Ethereum Price Outlook After Harvard’s ETH ETF Move

Harvard cuts Bitcoin ETF by 21%, adds $86.8M ETH ETF as Ethereum trades near $1,969 amid $161M weekly ETF outflows.

Ethereum traded below the $2,000 level after a broad crypto market pullback, and attention has shifted to institutional flows.

The Ethereum price outlook after Harvard’s ETH ETF move comes as the university adjusted its crypto exposure during the fourth quarter of 2025.

Harvard Adjusts Crypto Holdings Toward Ethereum

Harvard Management Company reduced its position in BlackRock’s iShares Bitcoin Trust during the fourth quarter. Regulatory filings show it sold about 1.48 million shares.

The reduction brought its holdings down by 21% to 5.35 million shares.

The remaining Bitcoin ETF position was valued at about $265.8 million at the end of December 2025. At the same time, the firm initiated a new position in BlackRock’s iShares Ethereum Trust.

The Ethereum ETF investment was valued at $86.8 million. By the end of the quarter, Harvard’s combined exposure to Bitcoin and Ethereum ETFs stood at $352.6 million.

The portfolio shift reflects a reallocation within its digital asset strategy. The filing did not provide detailed reasons for the change.

Ethereum Spot ETFs Record Mixed Flows

Ethereum spot ETFs recorded net outflows of about $161 million during the recent week.

BlackRock’s Ethereum ETF saw the largest withdrawal, with outflows of about $113 million. Fidelity’s Ethereum ETF also reported withdrawals of more than $40 million.

Despite these outflows, some products posted gains. Grayscale’s Ethereum Mini Trust recorded net inflows of about $49.9 million.

Its cumulative net inflows reached approximately $1.71 billion.

Total net asset value across Ethereum spot ETFs stood near $11.72 billion.

These figures show that institutional activity remains active, even during periods of market weakness. ETF flows continue to influence short-term price sentiment.

Related Reading: Ethereum Co-Director Unveils AI Governance Revolution Plan

Ethereum Price Outlook After Harvard’s ETH ETF Move

At the time of reporting, Ethereum traded near $1,969 after falling below $2,000.

The broader crypto market also declined, with total market value dropping by more than 2%.

Bitcoin traded lower during the same period, adding pressure to altcoins.

ETH/USDT 4-hour chart on Binance showing price action Source: TradingView,

ETH/USDT 4-hour chart on Binance showing price action Source: TradingView,

Technical indicators on the four-hour chart show bearish momentum. The Moving Average Convergence Divergence indicator remains below the signal line.

Red histogram bars suggest continued downward pressure in the short term.

Market participants are watching the $1,900 level as immediate support. A break below that level could open the path toward $1,800.

On the upside, a move above $2,100 may allow Ethereum to test the $2,200 area if momentum improves.

The post Ethereum Price Outlook After Harvard’s ETH ETF Move appeared first on Live Bitcoin News.

Ayrıca Şunları da Beğenebilirsiniz

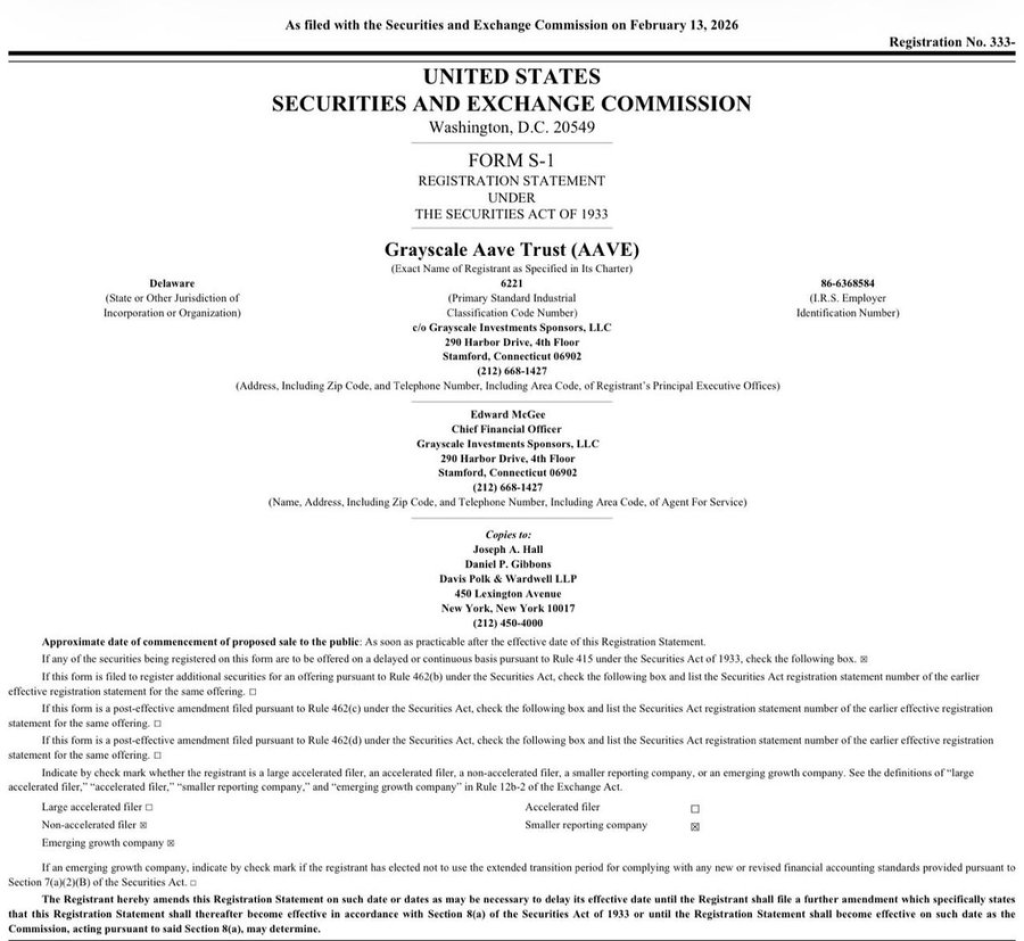

Will SEC Approve the First DeFi ETF? AAVE Filing Sparks Big Question

Wall Street Giants Lead Crypto Hiring Surge: JPMorgan, Citi & More