Bitcoin (BTC) Price Prediction: Why Fed Chair Drama Could Determine Next Major Move

TLDR

- Bitcoin faces pressure at $116,963 cost basis level where 3.75% of supply sits, potentially triggering a retest of $110,000

- $3 billion in realized gains hit the market on August 16, causing Bitcoin to drop 1.9% to $114,707

- Bitcoin’s Accumulation Trend Score dropped from 0.57 to 0.20, showing reduced HODLer buying activity

- September rate cut odds fell from 80% to 73% on Polymarket, while no-change contracts jumped to 26%

- Trump administration considering 11 candidates to replace Fed Chair Powell, with announcement potentially driving further Bitcoin price action

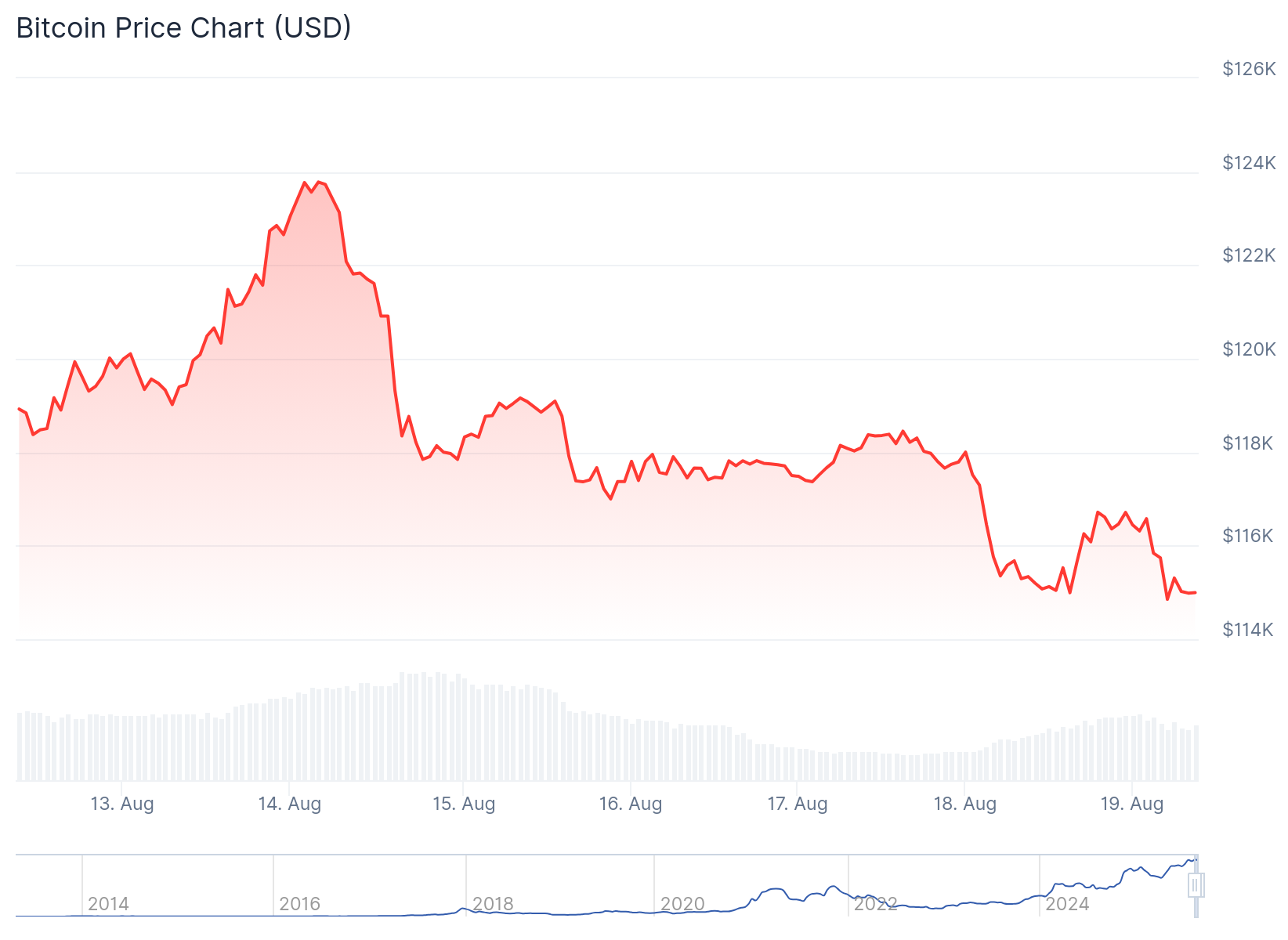

Bitcoin is testing crucial support levels after pulling back from recent highs. The cryptocurrency dropped to $114,707 following heavy profit-taking activity.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

On August 16, over $3 billion in realized gains entered the market. This created the largest profit-taking spike of the month. Bitcoin responded with a 1.9% intraday decline.

The key level to watch sits at $116,963. This represents Bitcoin’s largest cost-basis cluster according to on-chain data. Over 700,000 BTC, representing 3.61% of total supply, holds this price level as their breakeven point.

Source: TradingView

Source: TradingView

This concentration of supply creates a major resistance zone. If this level fails to hold, it could trigger further selling pressure from holders looking to minimize losses.

Current price action suggests $114,000 may only provide temporary support. The heavy supply cluster near $116,963 increases the risk of continued downward pressure.

Market analysts point to $110,000 as a more probable target for deeper pullbacks. This level could provide stronger support for renewed buying interest.

Accumulation Activity Slows Down

Bitcoin’s Accumulation Trend Score flipped to orange territory for the first time this month. The metric tumbled from 0.57 to 0.20 within a week.

This decline shows reduced HODLer activity even at discounted price levels. Long-term holders appear less willing to add to positions during the current pullback.

