Reversing Immigration With Simple Coding! No Walls, Laws, Taxes, or Conflicts!

\

What if we could reverse mass immigration not with walls or laws, but with just a few lines of code?

Every year, millions risk their lives crossing borders. Not because they want to, but because they have to or at least, they feel they have to. We build walls, pass laws, deport people, create conflicts. But we're treating the symptom, not the disease.

\

The real problem:

Economic desperation & Wealth Imbalance. When your currency loses 99% of its value, when you earn $2/day while others earn $100/day, migration isn't a choice, it's seen as a ticket for a better life!

What if the solution was code instead of conflict?

\

The Economic Root Cause: 85% of Immigration Caused by Economic Desperation & Wealth Imbalance

60% of immigration is driven by Economic Desperation:

- No jobs in home country, lack of opportunity

- Poverty and hunger

- Currency instability

25% of immigration is driven by Wealth Imbalance:

- Huge wage gaps ($2/day vs $100/day)

- Better social services abroad

- Stronger currencies (USD, EUR, GBP)

- Access to education and healthcare

\n The migration pattern is always the same:

Poor country → Rich country

Weak currency → Strong currency

Low opportunity → High opportunity

Never the reverse. Why? Because the current economic incentive is one-way!

\n The Code Solution: A Water Price-Based Universal Basic Income (UBI)

The O coin is a system of stable digital currencies (one per fiat currency) based on potable water price, defined as the average value to buy one liter of potable water individually.

To avoid entering into the volatile system of "supply and demand" where controlled and/or uncontrolled inventory set the value based on demands, the O coin isn't backed by any physical asset, allowing unlimited supply and avoiding inventory/price manipulation. Instead, we use a method of calibration where the average price of one liter of water is calculated based on randomly picked user's measurements and online bots, and stability is monitored through exchange rate observation with official fiat currencies.

To maintain the coin stable in its referential, when a currency becomes unstable —meaning the observed exchange rate with O is different than the rate calculated by the blockchain based on water price observation—it automatically generates coins equal to the value of the difference in volume and distributes them in small amounts to users whose currency (defined as place of birth's currency) follows the O exchange rate (stable currency). It also bans users attached to unstable currencies from receiving money issued from that stabilization mining process.

The benefit of this system is that individuals and governments would both have interest in keeping exchange rates as defined by the blockchain, so they don't generate money for good actors that follow the rules and they can also receive their part of the stabilization mining rewards.

The main innovation of this system is that it defies “Supply and Demand” by allowing unlimited coin creation while keeping the coin value stable in his global water price referential, independently of human, government and market confidence. This makes it the perfect candidate currency for a fair, debt-free, Universal Basic Income.

\

How It Works?

1. Water Price Calibration

Each O currency (one per fiat currency) is defined as the average cost of 1 liter of water in its local market:

USA: Water average cost per liter = $1.50/L → 1 O_USD = $1.50

Europe: Water average cost per liter = €1.20/L → 1 O_EUR = €1.20

Venezuela: Water average cost per liter = 50,000 VES/L → 1 O_VES = 50,000 VES

\ 2. Universal Basic Income Distribution

Everyone receives 420 O monthly (60 meals @ 7 O-coins per meal, a basic meal being on average 7 times the average price of a liter of water worldwide). UBI will be distributed to all living humans on earth without a means test or need to perform work.

\ 3. Same Purchasing Power Everywhere = No Migration Incentive

Before O Coin UBI:

Mexico: $10/day → USA: $100/day = 10× motivation to migrate

After O Coin UBI:

Mexico UBI: 420 O_MXN/month

USA UBI: 420 O_USD/month

Both = 420 liters of water worth of goods in their respective markets

Same purchasing power in local market = No economic reason to migrate

If a Mexican decides to move to USA under his OMXN coin UBI, he will loose 10 times his purchasing power. In addition to that, considering all his Mexican relatives and friends will also receive UBI in OMXN, the need of migrating to “better” countries to help them through remittances disappears.

\

The Three O Mechanisms to Reverse Immigration

1. Trust Restoration

All O currencies are equally stable. ie: OVES (Venezuela) is as stable as OUSD (USA). No need to migrate for currency stability.

