Cardano (ADA) Price: Market Correction Deepens as Support Levels Break Down

TLDR

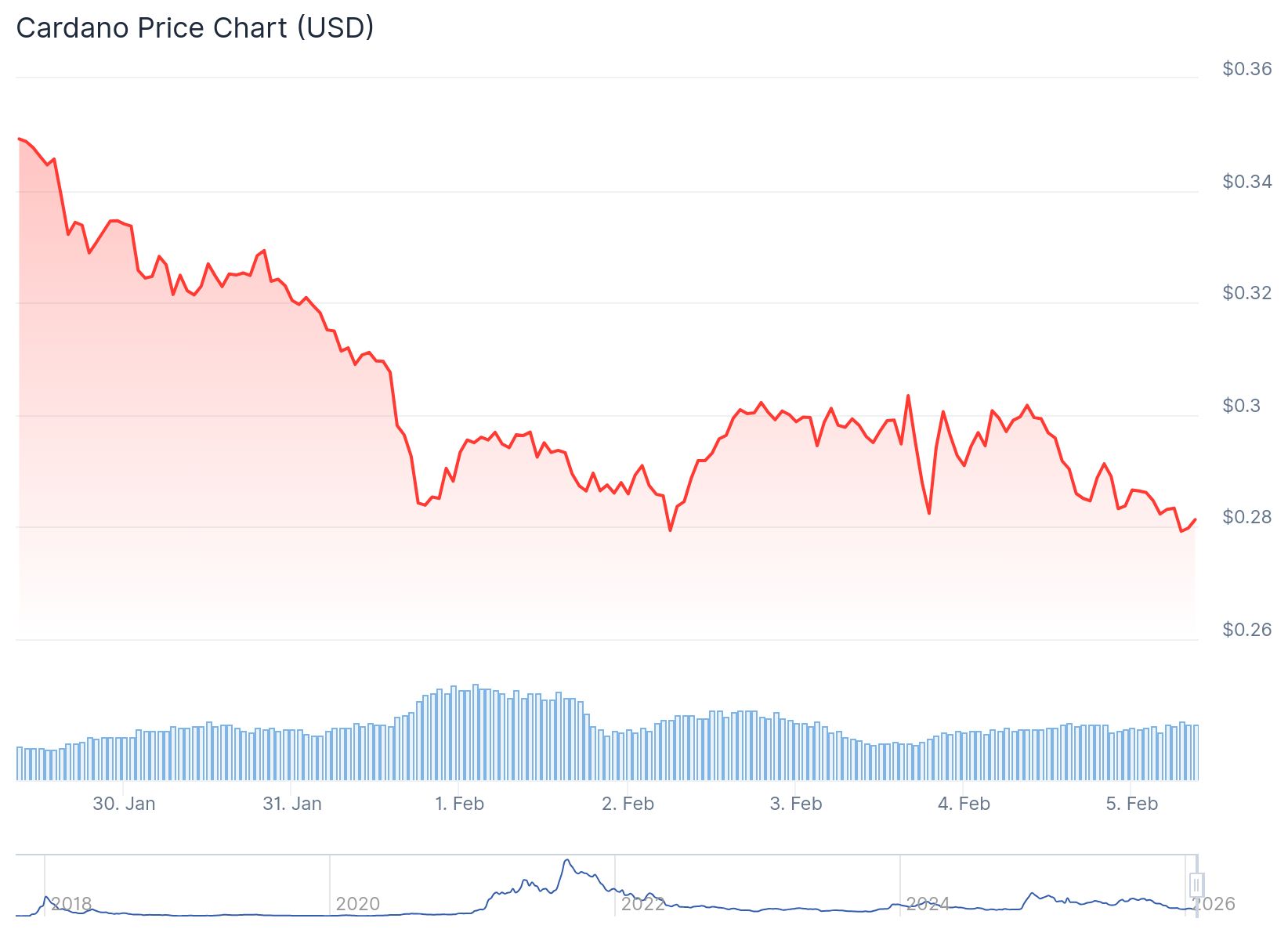

- Cardano trades at $0.28 on Thursday, down more than 15% last week and approaching October 2023 lows

- Open interest at Binance dropped to $90.21 million, the lowest level since November 2024, showing declining trader participation

- The long-to-short ratio stands at 0.95, indicating more traders are betting on price declines

- Technical indicators show bearish momentum with RSI near 30 and MACD maintaining a bearish crossover from January 18

- Key support sits at $0.32 with potential downside targets at $0.27 and $0.24 if selling pressure continues

Cardano price continues to decline, trading near $0.29 on Thursday after posting two consecutive days of losses. The cryptocurrency has dropped more than 15% over the past week, testing support levels not seen since late 2023.

