How newsrooms keep their audience in age of AI, TikTok

MANILA, Philippines – Journalism adapts to every phase of technological development, surviving to keep the public informed.

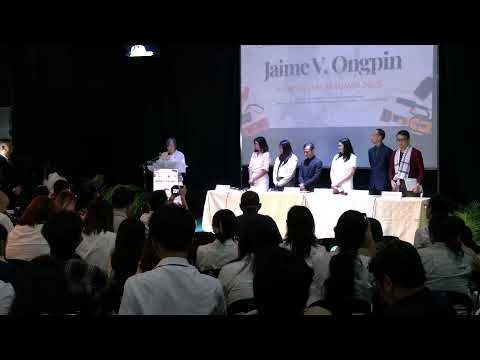

The 2025 Jaime V. Ongpin Journalism Seminar (JVOJS) by the Center of Freedom and Responsibility, held at the University of the Philippines College of Media and Communication on Thursday, November 27, centered on the current techniques newsrooms employ to keep their audience amid the age of influencers, algorithm, and news fatigue.

Rappler senior investigative reporter Lian Buan, who sat as one of the panelists, reiterated that the media is no longer the sole source of information: “Now the challenge we now have, [is that] audiences used to chase us. Now we have to chase you.”

Rappler senior investigative reporter Lian Buan is one of the panelists at the Jaime V. Ongpin Journalism Seminar held at the University of the Philippines College of Mass Communication on November 27, 2025. Angie de Silva/Rappler

Rappler senior investigative reporter Lian Buan is one of the panelists at the Jaime V. Ongpin Journalism Seminar held at the University of the Philippines College of Mass Communication on November 27, 2025. Angie de Silva/Rappler

Buan said that news is still the same, as far as its elements and methods are concerned. What changed is how newsrooms distribute information side by side with more social networking sites and so-called influencers.

“So I think the challenge for me now is to not get obsessed with the old ways but actually chase you [the audience] because that’s my responsibility. And I think the audiences are smart,” Buan said.

Buan joined Rappler senior reporter Dwight de Leon in the 2025 JVOJS panel. The two are part of Rappler’s investigative team that looks into the flood control corruption scandal hounding the Philippine government.

Former Philippine Center for Investigative Journalism executive director Carmela Fonbuena is one of the panelists at the Jaime V. Ongpin Journalism Seminar at the University of the Philippines College of Mass Communication on November 27, 2025. Angie de Silva/Rappler

Former Philippine Center for Investigative Journalism executive director Carmela Fonbuena is one of the panelists at the Jaime V. Ongpin Journalism Seminar at the University of the Philippines College of Mass Communication on November 27, 2025. Angie de Silva/Rappler

Veteran journalist and former Philippine Center for Investigative Journalism (PCIJ) executive director Carmela Fonbuena believes that although news distribution has changed, news elements stayed the same and should remain as they are.

However, Fonbuena noted that audiences have a different point of view on what news is, so journalists should understand these perspectives to better reach the public.

“The news [elements], I feel, shouldn’t change much, but how we understand our audiences so that they can understand the important stories that we need to tell them, that changes. We have to have a better understanding of how audiences get their news, and in what form, and in what language,” said Fonbuena, a former Rappler senior reporter.

Buan, De Leon, Fonbuena were joined by Cristina Chi of online news outlet Philstar.com, TV5 chief data and elections head Edson Guido, and Dominic Gutoman of alternative news publication Bulatlat in the panel.

No competition between text, video

De Leon highlighted that in order to cater to more audiences, journalists now create multiple versions of their reports. For example, apart from writing text stories, reporters also produce video versions of these reports meant to reach the population consuming TikTok, Instagram, and other related applications.

He noted, however, that one is not a replacement of the other — text and video reports complement each other.

“Also, narealize ko lang din, merong (Also, I’ve come to realize, that there’s) appetite for the audience to understand what we do behind the scenes…. And even in my future videos, and in my other videos, I told the public how I sourced my stories,” De Leon said.

