BlackRock’s Bitcoin Buying Spree: $878M Accumulated in 3 Straight Days

BlackRock added 9,619 Bitcoin BTC $89 864 24h volatility: 2.4% Market cap: $1.79 T Vol. 24h: $48.70 B worth about $878 million and 46,851 Ether ETH $3 092 24h volatility: 3.9% Market cap: $373.25 B Vol. 24h: $24.55 B worth about $149 million across three straight days.

The combined total stands near $1.03 billion, based on on-chain tracking from LookOnChain. The buys hit during market weakness, not during a breakout, which matters.

On January 6 alone, BlackRock picked up 3,948 Bitcoin worth about $371.9 million and 31,737 Ether worth about $100.2 million.

This flow dominated early-2026 ETF activity and marked the largest single-day intake of the year so far.

At the time of writing, Bitcoin is trading near $90,212 and ETH near $3,118 at press time, both lower on the day. While BTC’s trading volume fell 24%, Ether’s dropped 19%.

It is important to note that during the holiday period, BlackRock moved 1,134 Bitcoin and 7,255 Ether to Coinbase Prime.

The transfers raised sell-off concerns, but price action stayed heavy rather than sharp

ETF Flows Meet a Reset Market

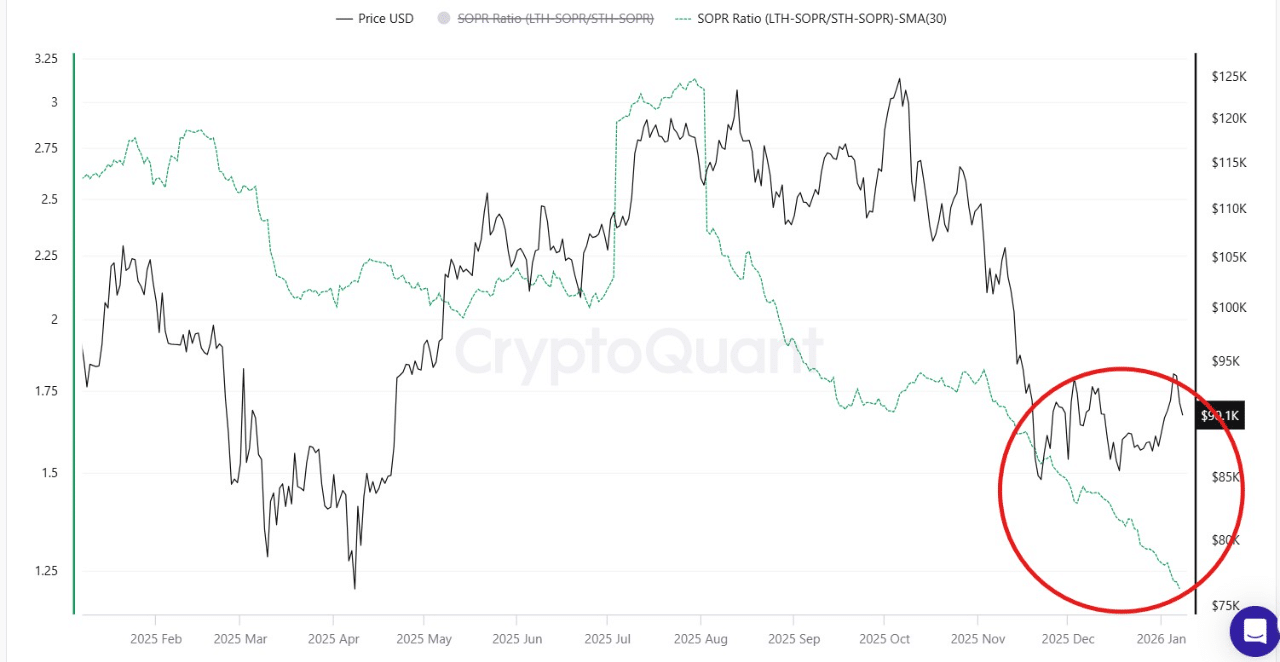

Bitcoin entered 2026 after a sharp pullback from the $110,000-$120,000 zone to the low $90,000s. On-chain data from CryptoQuant shows the SOPR ratio near exhaustion levels seen in prior resets.

Short-term holders locked losses through December, while long-term holders kept profit without heavy selling. This pattern often marks a transfer from weak hands to strong balance sheets.

Bitcoin SOPR Ratio. | Source: CryptoQuant

A hold above the current $90K zone keeps $100,000-$110,000 in play. A break below $88,000 opens risk toward $80,000.

Glassnode data shows a cleaner structure after year-end positioning washed out. More than 45% of options open interest cleared.

Futures interest has now turned higher while ETF flows have reappeared after late-2025 exits.

“The early-January breakout thus reflects a market that had effectively reset its profit-taking pressure, allowing the price to move higher,” Glassnode noted.

For now, Bitcoin support sits near $90,000. Overhead supply caps move between $95,000 and $104,000.

With options flow now favoring calls and volatility dropping near cycle lows, Glassnode painted an optimistic picture for the near future.

nextThe post BlackRock’s Bitcoin Buying Spree: $878M Accumulated in 3 Straight Days appeared first on Coinspeaker.

You May Also Like

White House Publishes Trump’s New Strategy Against Cybercrimes

Trump's new DHS pick can't stop embarrassing himself — and he hasn't even started