Bank of Japan Rate Hike to 1% in April 2026 Could Crash Bitcoin Price

The post Bank of Japan Rate Hike to 1% in April 2026 Could Crash Bitcoin Price appeared first on Coinpedia Fintech News

The global crypto market is back under pressure as expectations grow that the Bank of Japan could raise interest rates to 1% in April 2026. Bank of America warns that tighter policy in Japan may reduce global liquidity and trigger another sharp Bitcoin sell-off, similar to the 3% drop seen after January’s hike.

Bank of Japan Rate Hike to 1% in April 2026

According to Bank of America Global Research, the Bank of Japan (BOJ) is expected to increase interest rates by 25 basis points, which could push the interest rate to 1% in April 2026.

The Bank of Japan is expected to implement a 25 basis point interest rate increase, which will bring interest rates to 1% in April 2026, according to Bank of America Global Research

This would mean that interest rates in Japan would reach their highest interest rate level since the 1990s because Japan maintained its interest rates close to zero for an extended period.

Japan has always been the primary force behind the yen carry trade because it maintains interest rates between zero and near-zero for multiple years now.

The Bank of Japan already raised rates to 0.75% in January 2026, as rising inflation, stronger wage growth, and pressure on the weak yen continue to push policymakers toward further tightening.

Why Japan’s Monetary Policy Matters for Bitcoin Price

Japan holds the title of the largest creditor nation worldwide because it possesses approximately $1.2 trillion worth of U.S. Treasuries. Japanese banks and institutions also invest heavily in global bonds, stocks, and other risk assets, making Japan a key source of global liquidity.

If the Bank of Japan proceeds with another rate hike in April 2026, analysts warn that risk appetite could weaken further. A stronger yen and falling USD/JPY would signal reduced global leverage, which often pressures Bitcoin and altcoins.

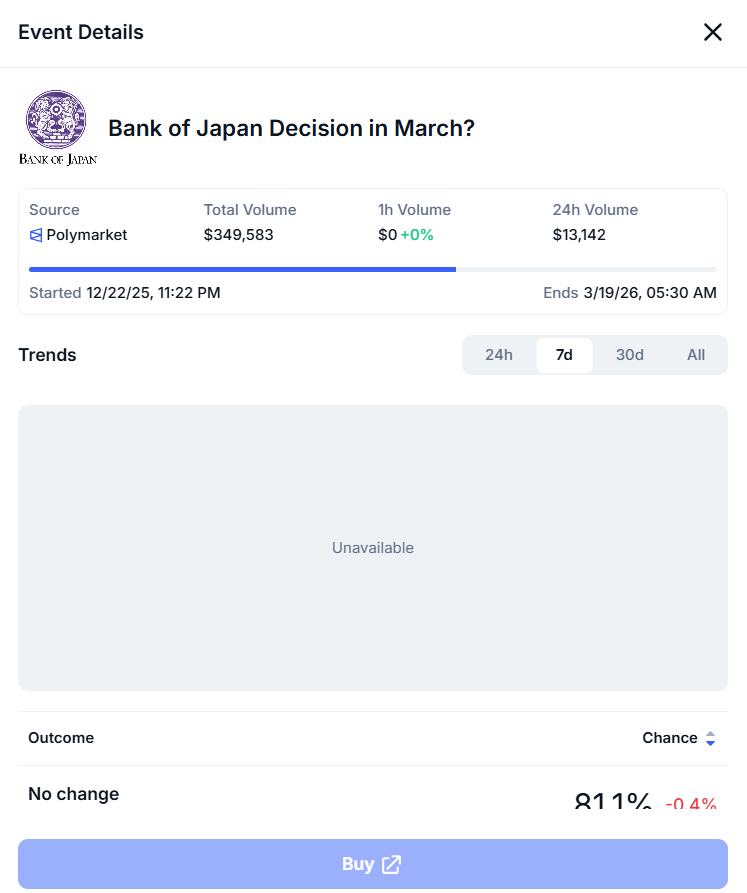

Current predictions on the Polymarket prediction platform show 81% likelihood that no rate hikes will occur in March, suggesting the next move could depend on future economic data.

- Also Read :

- CLARITY Act Update: Crypto Group Fires Back at Banks With New Principles

- ,

Bitcoin Price After BOJ Rate Hike

Looking at the earlier BOJ rate hike data shows strong sensitivity to Japan’s interest rate changes. The Bitcoin price after BOJ rate hike in January 2026 reflected this clearly, as Bitcoin fell nearly 3% shortly after the Bank of Japan raised rates to 0.75%. This showed how quickly crypto markets react when global liquidity conditions change.

When interest rates increase, borrowing becomes more expensive, which reduces the flow of capital into risk assets like Bitcoin.

If the Bank of Japan raises rates again toward 1%, analysts warn Bitcoin could face more downside pressure. Some estimates suggest a possible 4% to 5% decline, which may push the Bitcoin price closer to the $60,000 level.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Japan is a major source of global liquidity due to its large holdings of foreign assets. When the BOJ raises rates, it strengthens the yen and unwinds yen carry trades, reducing the flow of capital into risk assets like Bitcoin and causing market pressure.

Japan has kept rates near zero for years, making it the primary source of the yen carry trade. When the BOJ hikes rates, the yen strengthens, making these trades more expensive to maintain and forcing investors to sell off risk assets like crypto.

Current predictions on Polymarket show an 81% likelihood that no rate hikes will occur in March. This suggests the central bank is waiting for more economic data, with the next potential move being an increase to 1% in April 2026.

You May Also Like

Shaanxi Province issued its first digital RMB science and technology innovation bond, amounting to 300 million yuan.

Low Cap Altcoins to Watch in 2025: BlockchainFX, Little Pepe, and Unstaked Could Be the Next Big Crypto Coins