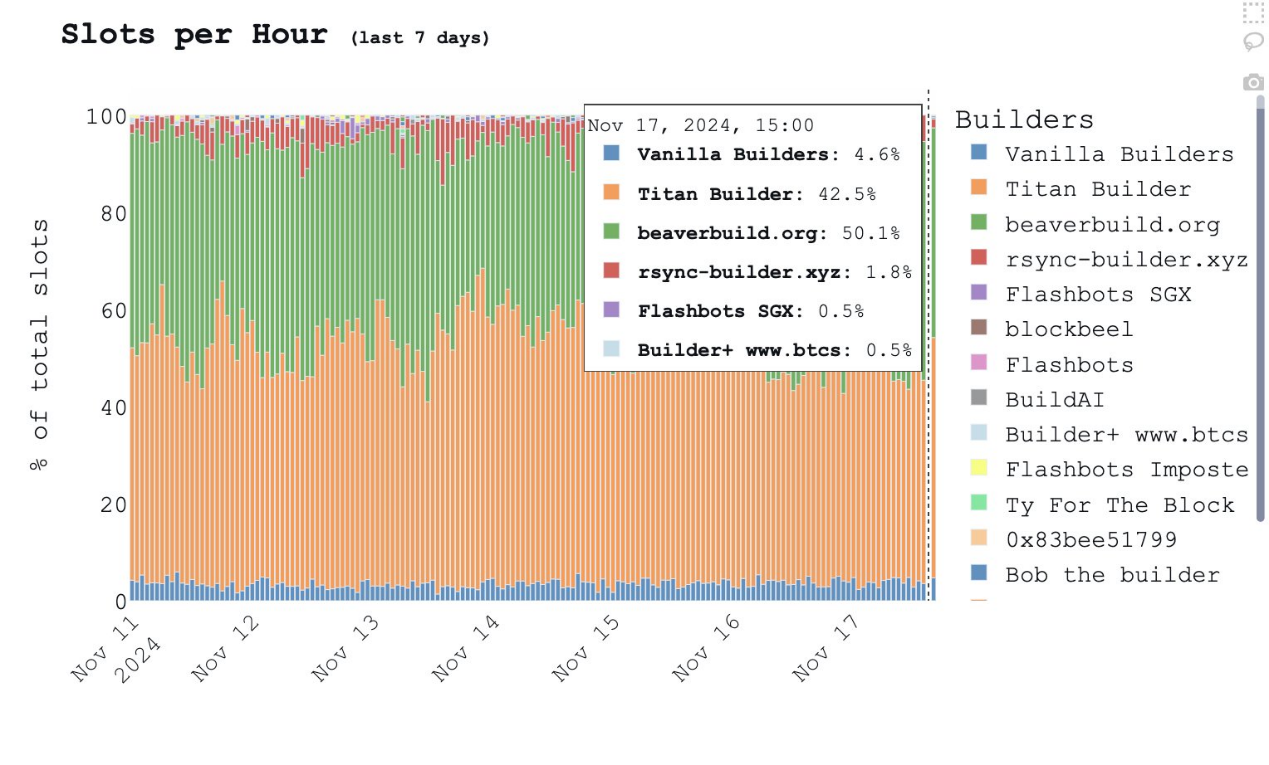

Refer to the picture below, initially (#1) Flashbots (pink) was the only running "Builder", and half a year later fierce competition emerged (#2). Now, there are only 2 important builders (#3): Beaver and Titan.

Obviously, a lot of things happened during this period, but one of the most impactful events was when Titan reached an exclusive order flow (EOF) agreement with Banana Gun — who later became a top Telegram trading bot — in April 2023. After this EOF deal occurred, Titan had the opportunity to build more profitable blocks for L1 validators than any other builder, as they had exclusive access to deals that offered higher rewards.

After this, more than 90% of Ethereum L1 transactions came from two companies (Beaver and Titan).

Even more interesting are the earnings statistics as of August this year:

Flashbots

- About 550,000 blocks created

- Profit 16.7 ETH

Titan

- About 600,000 blocks created

- Profit 13,151 ETH

At today's prices, the difference is $44 million.

While this is public data, some interesting questions remain:

- Why did Banana Gun choose to route its bundled services almost entirely to Titan when it had less than 1% market share?

- Did Titan strike a multi-million dollar deal with the Banana Gun team at the outset to boost market share?

- Is Titan promising kickbacks to the Banana Gun team to the detriment of its users?

The specific circumstances are unknown, and perhaps few people know this information.

As co-founder and CEO of Omni Network, why would Austin King take the time to think deeply about such a deal?

Because chain abstraction will unlock greater profit opportunities. The market is rapidly shifting to focus on crypto user experience (users don't think about gas, transaction submission, which chain to trade on, etc.), and the next wave of users will be far less "complex" than today's crypto users. New users will not care how all this happens, and there will be more such opportunities downstream of this abstraction, and each network can obtain a large source of income.

Today, OMNI’s 2 core primitives (EVM + Interop) are destroyed when used. However, few people understand that there is a business opportunity when revenue opportunities in the order flow supply chain are introduced directly into the core model of the token.

Related reading: Vitalik proposed a new concept of block construction, aiming to reconstruct the Ethereum ecosystem?

You May Also Like

Wholecoiner Inflows to Binance Hit Cycle Lows, Signaling Reduced Sell Pressure

Coinbase Vs. State Regulators: Crypto Exchange Fights Legal Fragmentation