The slowdown in accumulation creates an ask-heavy market environment. Supply is currently driving price action more than demand.

Bitcoin has pulled back nearly 8% from its recent all-time high. The lack of bid-side support has created clear order-flow imbalances.

Federal Reserve Policy Uncertainty Weighs on Markets

Rate cut expectations for September have declined on prediction markets. Odds dropped from over 80% to 73% according to Polymarket data.

Source: Polymarket

Source: Polymarket

Contracts betting on no rate change surged from 12% to 26% in the same period. This shift reflects growing uncertainty about Federal Reserve policy direction.

The changing expectations matter for Bitcoin’s price trajectory. Many investors had positioned for a fourth-quarter rally based on expected monetary easing.

With that tailwind potentially fading, buying interest has cooled. The reduced FOMO environment makes current levels less attractive to new buyers.

Economist Alex Krüger believes Bitcoin won’t be fully priced in until President Trump announces Jerome Powell’s replacement. Powell’s term expires in May 2026.

The Trump administration is reportedly considering 11 candidates for the position. Names include Jefferies’ David Zervos, BlackRock’s Rick Rieder, and former Fed Governor Larry Lindsey.

Some reports suggest Trump has narrowed the list to three or four candidates. An announcement could come sooner than expected.

The relationship between Trump and Powell has been strained since January. Trump has repeatedly criticized the Fed’s reluctance to cut rates and called for Powell’s removal.

The CME FedWatch Tool shows 83.9% of market participants expect a rate cut at the September 17 meeting. This could provide support for risk assets including Bitcoin.

Coinbase Institutional notes that retail capital remains on the sidelines in money market funds. Fed easing could unlock greater retail participation in Bitcoin markets.

The post Bitcoin (BTC) Price Prediction: Why Fed Chair Drama Could Determine Next Major Move appeared first on CoinCentral.

You May Also Like

Strive Finalizes Semler Deal, Expands Its Corporate Bitcoin Treasury

Why 2026 Is The Year That Caribbean Mixology Will Finally Get Its Time In The Sun