Polygon Hard Fork Fixes Bug That Knocked Nodes Offline — Network Back Online

Polygon has restored full network stability after a software bug temporarily disrupted milestone finality and forced some nodes offline, according to an official incident report published on the project’s status page.

The issue began early Wednesday when a bug affecting Bor, Polygon’s block producer, and Erigon, its data access layer, caused disruptions across parts of the ecosystem.

While the blockchain itself continued to produce blocks, some Remote Procedure Call (RPC) services and validators halted, forcing providers to rewind to the last finalized block and resynchronize.

Polygon Executes Emergency Hard Fork to Resolve Finality Bug

Polygon engineers confirmed the bug was preventing node progress under certain configurations, though restarting affected nodes resolved the issue for several validators and RPC providers.

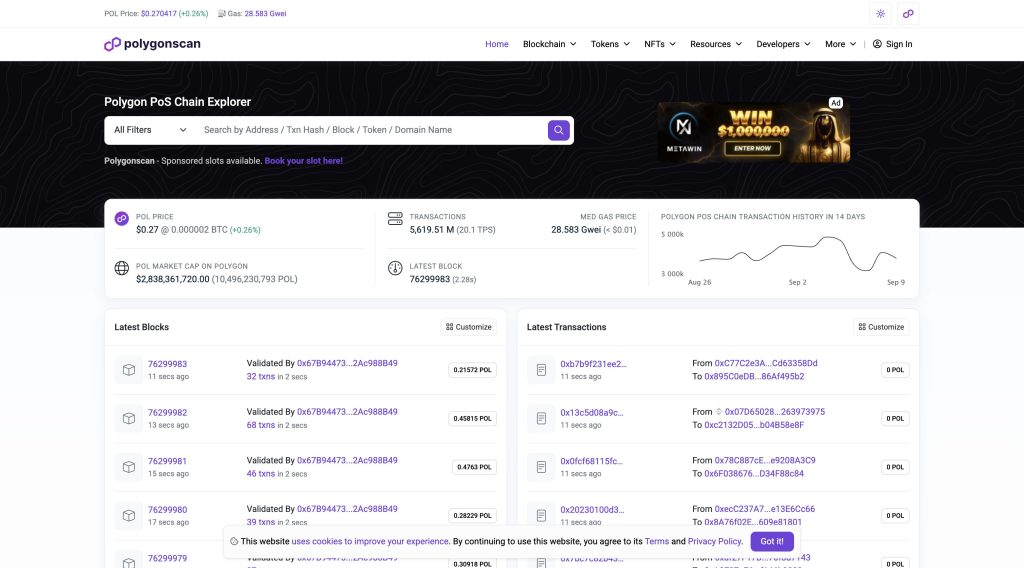

At the time, Polygonscan, the network’s block explorer, showed no block updates for more than five hours. Polygon later explained that Polygonscan’s nodes had halted after a faulty milestone produced by Heimdall, the project’s consensus engine.

A company representative said that the team was working with Polygonscan to switch to functioning nodes that had not halted, stressing that block production remained live.

“Checkpoint finality is working as expected within 15 minutes,” the team said in an update at 08:52 UTC, sharing an alternative link where real-time block production could be tracked.

Analysis revealed the problem stemmed from Heimdall’s finality gadget, which is responsible for producing milestones every few seconds.

Although checkpoints to Ethereum were still being posted every 20 minutes, milestones, which provide faster, deterministic finality, were not being processed. This left local fast finality delayed even as the main chain continued adding blocks.

To address the problem, Polygon rolled out emergency updates: Bor version 2.2.11-beta2 and Heimdall version 0.3.1, the latter requiring a hard fork. The upgrade, executed at 3 p.m. UTC, deleted the faulty milestone and purged it from node databases.

Polygon confirmed soon after that the hard fork was successfully completed and that both milestones and checkpoints were once again finalizing normally.

Source: Polygonscan

Source: Polygonscan

“The hard fork has been successfully completed, and milestones are now processing normally along with state sync. Checkpoints are going through, and consensus finalization has been fully restored on Polygon PoS,” the team wrote in a statement on X.

Polygon Foundation co-founder and CEO Sandeep Nailwal later explained that the disruption originated from a faulty milestone proposal that pushed some Bor nodes onto divergent forks. This triggered short-term instability not accounted for in the system.

He emphasized that while checkpoint finality on Ethereum had remained active throughout, local milestone finality was delayed.

“Milestones are a lightweight alternative to checkpoints, enabling faster, deterministic finality for transactions, even before a checkpoint is submitted to Ethereum,” Nailwal said. “The root cause came from a faulty milestone proposal. We rolled out fixes on both Heimdall and Bor.

With these fixes now live, nodes are not stuck, and consensus is finalizing normally.”

Nailwal described the event as part of the growing pains of scaling Polygon’s proof-of-stake chain but said each challenge strengthens its resilience. “There will be growing pains with any ambitious upgrade.

But each one makes Polygon PoS stronger on our road to GigaGas throughput,” he said, adding that more upgrades are planned to boost capacity and reliability.

Polygon engineers continue to monitor the network to ensure stability and are investigating how the faulty milestone was introduced.

Despite the temporary setback, the network has resumed normal operations, with blocks, milestones, and checkpoints processing in real time

Polygon’s Reliability Questioned After Finality Bug, TVL Down 87% From Peak

Polygon developers have deployed a hard fork to fix a bug that temporarily halted block production on its proof-of-stake chain, restoring the network after several hours of disruption.

The issue, tied to transaction finality, left exchanges and DeFi protocols unable to process deposits or withdrawals as they waited for confirmation guarantees.

The outage drew criticism from Polymarket traders, who argued that a blockchain hosting one of the sector’s largest prediction markets should not face such problems. “It might have gone unnoticed because no one was using it, but this has been going on for about two hours,” one trader posted, pointing to the risk of reversals during the downtime.

TokenPocket, a multichain stablecoin wallet, also paused Polygon transactions after observing that no new blocks had been finalized for over an hour.

The incident comes just weeks after Polygon’s Heimdall v2 upgrade, designed to cut finality times to five seconds and improve validator coordination.

That update followed the July 1 Bhilai hard fork, which raised throughput to 1,000 transactions per second and integrated Ethereum’s Pectra EIPs. Despite these efforts, network reliability remains a concern, as Polygon’s total value locked has dropped from a $9.43 billion peak in 2021 to $1.2 billion today, per DeFiLlama.

The chain’s native token, POL, has fallen 3.4% on the day and is down 30% year-to-date, trading at $0.27.

Meanwhile, another Ethereum Layer-2, Linea, faced a separate outage earlier today when its mainnet sequencer stalled, causing a 67-minute pause in block production.

While Linea has already deployed a fix, developers are questioning whether the two disruptions are linked. Linea has not disclosed the cause of its downtime.

Both events highlight the fragility of scaling networks that have become essential to Ethereum’s broader ecosystem.

Ayrıca Şunları da Beğenebilirsiniz

U.S. Court Finds Pastor Found Guilty in $3M Crypto Scam

MSCI’s Proposal May Trigger $15B Crypto Outflows