“This separates us from content creators because content creators don’t necessarily have these tools or don’t necessarily observe these journalistic skills that we journalists do,” he added.

Rappler senior multimedia reporter Dwight de Leon joins the panel of the Jaime V. Ongpin Journalism Seminar held at the University of the Philippines College of Mass Communication on November 27, 2025. Angie de Silva/Rappler

Rappler senior multimedia reporter Dwight de Leon joins the panel of the Jaime V. Ongpin Journalism Seminar held at the University of the Philippines College of Mass Communication on November 27, 2025. Angie de Silva/Rappler

“What does my audience prefer? And if my audience prefers video now, I’ll do video. If tomorrow it’s text, it’s text. It’s really not about what I prefer,” Buan said.

For Fonbuena, there’s no alternative to long form and investigative reporting. However, catering to the preferred platform of the audiences like short videos encourage them to also consume other formats of the reports like text stories.

“It’s not enough that audiences should be satisfied with short videos of important stories. But we recognize, heto ‘yong paano mo sila susunduin (how would you win them over)? So they get interested enough because it’s an attention economy and that’s reality,” she explained.

Bigger role of journalism

Apart from teaching the panel’s audience comprised mostly of students, Chi reiterated the importance of being a “better reader” in order to become a good communicator and journalist. She said that the youth, especially aspiring journalists, must actively seek out articles and contents to learn from.

Phistar.com reporter Cristina Chi is one of the panelists of the Jaime V. Ongpin Journalism Seminar held at the University of the Philippines College of Mass Communication on November 27, 2025. Angie de Silva/Rappler

Phistar.com reporter Cristina Chi is one of the panelists of the Jaime V. Ongpin Journalism Seminar held at the University of the Philippines College of Mass Communication on November 27, 2025. Angie de Silva/Rappler

“Wow, nabilib ako dito (I was impressed by this content). Save it, and deconstruct it, reverse engineer it, so that you can learn on your own,” Chir said. “‘Yon ‘yong pinaka-natutuhan ko no’ng college (That’s what I learned in college), and even now, to reverse engineer good work. So that also entails being a good fan, a good follower of reporters that you like.”

During the seminar, Gutoman shared the struggles of alternative media groups like Bulatlat. Apart from navigating complex social media algorithms, Bulatlat also faces a “shadow-banning” or a form of censorship where social media networks limit a content’s visibility without informing the author.

Although they are forced to adopt to new strategies amid the technological advancement, Gutoman said Bulatlat never forgets to keep in touch with the communities they’re serving.

Bulatlat’s Dominic Gutoman is one of the panelists at the Jaime V. Ongpin Journalism Seminar at the University of the Philippines College of Mass Communication on November 27, 2025. Angie de Silva/Rappler

Bulatlat’s Dominic Gutoman is one of the panelists at the Jaime V. Ongpin Journalism Seminar at the University of the Philippines College of Mass Communication on November 27, 2025. Angie de Silva/Rappler

“We organize discussions with them, with our reports. And then we also engage with different fora using our reports. So that they could at least feel grounded with the information [that we provide],” Bulatlat’s community manager said.

Technological advancement also dropped tons of accessible information to the public. Guido said there’s too much information around, but with not much explanation. For him, journalism — particularly data journalism — should be used to explain things with clarity and beyond surface level.

Edson Guido is one of the panelists at the Jaime V. Ongpin Journalism Seminar at the University of the Philippines College of Mass Communication on November 27, 2025. Angie de Silva/Rappler

Edson Guido is one of the panelists at the Jaime V. Ongpin Journalism Seminar at the University of the Philippines College of Mass Communication on November 27, 2025. Angie de Silva/Rappler

“Again, misinformation exists and thrives where clarity is absent. And with data journalism, you’re not just reporting, you’re really reporting beyond the surface level. And you get the trust of the public because he said, she said, it’s not an ego from impressions to evidence,” Guido explained. – Rappler.com

You May Also Like

Wormhole launches reserve tying protocol revenue to token

The man accused of stealing $11 million in XRP has filed a countersuit against the widow of American country music singer George Jones.