Spot Bitcoin ETF AUM Hits 2025 Low Not Seen Since April

Spot Bitcoin ETFs recorded a fresh outflow on Tuesday, pushing assets under management below the $100 billion threshold for the first time since April 2025. The decline followed $272 million in net redemptions, according to data from SoSoValue. The move comes as Bitcoin slid toward the mid-$70,000s amid a broad crypto market pullback, with the overall market capitalization retreating to about $2.64 trillion from roughly $3.11 trillion in the previous week, per CoinGecko. The setback underscores ongoing volatility in securitized exposure to the leading crypto asset, even as investors rotate into non-Bitcoin assets and altcoins show pockets of life.

The week’s sell-off was not uniform across the market. While BTC ETFs faced renewed outflows, funds tracking altcoins registered small inflows, signaling a divergence in investor appetite between securitized exposure to Bitcoin and exposure to other crypto assets. The broader backdrop remains one of macro- and risk-off pressure, with traders weighing the implications of ETF mechanics, regulatory signals, and shifting liquidity in a market still trying to find a steadier footing after a rapid rally and pullback.

Spot Bitcoin ETF flows since Jan. 26, 2026. Source: SoSoValueKey takeaways

- Spot BTC ETF assets under management fell below $100 billion for the first time since April 2025, following $272 million in outflows.

- The broader crypto market cap dropped to $2.64 trillion from $3.11 trillion over the previous week, reflecting continued volatility.

- Altcoin ETFs saw modest inflows: Ether (CRYPTO: ETH) $14 million, XRP (CRYPTO: XRP) $19.6 million, and Solana (CRYPTO: SOL) $1.2 million.

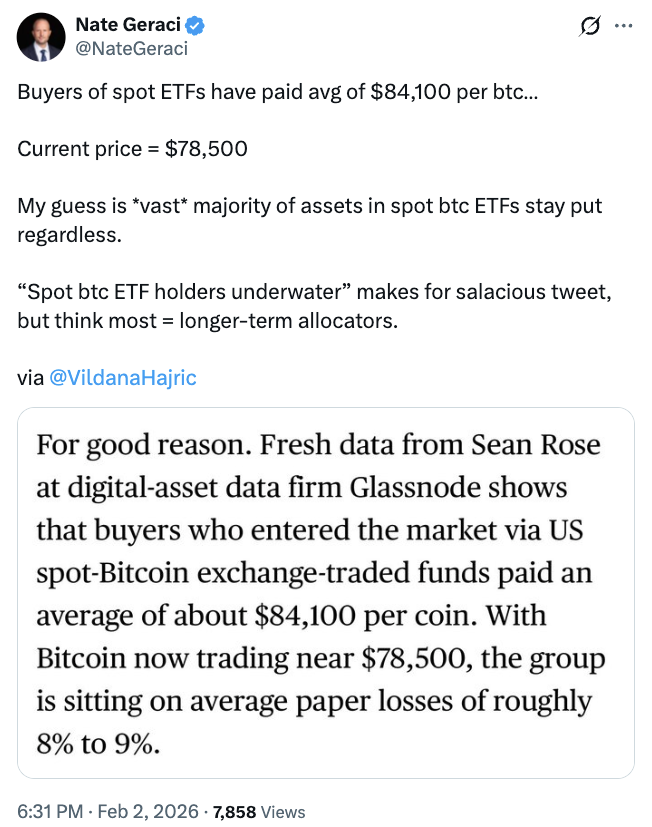

- Bitcoin trades below the ETF creation cost basis of $84,000, a dynamic that can constrain new ETF share creation and influence flows.

- Analysts emphasize that the ETF sell-off is unlikely to trigger a broad wave of liquidations, with some expecting a future shift toward direct on-chain trading by institutions.

Tickers mentioned: $BTC, $ETH, $XRP, $SOL

Sentiment: Neutral

Price impact: Negative. The combination of outflows from spot BTC ETFs and a BTC price dip contributed to a weaker near-term sentiment and potential pressure on related products.

