Record $12M Crypto Donation to Reform Rocks UK Politics as Government Weighs Ban

Reform UK has landed its biggest donation yet, after receiving £9 million ($12 million) from crypto investor and aviation businessman Christopher Harborne, according to newly released figures from the Electoral Commission.

The sum is now the largest single political donation ever made by a living person to a UK political party.

Harborne, a British investor living in Thailand, has long been active in UK political donations. He donated heavily to the Conservatives during Boris Johnson’s time in office and also supported the Brexit Party, which later became Reform UK, in both 2019 and 2020.

Two companies tied to him, AML Global and Sherriff Group, operate in the private aviation sector.

Harborne’s £9M donation Reshapes UK as Crypto Money Enters UK Politics

Harborne’s donation comes at a time when, as the next general election is not due until 2029, but local elections are scheduled for May. It also comes as Reform UK has remained at the top of several national opinion polls since the spring.

Harborne’s £9 million donation breaks the previous record of £8 million, which was set in 2019 by supermarket heir Lord David Sainsbury in support of the Liberal Democrats.

Separately, Lord John Sainsbury left £10 million to the Conservatives through his will in 2022.

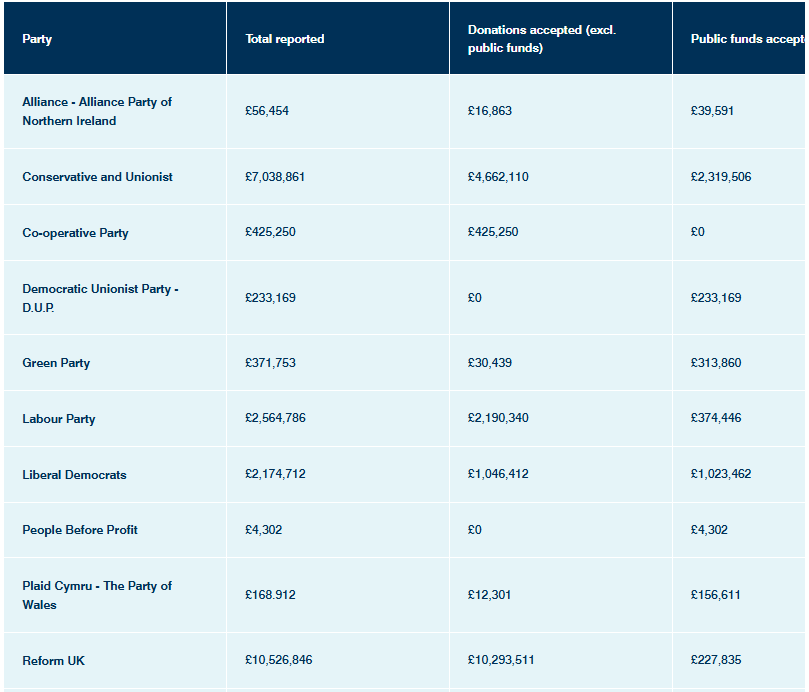

Figures released by the UK Electoral Commission show that Reform UK raised more than £10.2 million between July and September, over twice the amount collected by the Conservatives in the same period, which brought in £4.6 million.

Source: Electoral Commission UK

Source: Electoral Commission UK

Labour brought in £2.1 million, and the Liberal Democrats reported £1 million. This makes it the first full quarter in which Reform will outpace Conservatives in fundraising since the general election in 2024.

Still, the longer-term numbers slightly favor the Conservatives, showing that since July 2024, they have raised around £14.4 million in total, compared with Reform’s £13.5 million.

Conservative leader Kemi Badenoch downplayed the impact of Harborne’s contribution, describing it as a “one-off” and insisting her party remains stronger when it comes to steady, repeat donors

Beyond fundraising, the donation has reignited debate around the role of cryptocurrency in UK politics.

In May, Reform leader Nigel Farage announced that the party would begin accepting Bitcoin donations, making it the first UK political party to do so.

The party later launched a dedicated digital donation portal and confirmed that it had already received a small number of crypto contributions, the first recorded instance of such donations in British political history.

Foreign Influence Fears Drive UK Review of Crypto Political Funding

That decision is now under increasing political scrutiny. The UK government says it’s now looking into whether cryptocurrency donations should be blocked entirely for political parties.

While no formal proposal has been confirmed, officials say discussions are underway across Whitehall about it, driven by rising concerns over transparency and the risk of foreign interference in British politics.

Additionally, security specialists caution that while blockchain records are public, the real origin of funds can still be obscured through layered wallets, intermediaries, and offshore structures.

The debate gained urgency after former Reform Wales leader Nathan Gill was convicted and sentenced to over 10 years in prison for accepting payments to push pro-Russian narratives while serving as a Member of the European Parliament.

The Ministry of Housing, Communities and Local Government, which is leading work on the Elections Bill, has also warned that existing rules leave the political system exposed to covert foreign influence.

Proposed changes are expected to focus on donations funneled through shell companies and to introduce stricter risk checks for politically sensitive contributions.

The discussion unfolds as the UK moves ahead with its wider digital asset rules. On December 3, Parliament passed a law recognizing cryptocurrencies and stablecoins as legal property for the first time under UK law.

You May Also Like

Wormhole launches reserve tying protocol revenue to token

Fed Acts on Economic Signals with Rate Cut