Bitcoin Bear Flag Alert: Will Price Hit $90K or Reverse?

Bitcoin Approaching Critical Breakout as Market Volatility Hits Extremes

Bitcoin has recently fallen below the $90,000 support level, closing the week on a bearish note amid mounting forecasts of increased volatility. Traders and analysts are closely monitoring the cryptocurrency’s next move, with some predicting a significant breakout on the horizon as market conditions tighten.

Key Takeaways

- Bitcoin’s price remains confined within a narrow trading range, with volatility reaching historically low levels.

- Repeated attempts to push above resistance levels have failed, increasing speculation of a forthcoming decisive move.

- Analysts are divided over whether Bitcoin will experience a sharp decline towards $50,000 or rebound to test nearby highs.

- Market sentiment suggests a pivotal moment is near, with potential for increased directional movement.

Market Indicators Signal Imminent Volatility

Data from Cointelegraph Markets Pro and TradingView indicate a period of stagnation over the weekend, with Bitcoin’s price oscillating around the recent support levels. The absence of significant movement has contributed to a consolidation phase, but technical indicators suggest that a breakout may be imminent.

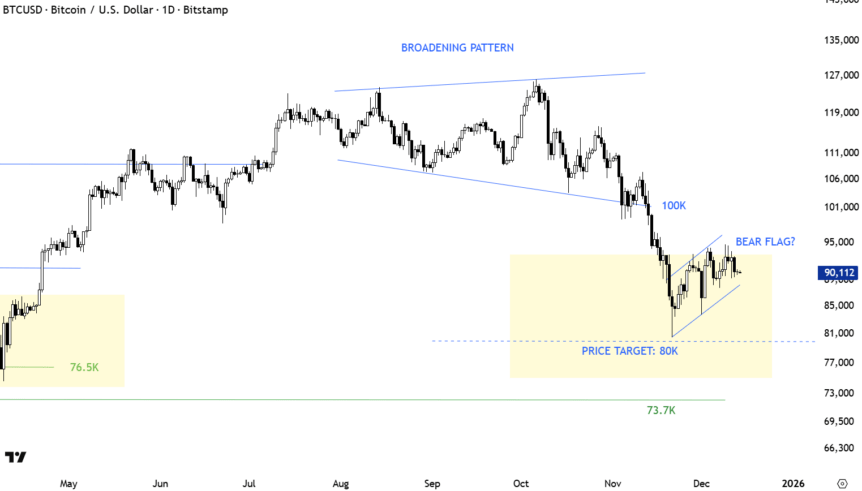

BTC/USD one-hour chart. Source: Cointelegraph/TradingViewMultiple failed attempts to breach higher levels this week have heightened expectations of a major move. Trading analyst Aksel Kibar notes that “extreme low volatility setups typically precede directional shifts.” He outlined two possible scenarios: a decline if the current bear flag on the daily chart plays out, potentially pushing the price down to the $73,700-$76,500 range, or a rally toward $95,000 if bullish momentum resumes.

BTC/USD one-day chart. Source: Aksel Kibar/X

BTC/USD one-day chart. Source: Aksel Kibar/X

Market sentiment remains cautious. Traders are watching key levels such as $92,000 and $94,000 for potential bullish breakthroughs, while a drop below $89,000 could trigger a sharper decline towards $85,000, as noted in recent social media analysis.

Potential Downside Targets and Bear Market Outlook

On-chain data platform CryptoQuant has highlighted that the current market environment is indicative of an ongoing bear market. Contributing factors include declining simple moving averages and persistent resistance at key trendlines, suggesting that recent rebounds lack conviction. As a result, many analysts warn of further downside risks, with some forecasting Bitcoin could decline to as low as $50,000 before a substantial recovery occurs.

Although Ethereum has shown some resilience from recent lows, overall market sentiment remains bearish. Technical analyst Pelin Ay emphasizes that attempts at recovery are weak, with low trading volumes and strong selling pressure reinforcing the view that a deeper bear phase may be on the horizon.

Cointelegraph has previously reported that traders are increasingly expecting a prolonged downward trend, with the next significant support potentially tested in the coming months. The prevailing technical signals and macroeconomic factors suggest that investors should prepare for heightened volatility and possible further declines before a sustained bullish reversal occurs.

This outlook underscores the importance of diligent risk management and comprehensive research in navigating the volatile current landscape of digital assets.

This article was originally published as Bitcoin Bear Flag Alert: Will Price Hit $90K or Reverse? on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

JPMorgan Chase: Circle faces "intense" competition from Tether, Hyperliquid, and fintech firms

Vàng Cán Mốc Lịch Sử 5.000 USD: Khi Dự Báo Của CEO Bitget Gracy Chen Trở Thành Hiện Thực Và Tầm Nhìn Về Đích Đến 5.400 USD