Digital Remittance Statistics 2026: Market Surge Now

In the rapidly evolving world of finance, digital remittance has emerged as a critical tool for millions of people worldwide, connecting families and fueling economies. With technology advancing at an unprecedented pace, the way money is transferred across borders is becoming faster, more secure, and more accessible. Today, this market promises to grow even further, driven by key milestones, technological advancements, and a rising global need for seamless financial solutions.

Editor’s Choice

- Mobile-based remittance transactions now account for the majority of digital transfers, with the mobile market at $40.2 billion.

- By year-end, over 60% of all remittances globally will be processed using fintech platforms. (Note: 2026 data aligns with 2025 trends.)

- Blockchain technology is transformative, with GCC blockchain remittances at $1.2 billion and growing adoption enhancing transparency.

- The average cost of sending $200 through digital channels remains around 4.6%, nearing the UN’s 3% target.

- Western Union and MoneyGram remain dominant, while Remitly and Wise gain share with lower fees and faster transfers.

Recent Developments

- Western Union launched international money transfers in the Penny Pinch app for Saint Lucia users, enabling sending to over 200 countries.

- Ripple’s CBDC pilot with Bhutan RMA advances to nationwide rollout post-2026, cutting cross-border fees by 40-60%.

- Remitly projects high-teens revenue growth in 2026 with adjusted EBITDA of $300-320 million, expanding beyond remittances.

- MoneyGram’s Mastercard partnership enables sending from U.S. cards to 38 markets and receiving at 10 billion endpoints worldwide.

- PayPal-TerraPay collaboration facilitates real-time transfers to mobile wallets and banks across the Middle East and Africa.

- WhatsApp Pay gains full rollout approval in India for its 500+ million users, removing the prior 100 million cap.

- Western Union plans a Solana-based USD Payment Token launch by mid-2026 for blockchain transactions.

- Visa formed 300+ partnerships for Visa Direct; Mastercard Send enables seconds-to-minutes cross-border transfers.

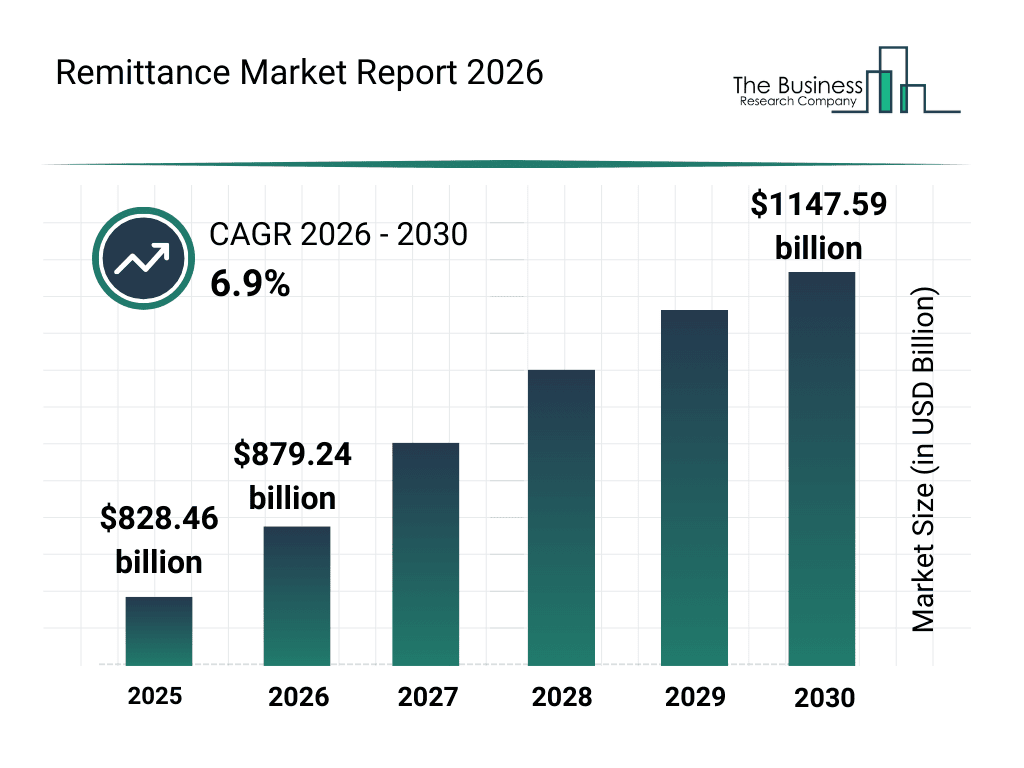

Remittance Market Size Growth Forecast

- The global remittance market will reach $828.46 billion in 2025.

