Ripple’s XRP Supply Shrinks Fast: Could $10 Be Next This Cycle?

Ripple’s XRP token is once again drawing attention. Large amounts of the token are leaving major exchanges, including Upbit and Binance. The last time this happened on Upbit in late 2024, the asset’s price rose sharply. Now, similar outflows are being seen, raising questions about what might come next.

XRP Supply on Upbit Is Falling Again

In November 2024, XRP reserves on Upbit dropped from 6.6 billion to under 6 billion. During that time, the token surged from $0.5 to $3.29, according to analyst CW. This drop in available supply was followed by a strong rally.

A similar move appears to be happening now. In early January 2026, XRP reserves on Upbit started falling again. As that happened, its price climbed to around $2.3. Fewer tokens on the exchange often suggest reduced sell pressure, as more users move their holdings to private wallets.

However, the current drop isn’t as sharp as the one seen in 2024, but the pattern is familiar. Traders are watching to see if history will repeat.

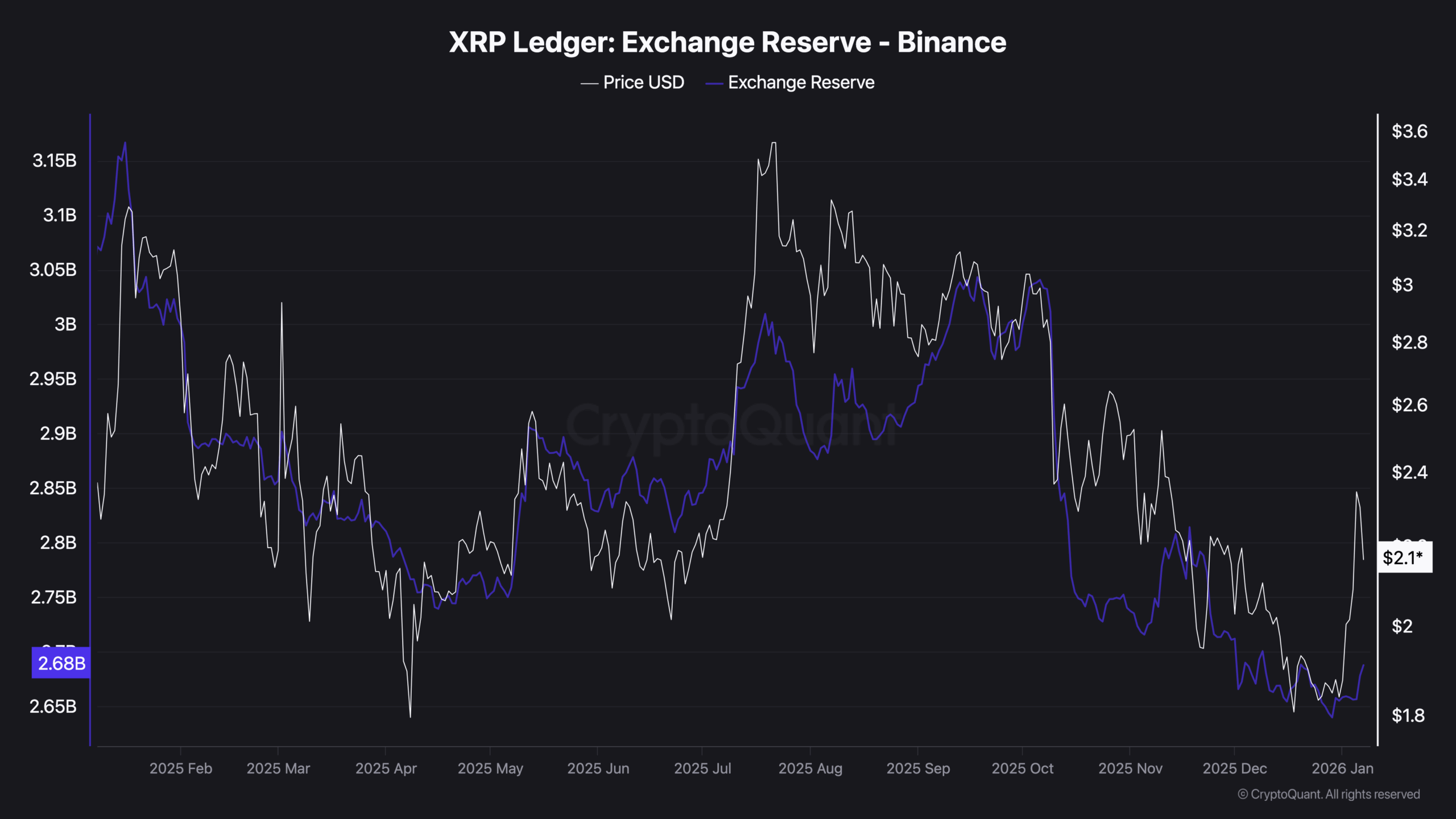

In addition, Upbit isn’t the only exchange seeing XRP withdrawals. Binance has also recorded a steady drop in reserves. Since October 2025, more than 300 million XRP have been pulled from the platform. Its reserves fell from over 3 billion to 2.68 billion.

XRP Exchange Reserve on Binance 8.1. Source: CryptoQuant

XRP Exchange Reserve on Binance 8.1. Source: CryptoQuant

While this was happening, XRP’s price dropped from over $3 to around $1.8. However, the chart shows a recent recovery, with the price now back above $2.

Market Levels and Analyst Views

As of press time, XRP is priced at around $2.10. It is down nearly 6% in the last 24 hours but up more than 16% over the past week. The recent drop from $2.28 shows that this level is acting as resistance. Technical trader CRYPTOWZRD said,

They also noted a double top pattern forming, which could lead to more downside unless buyers step in soon.

Other analysts remain optimistic. Chartist Ali Martinez shared that a TD buy signal is in progress, while Elliott Wave specialist XForceGlobal sees a larger move forming. The analyst said XRP might already be in the early stages of a new uptrend, adding:

Speaking further, he sees $5 as a realistic target and even mentioned the possibility of $10 to $20 during the current cycle. He did note that a dip to the $1.30–$1.50 range could still happen.

Meanwhile, XRP’s performance in early 2026 has caught investor interest. It outpaced Bitcoin and Ethereum in the first week of the year. CNBC called it the “hottest crypto trade of the year,” noting the shift in attention toward XRP as traders search for alternatives.

US-listed spot XRP ETFs have continued to see steady inflows into January. These flows are seen as a sign of growing interest from larger investors. Combined with the falling supply on exchanges, some traders believe this could set the stage for further gains — if key levels like $2.28 are cleared.

The post Ripple’s XRP Supply Shrinks Fast: Could $10 Be Next This Cycle? appeared first on CryptoPotato.

You May Also Like

Landmark Court Ruling Rejects Terrorism Financing Claims

IP Hits $11.75, HYPE Climbs to $55, BlockDAG Surpasses Both with $407M Presale Surge!