Plus, participate in weekly giveaway of 60,000 USDT prize pool!

ChatGPT Predicts the Price of XRP, Pi Coin and Cardano by the End of 2025

OpenAI’s ChatGPT predicts the crypto sector could finish 2025 with a price explosion. Bitcoin’s encouraging rally to a historic peak of $111,814 on May 22 has reignited widespread investor interest, especially with the price lingering just shy of that record since.

Market participants across the crypto sector are increasingly hopeful that a new phase of transformative growth is underway—one that could potentially surpass the euphoric highs of 2021.

Based on a blend of technical indicators, project fundamentals, evolving regulations, and macroeconomic conditions, ChatGPT predicts several promising altcoins poised for substantial price appreciation.

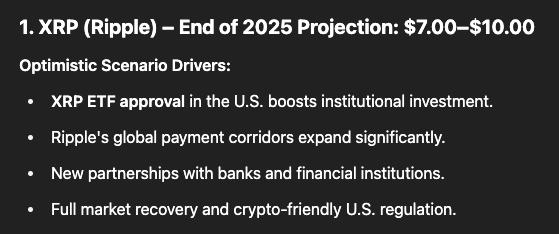

Ripple (XRP): Slow and Steady Gains for Crypto’s Legal Trailblazer

ChatGPT’s projection for Ripple’s XRP places it at $10 sometime in 2025—more than quadruple its current value of roughly $2.17.

This forecast hinges on a potential approval of a U.S.-listed XRP spot exchange-traded fund (ETF). However, other factors come into play here, including XRP’s recent legal clarity (which was a win for the whole industry) and heightened institutional interest.

Toward the end of last year, the United Nations Capital Development Fund (UNCDF) spotlighted XRP as a reliable and compliant blockchain-based tool for cross-border financial transactions.

XRP launched in June 2012, making it one of the oldest market leading cryptocurrencies in the game. When the US SEC filed a lawsuit against XRP progenitor Ripple in December 2020 for allegedly breaching federal securities laws, the coin became a little notorious among people outside the industry.

However, a major turning point in XRP’s history came in 2023 when a federal judge ruled that Ripple’s sale of XRP to retail investors did not violate securities regulations.

This longstanding case formally ended in March after the SEC dropped its lawsuit—an announcement made public by Ripple CEO Brad Garlinghouse. The crypto industry widely celebrated the decision as a precedent that discouraged misapplication of securities laws to digital assets.

With XRP maintaining solid support near the $2 range, analysts suggest the next hurdle sits at $3. A breakthrough at that level could set the stage for a climb toward $7 by Autumn.

Still, even ChatGPT’s highly optimistic target could be easily exceeded with the advent of a full-blown bull market paired with some long overdue comprehensive crypto legislation in the U.S.

Pi Network ($PI): A Unique Mining Approach with Explosive Price Potential Predicted by ChatGPT

Pi Network ($PI) is gaining momentum with its unconventional, tap-to-mine model that appeals to casual users. Since its February 2025 launch, $PI saw a 40% price spike in early May, thanks in part to whale-driven buying.

While the crypto market fell 1% in the last 24 hours to post a collective market cap of $3.41 trillion, Pi Network is proving one of the top-performing coins today after rising 4% overnight to change hands at $0.5516.

Its Relative Strength Index (RSI) is down trending from 34. Once it hits 30, the token will be oversold and thus underpriced. Typically, this causes traders to buy back in, so it is likely the price will continue climbing over the weekend.

While ChatGPT predicts $PI could climb to $8 by New Year (nearly 15X from its current price), it looks like with continued ecosystem expansion, its next immediate target could be $3 by the midsummer.

Unlike traditional crypto mining, Pi’s model does not require expensive equipment. Users simply interact with the mobile app once daily to earn tokens, making it highly accessible and appealing to newcomers.

With its foundational Layer 1 blockchain infrastructure and growing community, Pi Network could emerge as one of the more notable performers in the current cycle.

Cardano ($ADA): ChatGPT Predicts a 17X Price Rally for This Smart Contract Giant

Cardano ($ADA) is regaining investor attention following its mention by U.S. President Donald Trump, who proposed using ADA in a national crypto reserve—albeit a “hold-only” asset acquired exclusively through law enforcement seizures rather than direct purchases from the market, like his proposed Bitcoin strategy.

Founded by Ethereum co-architect Charles Hoskinson, Cardano is known for its rigorous academic development model and a future-oriented focus on scalability and sustainability.

Currently valued at $21.8 billion, ADA continues to rival Ethereum and is closing the gap with fast-rising competitors like Solana.

ChatGPT’s outlook places ADA at $10 by year-end, nearly 17X from its present price of $0.6038, which has been unchanged in the last 24 hours.

On the technical side, ADA has been consolidating within a descending wedge since late 2024. If it breaches resistance around $1.10, a climb to $1.50 could occur before fall.

Reaching ChatGPT’s lowest optimistic price projection of $6.50 would mean doubling its previous all-time high of $3.09, achievable only under robust bull market conditions.

Solaxy ($SOLX): Solana’s First L2 Protocol Draws Massive Investor Interest

Solaxy ($SOLX) is breaking new ground as Solana’s premier Layer-2 scaling solution and has already attracted over $55.5 million in presale funding since December 13, 2024.

Serving multiple functions—including network fees, staking, and validation—the SOLX token offers a high-yield staking option with an impressive 76% annual return. Its codebase has passed a security audit by industry watchdog Coinsult, further legitimizing the project.

By leveraging rollup technology, Solaxy aims to enhance transaction throughput on the Solana network without sacrificing compatibility with its bustling ecosystem. This functional relevance, along with viral buzz, has drawn both developers and investors to the project.

With the official launch only just under three days away, analysts predict a strong market debut. Reaching eight-figure presale numbers is no small feat, marking Solaxy as one of the most anticipated releases in the current cycle.

Given the growing need for scalable Solana-based infrastructure, SOLX appears well-positioned for rapid price appreciation.

Stay up to date with Solaxy on X and Telegram or visit the Official Solaxy ($SOLX) website.

You May Also Like

Meme Daily, a picture to understand the popular memes in the past 24 hours (2025.7.10)

Crypto Scammer’s Sentence Jumps from 18 Months to 12 Years in $20M Fraud Case