Why Is Crypto Crashing in February 2026? China Slams the Door on Stablecoins and Galaxy Buys the Dip, but DeepSnitch AI is Still Gearing for 1000x Run in Q1 After Launch

China went to shut the door on yuan-pegged stablecoins, with the central bank and seven regulators issuing a joint ban on unapproved stablecoin and tokenised RWA issuance while steering activity toward the digital yuan. Days later, in early February, Galaxy Digital authorised a $200M share buyback after posting a $482M quarterly loss and seeing its stock fall 25% in a month.

So, why is crypto crashing right now? Two forces smashing into each other: regulatory compression from the East and leverage liquidations across the West. BTC tumbled to a low near $60,300. Coinbase stock is down 36%, and Strategy posted a $12.4B quarterly loss. The crypto market crash explained in a nutshell is: too much leverage chasing too little substance.

But DeepSnitch AI has raised above $1.5M at $0.03906, with five AI agents already live, staking active, and full launch bearing down. When the question is why is crypto crashing, the sharper question might be, what’s still being built to last and to climb like no other token?

China’s stablecoin crackdown collides with Galaxy’s $200M buyback and cascading leverage liquidations

China’s ban is the latest strike in a deliberate multi-year project to centralise all digital currency activity under the e-CNY. Former CIC Managing Director Winston Ma confirmed the rule covers both onshore (CNY) and offshore (CNH) yuan markets. Beijing briefly flirted with allowing private stablecoins in August 2025, reversed course by September, and in January 2026 approved banks to pay interest on digital yuan wallets. The carrot was the e-CNY interest, and this ban is the stick.

And Galaxy’s $200M buyback is sending mixed signals, as CEO Mike Novogratz insists the company enters 2026 from a position of strength. But it’s also worth noting a $241M annual loss for 2025, shares down 25% in a month, and Strategy posting a $12.4B quarterly loss, as mining stocks like MARA are off roughly 27% over 30 days.

Here’s the crypto market crash explained plainly: overleveraged institutions unwinding into regulatory headwinds. For large-cap holders, this is a painful grind. But if you’re watching this and thinking about pre-market entries, the conditions are arguably ideal, particularly when a project like DeepSnitch AI is shipping live tools at a price that hasn’t absorbed any of the macro turbulence yet.

Why is crypto crashing? Token comparison to evaluate what’s worth buying in early 2026

1. DeepSnitch AI

If Bitcoin price updates are dampening your mood lately, you’re in good company. Every headline seems to amplify fear, and eking out trades on the majors has become a patience test. But that’s exactly why more traders are rotating attention toward presales instead of fighting the chop.

DeepSnitch AI has been one of the standouts with all this in mind, and even with the broader market wobbling. The presale keeps powering forward, having now locked in $1.5M at a $0.03906 entry. This momentum is easy to spot for what it could entail, namely, a moonshot token with the potential to rake in incredible rewards on the back of its utility.

Once live, the platform will run five AI agents, or “snitches,” designed by expert on-chain analysts to help retail traders equip themselves with an information edge, guidance, and certainty-in-trading (as much as you can have) like never before. And there’s no doubt about the credibility of DeepSnitch AI, as the platform is already shipping tools built to audit contracts, score risk, and track sentiment in real time.

Actually using it is refreshingly simple, as early holders who already have access to the platform will know well.

As Galaxy needs a $200M buyback programme to prop up its share price, DeepSnitch AI needs a tiny fraction of that capital to send its price multiples higher at presale scale. The crash is temporary, but the tools are permanent, and this token isn’t going anywhere. Instead, it has a 1000x run on the cards after it launches, and that launch is days away at the time of writing.

2. Tron

While everything else was getting hammered, Tron did what Tron does and managed to survive. On February 6, TRX was trading at around $0.274 after a modest 1.2% uptick, outpacing a market that was broadly treading water. As the dominant settlement layer for USDT, Tron’s transactional utility gives it a floor that most altcoins can only dream of.

If TRX holds above $0.269, a retest of $0.281 looks feasible. But forecasts paint a sobering picture of roughly $0.268 by year-end, which is essentially sideways. And China’s freshly minted stablecoin ban introduces a genuine wildcard, where if regulatory pressure trickles into the Asian stablecoin corridors where Tron dominates, the knock-on effects could cap any recovery before it gets going.

Tron is resilient, absolutely. But it’s not a moonshot from here.