Market context: The episode reflects ongoing volatility in ETF-related flows against a backdrop of risk-off trading, with investors differentiating between securitized exposure to Bitcoin and direct or non-BTC crypto exposure. The weekly retreat in market capitalization highlights continued sensitivity to macro cues and liquidity conditions in a market still adapting to higher interest-rate environments and evolving regulatory signals.

Why it matters

The current pattern—spot BTC ETF outflows alongside modest altcoin inflows—offers a nuanced read on institutional engagement with crypto assets. While the ETF structure provides regulated access to Bitcoin, the observed outflows suggest that some investors are rebalancing risk, seeking exposure through non-securitized channels, or waiting for clearer macro signals before increasing holdings in securitized products. The contrast with altcoins indicates that market participants still differentiate between asset classes within the crypto universe, allocating capital to Ethereum, XRP, and Solana when risk appetite allows.

Institutional participants, who historically have been more likely to use securitized products, are increasingly discussed in terms of a potential shift toward on-chain trading and direct asset ownership. That shift could reshape liquidity dynamics and pricing for both spot products and the ETFs that track them. The comments from industry insiders underscore a belief that the next phase of crypto institutional adoption may hinge less on holding securitized exposure and more on engaging with the underlying assets themselves, potentially driving deeper liquidity and new trading venues outside traditional funds.

The price action surrounding BTC—trading under the $74,000 mark while ETF creation remains suppressed by a higher cost basis—adds a layer of complexity for managers of passive crypto portfolios. Even as some investors trim exposure, others may view the current levels as a continuation of a broader re-pricing process that factors in regulatory clarity, macro liquidity, and the evolving competitive landscape among crypto investment vehicles.

Source: Nate Geraci

Source: Nate Geraci

Thomas Restout, CEO of institutional liquidity provider B2C2, offered a parallel view, noting that institutional ETF investors have shown resilience and patience even as flows wobble. He suggested that a substantial portion of assets could remain within ETFs, but the market is approaching a potential pivot point where some appetite could shift toward direct crypto trading. “The next level of transformation is institutions actually trading the crypto, rather than just using securitized ETFs,” Restout said recently on a Rulematch Spot On podcast. His comments point to a broader re-evaluation of how institutions allocate in crypto markets, with possible implications for liquidity provisioning and price discovery across the ecosystem.

What to watch next

- Next data release on spot BTC ETF AUM from SoSoValue and any observable shifts in creation or redemption activity.

- BTC price stabilization or further moves toward the $70k–$75k zone and how that interacts with ETF flow dynamics.

- Any regulatory updates or policy signals that could impact ETF structures or on-chain trading incentives.

- Evidence of institutional traders increasing direct exposure to crypto assets beyond securitized products.

Sources & verification

- SoSoValue data on spot Bitcoin ETF assets under management and outflows.

- CoinGecko market-cap data showing weekly changes in the global crypto sector.

- Reported inflows for altcoin ETFs: Ether, XRP, and Solana with metrics provided in the article.

- Nate Geraci’s X post discussing ETF asset retention within spot BTC ETFs.

- Thomas Restout’s comments on the Rulematch Spot On podcast regarding institutional adoption and on-chain trading.

Market reaction and key details

The market continues to grapple with the question of how institutions will allocate capital as crypto products evolve. While securitized exposure to Bitcoin remains a convenient entry point for many investors, outflows in the spot BTC ETF space highlight a cautious stance amid price volatility and a broad sell-off across risk assets. The modest inflows into Ether, XRP, and Solana indicate selective confidence in non-Bitcoin assets, suggesting investors are evaluating diversification opportunities within the crypto universe even as the largest asset experiences pressure.

This article was originally published as Spot Bitcoin ETF AUM Hits 2025 Low Not Seen Since April on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

Mohlo by se vám také líbit

PCE Data Sparks Tensions: A Key Day for Bitcoin

Crucial Fed Rate Cut: October Probability Surges to 94%