Crypto Social Data: Bitcoin, Solana, and XRP Dominate Market Sentiment in Latest Trends

- Bitcoin dominates the discussion amid volatility, institutional flows, and ecosystem updates, while Solana gains traction due to ETF filings.

- Despite improving sentiment, retail investors continue to sell across BTC, ETH, and XRP, with Santiment data suggesting an increased likelihood of a rebound.

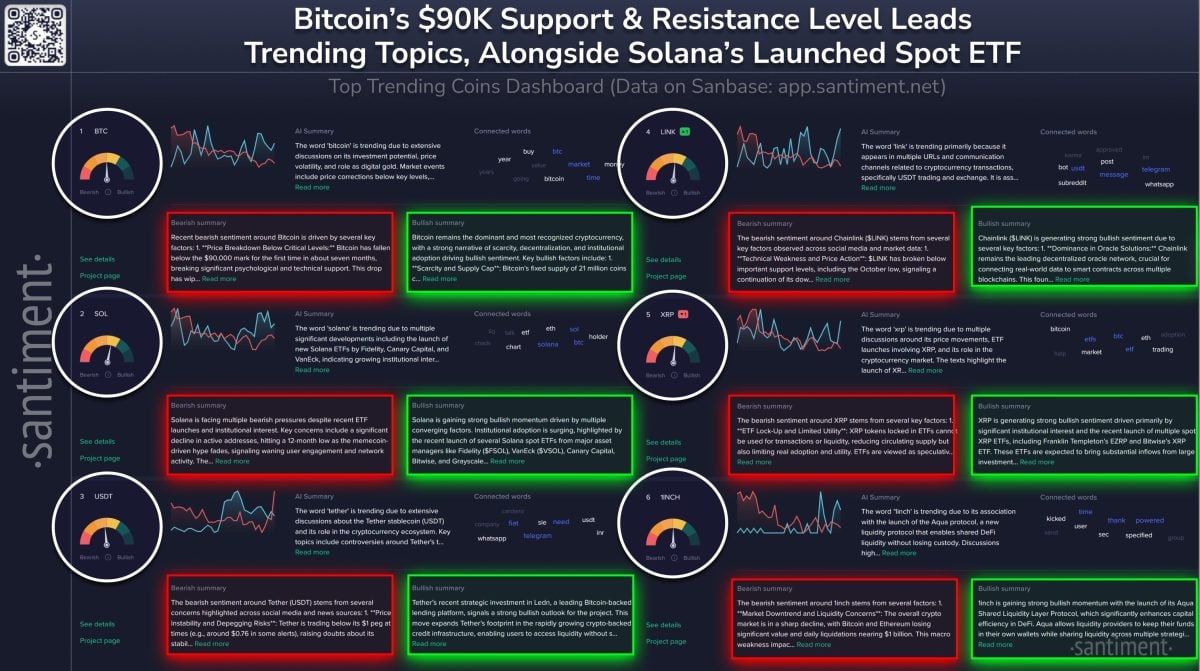

The crypto market is seeing some relief recovery after multi-billion-dollar long liquidations over the past week. Bitcoin (BTC), Solana (SOL), and Ripple’s XRP are largely dominating the overall market sentiment.

Market experts believe that the bottom could already be in, as BTC and other digital assets prepare for a year-end rally. Blockchain analytics firm Santiment noted that with small wallets selling, the chances of a market rebound have increased.

Bitcoin, Solana, and XRP Dominate Social Volume

Bitcoin (BTC) remains the most discussed asset, driven by debates over its investment outlook, volatility, and status as digital gold. With the BTC price dropping under $90,000 recently, the asset has lost crucial support levels, triggering market turmoil.

On the other hand, the BTC chatter has increased amid ongoing Mt. Gox–related movements, El Salvador’s continued purchases, and institutional flows such as BlackRock deposits. Technical indicators point toward potential bearish conditions, while ecosystem updates highlight developments in stablecoins and Layer-2 integrations.

Social media conversations continue to focus on BTC’s decline below $90,000 and shifting market sentiment, reported Santiment.

Source: Santiment

Source: Santiment

Solana (SOL) is the second major crypto asset currently trending in the market, with multiple asset managers – Fidelity, Canary Capital, and VanEck – racing to bring spot Solana ETFs to the market. Whale accumulation, increased staking inflows, rising developer activity, and technical signs of recovery have strengthened confidence in Solana’s fundamentals, as mentioned in our previous story.

On social platforms, discussions largely revolve around liquidity, market cap growth, and heightened trading activity.

The third major cryptocurrency dominating social volumes as of now is Ripple’s native XRP. This altcoin is seeing elevated attention amid price swings, new ETF products, and debates over its long-term role in the crypto ecosystem. Recent developments include the launch of multiple XRP ETFs.

As of today, the entire crypto market is showing signs of a bounce back, with Bitcoin and other altcoins participating in this upside. If these digital assets hold their crucial support levels, experts believe that we could be in for a year-end rally.

Retail Investors Continue to Sell

In another report, blockchain analytics firm Santiment noted that Bitcoin, Ethereum, and XRP are showing signs of a potential rebound as retail investors continue to sell, according to the latest on-chain data. Small wallets—defined as holding less than 0.01 BTC, 0.1 ETH, or 100 XRP—have been offloading their assets across all three networks.

Source: Santiment

Source: Santiment

Bitcoin retail wallets have dumped 0.36% of their holdings over the past five days, Ethereum wallets have sold 0.90% over the past month, and XRP wallets have shed 1.38% since the start of November.

Analysts note that prices often move in the opposite direction of retail behavior. Thus, the ongoing panic selling could potentially act as a signal for a broader market recovery.

]]>You May Also Like

US Jobs Miss Fails to Stop Bitcoin Erasing Its $74,000 Breakout Attempt

SushiSwap (SUSHI) Price Prediction 2026, 2027-2030: Future Outlook, Targets, and Long-Term Forecast