Mevolaxy introduces mevstaking for steady gains in a volatile market

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Mevolaxy is offering a new approach to crypto staking by using MEV bots to generate steady returns from market volatility rather than relying solely on market growth.

- Mevolaxy’s MEV bot liquidity pool allows investors to earn from price volatility instead of fixed rates or token emissions.

- The bots use a sandwich trading strategy to capture profits around large blockchain transactions.

- Investors can register, deposit funds, and monitor real‑time earnings with full transparency and no manual trading required.

Staking cryptocurrencies has long been a popular way to earn passive income. However, traditional options often depend on market growth. The US-based crypto firm Mevolaxy changes this narrative by offering an alternative: mevstake in a liquidity pool managed by MEV bots. This allows users to earn income from volatility and price movements.

For context, MEV (Maximal Extractable Value) refers to profit obtained through the optimal organization and order of transactions on the blockchain. Mevolaxy bots use a sandwich strategy: they track large orders and execute transactions before and after them to capture the price difference and generate profit. Investors deposit funds into the liquidity pool, and the bots automatically manage them.

Unlike traditional staking, where income depends on fixed percentages or token emissions, MEV bots earn from any market movements. This is especially relevant in volatile markets when prices fluctuate and traders execute many large transactions. In such conditions, bots can provide a stable income independent of the overall market trend.

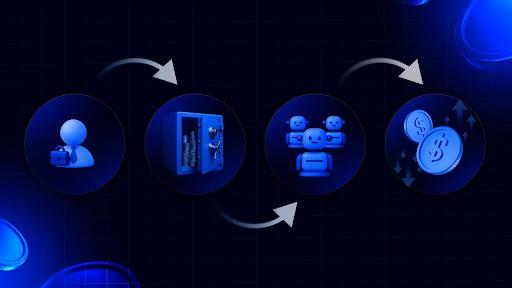

Getting started on Mevolaxy is quite simple. First, users will need to register on the Mevolaxy platform. Next, they must deposit funds into the liquidity pool. The bots will take over, monitoring the mempool around the clock, reacting to large transactions, and automatically making profitable trades. Investors receive reports and can monitor their earnings in real time.

The Mevolaxy platform provides full transparency of operations, allowing investors to track the performance of the bots. The platform minimizes the risks associated with emotions and errors in self-trading and reduces dependence on market growth.

Mevstake in the MEV bot liquidity pool from Mevolaxy has proven to be a convenient and stable way to earn passive income. It is ideal for investors who want to work with cryptocurrency without constant monitoring or complex trading strategies. Interested investors can visit the Mevolaxy platform to learn more about the platform and its offerings.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

You May Also Like

XRP Price News: Elon Musk Confirms X Money Crypto Plans as Pepeto’s Three Products Approach Launch and the 537x Window Stays Open

CME Group to Launch Solana and XRP Futures Options