Tom Lee Still Sees Bitcoin At $250,000 But Warns 2026 Gets ‘Jagged’

Fundstrat’s Tom Lee reiterated his $250,000 Bitcoin target while cautioning that 2026 could be a “jagged” year for crypto adoption and a turbulent one for broader risk assets, framing any major pullback as a buying window rather than a signal to de-risk.

Speaking on The Master Investor Podcast with Wilfred Frost in an interview released Jan. 20, Lee said he expects 2026 to ultimately “look like a continuation of the bull market that started in 2022,” but argued markets must first digest several transitions that could deliver a drawdown large enough to “feel like a bear market.”

$250,000 Bitcoin Call Comes With A 2026 Warning

Lee pointed to what he described as a “new Fed” dynamic, arguing markets tend to “test” a new chair and that the sequencing of identification, confirmation, and reaction can catalyze a correction. He also warned that the White House could become “more deliberate in picking winners and losers,” expanding the set of sectors, industries, and even countries “in the bullseye,” which he said is already visible in gold’s strength.

A third friction point, in his telling, is AI positioning: the market is still calibrating “how much is priced into AI,” from energy needs to data-center capacity, and that uncertainty could linger until other narratives take the baton.

Pressed on magnitude, Lee said with regards to the S&P 500, the drawdown “could be 10%,” but also “could be 15% or 20%,” potentially producing a “round trip from the start of the year,” before finishing 2026 strong. He added that his institutional clients did not appear aggressively positioned yet, and flagged leverage as a tell: margin debt is at an all-time high, he said, but up 39% year-over-year—below the 60% pace he associates with local market peaks.

For crypto, Lee leaned on a market-structure explanation for why gold outperformed: he said crypto tracked gold until Oct. 10, when the market suffered what he called “the single largest deleveraging event in the history of crypto,” “bigger than what happened in November 2022 around FTX.”

After that, he said, Bitcoin fell more than 35% and Ethereum almost 50%, breaking the linkage. “Crypto has periodic deleveraging events,” Lee said. “It really impairs the market makers and the market makers are essentially the central bank of crypto. So many of the market makers I would say maybe half got wiped out on October 10th.”

That fragility, he argued, doesn’t negate the “digital gold” framing so much as it limits who treats it that way today. “Bitcoin is digital gold,” Lee said, but added that the set of investors who buy that thesis “is not the same universe that owns gold.”

Over time, Lee expects the ownership base to broaden, though not smoothly. “Crypto still has a, I think, future adoption curve that’s higher than gold because more people own gold than own crypto,” he said. “But the path to getting that adoption rate higher is going to be very jagged. And I think 2026 will be a really important test because if Bitcoin makes a new all-time high, we know that that deleveraging event is behind us.”

Within that framework, Lee reiterated his high-conviction upside call: “We think Bitcoin will make a new high this year,” he said, confirming a $250,000 target. He tied the thesis to rising “usefulness” of crypto, banks recognizing blockchain settlement and finality, and the emergence of natively crypto-scaled financial models.

Lee cited Tether as a proof point, claiming it is expected to generate nearly $20 billion in 2026 earnings with roughly 300 employees, and argued that the profit profile illustrates why blockchain-based finance can look structurally different from legacy banking.

Lee closed with advice that intentionally cuts against short-horizon reflexes. “Trying to time the market makes you an enemy of your future performance,” he said. “As much as I’m warning about 2026 and the possibility of a lot of turbulence, they should view the pullback as a chance to buy, not the pullback as a chance to sell.”

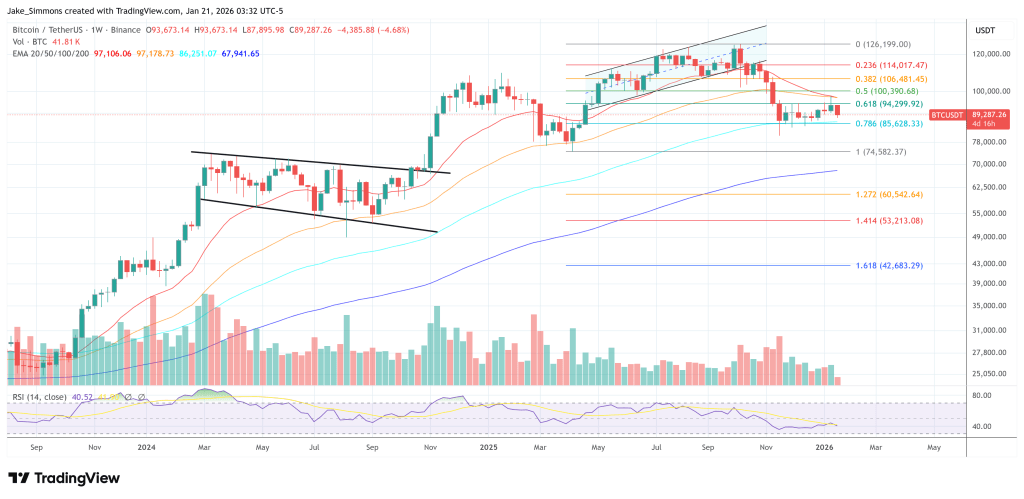

At press time, Bitcoin traded at $89,287.

You May Also Like

STRC Stock Surge: How Much Bitcoin Can Saylor Buy?

Ethereum co-founder Jeffrey Wilcke sends $157M in ETH to Kraken after months of wallet silence