2. Equal Value

With O Coin UBI, everyone has the same purchasing power. 420 O anywhere = 420 liters of water worth of goods anywhere. Economic migration incentive eliminated. Families not depending on remittance anymore.

3. Local Economic Reinforcement

UBI creates local markets. Entrepreneurs stay. Workers stay. Money circulates locally. Brain drain is reversed.

\

The Immigration Expected Reversal Timeline Once O UBI Is Implemented

Months 1-6: Currency stability → Migration pressure decreases

Months 6-18: Economic migration drops → People choose to stay

Months 18-36: Return migration begins → Families reunite

Years 3-10: Mass return → Origin countries strengthen

Years 10+: Equilibrium → Migration becomes voluntary, not forced

\n Why This Works? The Push-Pull Theory Reversal

Traditional: Push factors (poverty) push people out. Pull factors (opportunity) pull people in. Result: One-way migration.

With O Coin UBI: Push factors eliminated. Pull factors equalized. Result: No economic migration pressure.

\

The Birth Currency Principle

Wherever you’re born, you should have the same economic opportunity as someone born in “rich/developed” countries to prevent migration in a very natural way.

How: 420 OVES = 420 OUSD = 420 O_EUR = …. in purchasing power (in all O currencies = 420 liters of water worth).

Result: Birth location no longer determines economic destiny and opportunities are equalized

\

FAQ

- "What about skilled migration for education?"

That's voluntary migration, not forced. O Coin UBI eliminates economic migration. People can still migrate for education, love, adventure—but by choice, not necessity.

\

- "What about refugees from conflict?"

O Coin solves economic migration. Conflict refugees are a separate issue requiring political solutions. But world economic stability reduces conflict risk.

\

- "Won't rich countries lose needed workers?"

No. With equal purchasing power, workers choose where to live based on preference, not economics. Some stay, some go—but it's voluntary.

\

- "This is unrealistic."

They will migrate—but voluntarily. The difference: migration for survival vs. migration for choice. O Coin eliminates the survival motivation.

\

- "This will devalue the value of work."

No, it won't. If everybody on earth earns the same base amount with the same purchasing power, it will only be an offset to the current system of income rather than a subsidy or welfare for some. This will allow humanity to successfully go through poverty, homelessness, and technology unemployment without taxing other humans. O UBI also provides many more benefits to all of us: Creates Jobs and Boosts the Economy, Improves Security, Reduces Gender Inequality, Improves Health, Supports Education, Improves Retirement…

For more information about Universal Basic Income benefits, check out our video: https://www.youtube.com/watch?v=DTVuE1nzNAo&t=7s

- I don't want other countries to have a currency as strong as ours—that's why we're strong!"

This is a natural concern in a world of currency competition, where stronger currencies are often associated with developed countries. However, this is a consequence, not a cause (Strong country => Strong currency => High Attraction for Migrants, not the opposite).

The real question is: Do we prefer maintaining currency dominance with its side effects—mass immigration, industry exodus, social dumping, and international tensions—or having equal currency value worldwide that eliminates these problems while preserving economic stability?

With O Coin, every country maintains its own currency (OUSD, OEUR, O_VES, etc.), but all have equal purchasing power without inflation. This eliminates the competitive advantage that drives migration while preserving economic sovereignty.

\

- "Is Universal Basic Income a political concept like communism or socialism?"

UBI is neither communism nor socialism. It's a 21st-century solution to 21st-century challenges.

- Communism: State owns all property and means of production. Central planning dictates economic activity. No private ownership.

- Socialism: Government controls major industries and redistributes wealth through state programs.

O Coin UBI specifically avoids any political or financial issues:

✅ No government control (decentralized blockchain)

✅ No wealth redistribution (algorithmic coin creation)

✅ No state ownership (private property remains)

✅ No taxation required (self-funding through coin creation)

✅ No political/religious strings attached (unconditional payment)

✅ No central planning (free market continues)

\

\n The Technical Stack of the O Blockchain

- Bitcoin Core - Proven security

- 142 Currencies - One O currency per national currency ({USD,O-USD}, {EUR,O-EUR}, {MXN,O-MXN}, …)

- Water Price / Exchange Rate Measurement - Bots and Randomly Selected Verified Users, Online and Offline - All data Validated by Humans

- Open Source - MIT licensed

- No Central Authority - Community governance

\

Conclusion

Mass immigration isn't a border problem. It's an economic problem. And economic problems have economic solutions.