- The market will grow to $879.24 billion in 2026, signaling steady expansion.

- By 2027, global remittances will approach about $939.90 billion.

- The market will surpass the $1 trillion mark in 2028, reaching roughly $1,004.76 billion.

- Continued growth will push the market to around $1,073.67 billion in 2029.

- By 2030, the global remittance market will hit $1,147.59 billion.

- Overall, the sector will expand at a 6.9% CAGR between 2026 and 2030, highlighting sustained global demand for cross-border transfers.

(Reference: The Business Research Company)

(Reference: The Business Research Company)

Technological Advancements in Remittances

- 98% of financial institutions now use AI-powered fraud detection, achieving 2-4x better detection rates.

- RippleNet spans 55+ countries with 80% of Japanese banks integrated for remittances.

- Biometric authentication in remittances boosts security, reducing fraud losses by up to 65%.

- API integrations between banks and remittance platforms cut transfer fees by 15% on average.

- Smart contracts market grows to $3.39 billion, up from $2.69 billion last year at 26.3% CAGR.

- Mobile payments like Apple Pay and Google Pay drive 75% contactless transaction share.

- AI chatbots resolve 80% of inquiries instantly, cutting support costs by up to 30%.

- UAE mandates biometrics over SMS OTPs from January 6, accelerating remittances velocity.

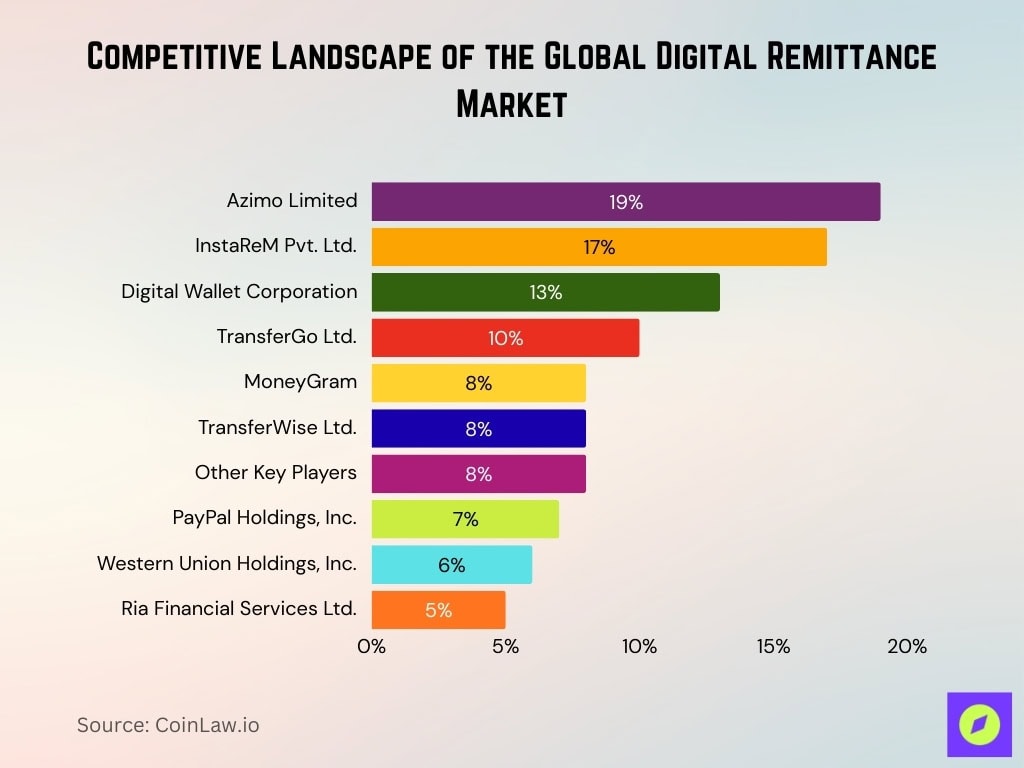

Competitive Landscape of the Global Digital Remittance Market

- Azimo Limited leads the market with the largest share at 19%, highlighting its strong global digital remittance presence.

