Ethereum News: Institutional Buying, Staking Boom, and a $5,000 Target

Prices hovering near $4,500 are just the surface of a deeper story: institutions are hoarding ETH at record levels, staking is locking up massive amounts of supply, and smart contract activity has reached heights never seen before.

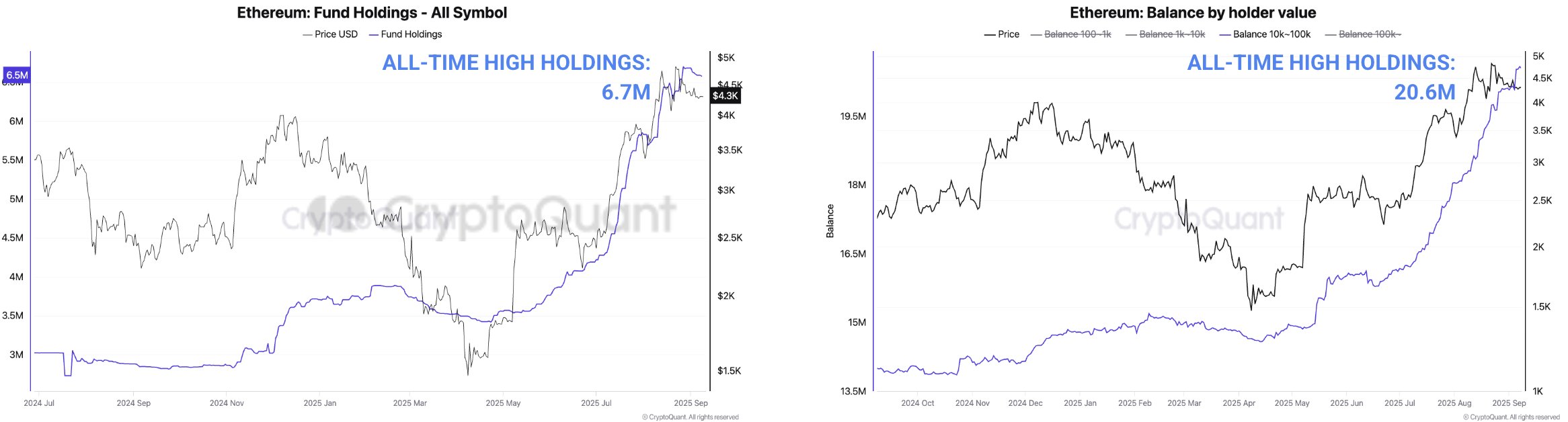

Institutions Take the Driver’s Seat

Corporate treasuries and investment funds have quietly transformed Ethereum into a core holding. Since April, fund-controlled reserves have more than doubled, reaching 6.5 million ETH. Whale wallets, defined as addresses with holdings between 10,000 and 100,000 ETH, now collectively manage more than 20 million coins.

The standout player in this race is BitMine. Originally a mining company, it has become the single largest corporate holder of Ethereum after a $201 million purchase in September lifted its treasury to over 2.1 million ETH, worth more than $9 billion. That one move has made BitMine a bellwether for institutional confidence in Ethereum’s future.

Locked Supply, Rising Demand

On the technical side, Ethereum’s proof-of-stake model is tightening supply faster than ever. More than 36 million ETH is staked, and the waiting queue to become a validator has ballooned past $3.6 billion. With coins leaving exchanges and entering long-term staking, analysts see a classic setup for a supply squeeze if buying continues.

A Network at Full Throttle

Activity on-chain tells the same story. Over 12 million daily smart contract calls are being recorded — a record that underlines Ethereum’s role as the backbone of decentralized finance, tokenized assets, and next-generation applications.

READ MORE:

Major Pi Network News: Big Developments You Can’t Ignore

This surge in use coincides with strong price action. Ethereum briefly touched an all-time high of $4,956 in late August before settling into the mid-$4,000s. With resistance pegged around $5,200 and declining inflows to exchanges, traders are eyeing the possibility of another breakout.

Bigger Vision Ahead

For Joseph Lubin, founder of ConsenSys, this is only the beginning. He envisions Ethereum evolving into the foundation of global finance, predicting Wall Street adoption could multiply its value a hundredfold. That outlook suggests Ethereum could eventually challenge Bitcoin’s dominance as a monetary base.

The combination of institutional buying, aggressive staking, shrinking exchange reserves, and soaring on-chain activity has created a perfect storm for Ethereum in 2025. Whether ETH crosses $5,000 soon or consolidates first, the bigger trend is clear: Ethereum is no longer just another blockchain — it is being positioned as a central pillar of the financial system itself.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post Ethereum News: Institutional Buying, Staking Boom, and a $5,000 Target appeared first on Coindoo.

You May Also Like

The Best Crypto Presale in 2025? Solana and ADA Struggle, but Lyno AI Surges With Growing Momentum

What to Look for in Professional Liability Insurance for Beauty Professionals