Cardano (ADA) Price

Cardano (ADA) Price

ADA reached $0.287 on February 5, 2026, down from $0.2906 the previous day. This represents a decline of roughly 1.2% based on end-of-day levels.

The cryptocurrency has fallen approximately 10% from late January prices near $0.32-$0.33. It sits almost 20% below levels above $0.35-$0.36 seen earlier in the month.

Over a one-year period, ADA has dropped more than 60%. This decline is deeper than Bitcoin and matches the performance of other lagging smart-contract tokens.

Derivatives Data Points to Weakness

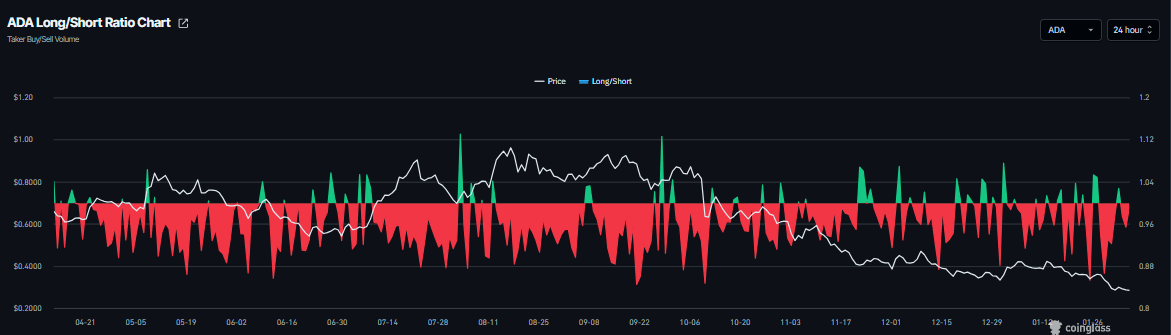

Futures open interest at Binance exchange fell to $90.21 million on Thursday. This marks the lowest level since early November 2024.

Source: Coinglass

Source: Coinglass

Open interest has been steadily declining since mid-January. The drop reflects reduced investor participation in Cardano futures markets.

The long-to-short ratio currently stands at 0.95 according to CoinGlass data. A ratio below one indicates more traders are positioned for price declines than gains.

Source: Coinglass

Source: Coinglass

Aggregated perpetual funding rates sit slightly positive near 0.01% per 8-hour period. This shows a modest long bias but remains far below levels seen during speculative rallies.

Aggregated open interest has declined by 11-12% in recent sessions. This reduction suggests both long and short traders have closed positions as price moved lower.

Technical Outlook Turns Bearish

The Relative Strength Index on the daily chart stands near 30. The indicator points downward toward oversold territory, showing strong bearish momentum.

The Moving Average Convergence Divergence indicator showed a bearish crossover on January 18. This signal remains intact and supports the negative outlook.

ADA trades below its 21-day, 50-day and 100-day exponential moving averages. All three moving averages are acting as resistance levels on bounce attempts.

The price structure shows a series of lower highs and lower lows since January. This pattern indicates a short-term downtrend on the daily timeframe.

If the downward trend continues, ADA could extend declines toward the October 21, 2023 low of $0.24. Initial support sits at the October 10 level of $0.27.

On the upside, resistance appears around $0.32 in the near term. A recovery above that level could push prices toward $0.36-$0.38, where previous rallies stalled.

The $0.32 level ties to late December and late January swing lows. A break below this zone would open the door to further downside.

Cardano’s updated on-chain constitution took effect at the epoch boundary on January 24. The constitution passed with approximately 79% of voting stake.

Recent development updates highlight continued work on Hydra-based layer-2 trading infrastructure. The Cardano Foundation also announced a 2026-27 Net Change Limit for the treasury.

These governance and scaling milestones have not translated into price support. Traders have focused on technical weakness rather than ecosystem developments.

Bitcoin continues to hold a firm position versus Ethereum this week. Major cryptocurrencies are consolidating rather than breaking down, while ADA trades near the lower end of its recent range.

The post Cardano (ADA) Price: Market Correction Deepens as Support Levels Break Down appeared first on CoinCentral.

You May Also Like

‘Big Short’ Michael Burry flags key levels on the Bitcoin chart

Solana Price Prediction: SOL Tipped for 3x Boom While Little Pepe (LILPEPE) Gains 100x Speculation