- InstaReM Pvt. Ltd. holds a significant 17% share, positioning it as a major challenger in cross-border transfers.

- Digital Wallet Corporation accounts for 13% of the market, reflecting the growing role of wallet-based remittance services.

- TransferGo Ltd. captures 10% market share, benefiting from its focus on low-cost international transfers.

- Both MoneyGram and TransferWise Ltd. each hold 8%, demonstrating strong competition among established fintech providers.

- Other key players collectively represent 8%, indicating a fragmented segment of smaller providers.

- PayPal Holdings, Inc. controls 7% of the market through its global payments ecosystem.

- Western Union Holdings, Inc., a traditional remittance giant, maintains a 6% share in the digital segment.

- Ria Financial Services Ltd. holds the smallest share among listed firms at 5%, reflecting more limited digital penetration.

(Reference: Market.us Scoop)

(Reference: Market.us Scoop)

Top Digital Remittance Market Companies by Country

- United States: Western Union leads with outbound remittances at $35.84 billion, Remitly grows share amid 38.42% regional dominance.

- China: Alipay and WeChat Pay enable fast cross-border transfers, handling billions via phone number remittances.

- Philippines: Inflows near $38 billion annually, GCash partners with Western Union for global cash-ins.

- Nigeria: Inflows projected $26 billion, Flutterwave drives digital growth despite $9.80 cost for $200.

- Pakistan: Inflows exceed $30 billion, EasyPaisa and JazzCash handle BISP stipends for millions.

- Bangladesh: Inflows hit $33 billion (+22% YoY), bKash receives Tk200 billion across 4.1 million accounts.

- Vietnam: National inflows ~$18 billion, Ho Chi Minh City $10.5 billion (+10.5%), MoMo leads digital wallets.

Mobile Banking Usage in the US

- 72% of US adults actively use mobile banking services.

- 42% of consumers prefer mobile apps for managing finances.

- 36% of consumers favor PC/online banking websites.

- 55% of consumers use mobile apps as their top banking method.

- 39% of US adults use only mobile banking, avoiding branches.

- 78% of online banking users prefer mobile apps over other methods.

- 67% of Millennials primarily use mobile banking apps.

Challenges and Regulatory Frameworks

- Global AML compliance costs exceed $100 billion annually for financial institutions, with large banks spending up to $1 billion each.

- EU PSD3 raises the money remittance capital threshold to €150,000 from €25,000 proposed.

- FATF sets a €15,000 threshold for mandatory CDD on occasional cross-border transactions.

- African countries impose onerous KYC and FX controls, raising remittance costs by up to 12%.

- India mandates crypto data sharing from April 2027, with ₹200 daily penalties for non-reporting from April 2026.

- GDPR/CCPA require consent management and DPAs, increasing remittance data compliance costs 20-30%.

- Small remittance providers face $0.07-$0.37 per-transfer compliance costs under CFPB rules.

End-User Segmentation in the Digital Remittance Market

- Personal users dominate with 68.39% market share, driven by migrant family support.

- Business users hold 31.61%, growing fastest at 16.91% CAGR via e-commerce.

Frequently Asked Questions (FAQs)

Personal remittances account for 68.39% of the market.

Business remittances grow at 16% CAGR.

Online channels grow at 17.48% CAGR.

Conclusion

The digital remittance landscape is poised for even greater transformation. With blockchain, cryptocurrency, and AI-driven technologies reshaping the way money moves across borders, we are witnessing a shift towards faster, cheaper, and more secure remittance solutions. Key players like Wise, Remitly, and Ripple are setting new standards for transparency and efficiency, while regulatory frameworks evolve to meet the challenges of this fast-growing industry.

As mobile adoption rises and remittance costs continue to drop, the global remittance market will remain a lifeline for millions of families worldwide, fueling economic growth and financial inclusion across all corners of the globe.

The post Digital Remittance Statistics 2026: Market Surge Now appeared first on CoinLaw.

Mohlo by se vám také líbit

Rizz Network Lands $5M Capital Commitment from Nimbus Capital to Drive Next-Generation AI-DePIN Rizz Wireless Rollout

Paris Saint-Germain Embraces BTC for Treasury Strategy