O Coin UBI with water price calibration:

- Eliminates currency instability (trust)

- Creates equal purchasing power (fairness)

- Eliminates inflation (stability)

- Strengthens local economies (opportunity)

- Reverses migration flows (choice)

No walls. No laws. No taxes. No conflict.

Just simple coding. Just economic incentives. Just water price calibration.

\

Learn More:

- Full analysis: (https://github.com/cno127/o-blockchain/wiki/Immigration-Impact)

- GitHub Code: (https://github.com/cno127/o-blockchain)

- Support Us! Visit our Website: (https://o.international)

\ \ O International is a French non-profit association focused on the design, creation and promotion of a water price-based digital stable currency. All code is open source (MIT license).

:::info This article is published under HackerNoon’s Business Blogging program.

:::

\

You May Also Like

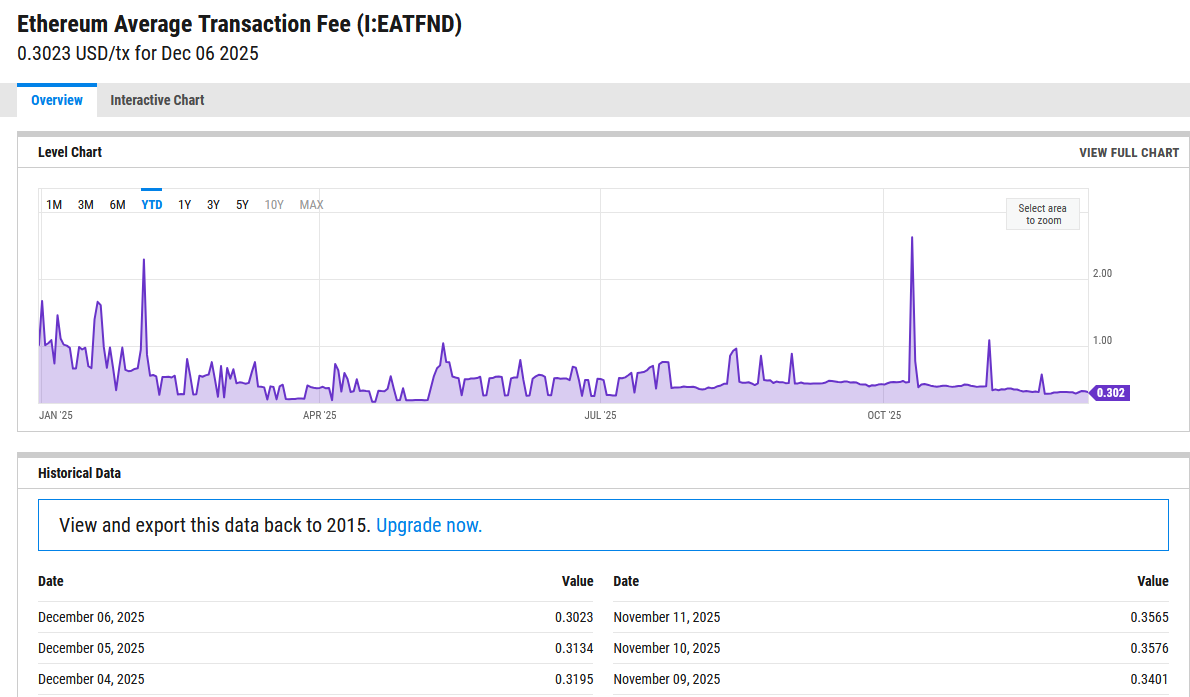

Vitalik Buterin Proposes Onchain Gas Futures to Stabilize Ethereum Fees

Trading Moment: Markets Enter a Key Week Ending the Year, Bitcoin Holds Key Level at $86,000