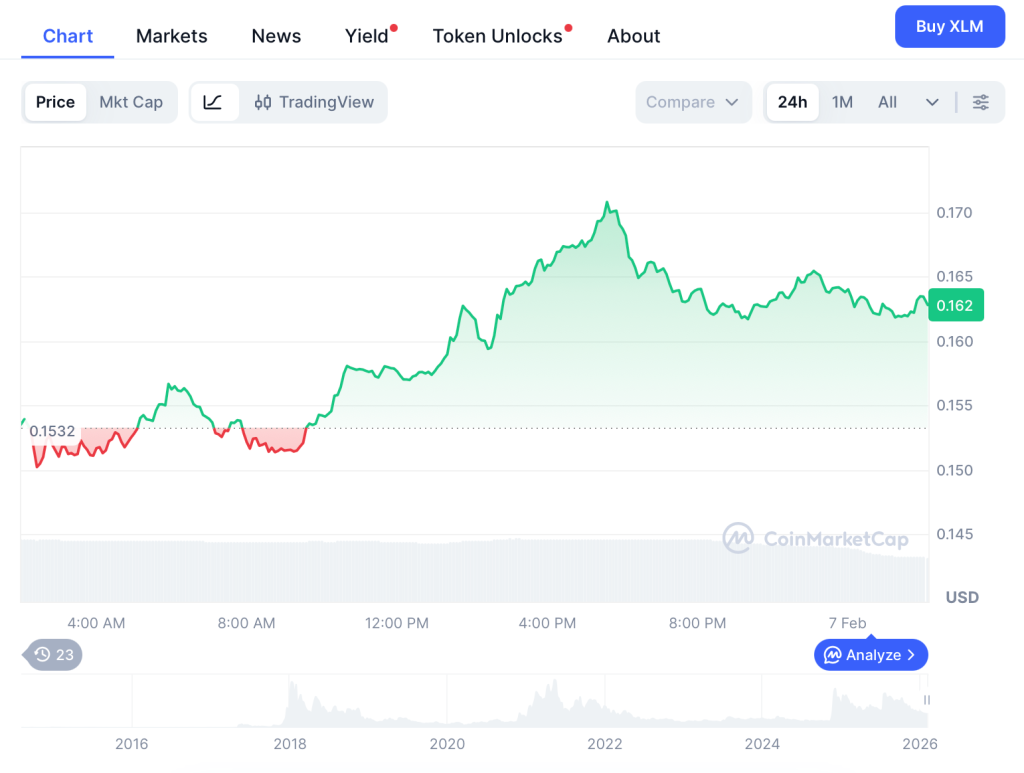

3. Stellar

Stellar had the more dramatic day of the two, surging around 12% to $0.165 on February 6, caught in a violent market-wide short squeeze that liquidated above $954M in shorts across the board. XLM’s 96.9% correlation with the S&P 500 confirms this was a macro wave, full stop, not a Stellar-specific moment.

The cross-border payments infrastructure underneath is elegant and genuinely useful for remittance corridors, and the network has been reliable for years. But the token has been one of the most frustrating underperformers relative to its thesis in all of crypto.

From here, roughly $0.18 by year-end, or about 11% upside, is projected. If XLM holds above the $0.1538 pivot, a test of the 7-day SMA near $0.174 is in play. But if you’re asking why is crypto crashing and trying to figure out where to deploy capital for maximum impact, 11% annualised is not the answer.

A pre-launch AI presale at $0.03906 with live utility, uncapped staking, and imminent launch is an entirely different opportunity, and it’s all DeepSnitch AI’s.

Final say

China is banning stablecoins, as Galaxy is buying back stock after a $241M annual loss. Leverage liquidations are still cascading, too. When the question is why is crypto crashing?, the answer is always some version of too much leverage meeting too little substance.

DeepSnitch AI is the direct counter to this, with powerful tools, many of which have already shipped internally, and pre-market pricing where the downside is anchored by what’s already been built and the upside has no ceiling.

The price of $0.03906 won’t stick around for long with the presale already clearing $1.5M. Buyers committing $30K or more can amplify their exposure using a host of bonus codes, all available on the website.

Lock in your early-stage entry on the official website, and stay ahead of the launch via X and Telegram.

FAQs

Why is crypto crashing in February 2026?

The crash is coming, at least in part, from leverage liquidations, Bitcoin ETF outflows topping $690M weekly, and fresh regulatory tightening, including China’s comprehensive ban on yuan-pegged stablecoins and tokenised RWAs. But DeepSnitch AI’s presale operates outside this dynamic, offering a pre-market entry insulated from the risk-off sentiment dragging established tokens down.

Is it smart to buy crypto during a market crash?

Historically, crashes produce the strongest entry points for projects with real utility. DeepSnitch AI’s presale at $0.03906 offers asymmetric upside still, and if the crypto market crash explained could be summed up in one line, it’s this: overleveraged positions unwind, quality projects survive, and early holders benefit most. DeepSnitch AI is built for exactly this.

What does China’s stablecoin ban mean for the crypto market?

China banned all unapproved yuan-pegged stablecoins and tokenised RWAs, pushing digital currency activity toward the state-controlled e-CNY. This could pressure Asian stablecoin corridors relevant to TRX and XLM, but it has no direct impact on AI-focused projects like DeepSnitch AI, which derives its value from platform utility and adoption rather than fiat-pegged token flows. If you’re asking why is crypto crashing and what’s immune to the answer, utility-driven presales are a strong place to look.

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.

The post Why Is Crypto Crashing in February 2026? China Slams the Door on Stablecoins and Galaxy Buys the Dip, but DeepSnitch AI is Still Gearing for 1000x Run in Q1 After Launch appeared first on CaptainAltcoin.

You May Also Like

Altcoin Rally Will Come Only When This Coin Makes ATH

AI Data Centers: Unleashing Billions in a Revolutionary Tech Investment Wave