[LIVE] Suspected Exploit Hits GMX Exchange: Over $42M Drained from Vaults – DeBank Reports

Decentralized exchange GMX is believed to have suffered a major exploit, with over $42 million in digital assets reportedly drained from its vaults, according to data from DeBank.

The incident appears to involve a suspicious outflow of funds. Over $42 million was transferred from GMX Vault-related contracts to a single wallet address: 0xdf3340a436c27655ba62f8281565c9925c3a5221.

The funds are now being bridged from Arbitrum, a Layer 2 Ethereum scaling network, back to the Ethereum mainnet—a common tactic used by attackers to obfuscate and launder stolen assets.

According to blockchain security firm PeckShield, the attacker has already bridged around $9.6 million worth of crypto assets from Arbitrum to the Ethereum network, suggesting a potential attempt to obfuscate and launder the stolen funds across chains.

Suspected Smart Contract Vulnerability

The nature of the incident is still under investigation, but on-chain data indicates it was likely a targeted exploit or smart contract vulnerability rather than a user error or regular withdrawal.

The GMX team has not yet released an official statement confirming the breach or outlining any steps being taken in response.

DeBank, a leading blockchain data analytics platform, was among the first to report the anomaly, describing the event as a “significant abnormal outflow.”

The affected contracts are linked to GMX’s vault infrastructure, which is designed to manage liquidity for leveraged trading and derivatives products on the platform. As of the time of writing, no white hat intervention or recovery transactions have been observed.

Community and Market Reaction

The address involved in the exploit continues to move funds, increasing concern over the likelihood of recovery. Community members and independent security researchers are tracking the wallet activity in real time, hoping for further clarity and potential mitigation.

This incident marks one of the larger DeFi-related exploits of the year and comes amid ongoing concerns about the security of cross-chain protocols and smart contract platforms.

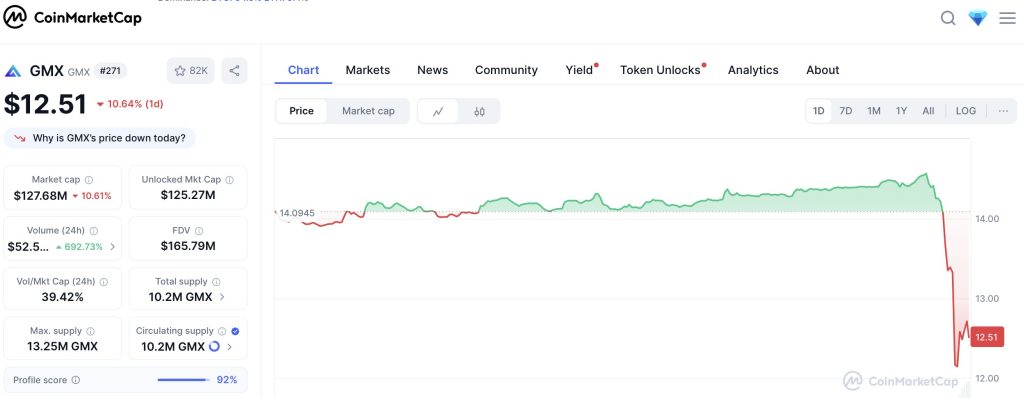

The GMX token (GMX) saw a sharp drop in price down to $12.51 at press time following the initial reports, reflecting market uncertainty around the scope and resolution of the exploit.

More updates are expected as the GMX team investigates and releases an official statement.

Security Update From GMX

You May Also Like

Woman shot 5 times by DHS to stare down Trump at State of the Union address

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise