Bitcoin miner Hive opens door to $300 million stock sales after record quarter

HIVE Digital Technologies put a new at-the-market equity program in place on Tuesday that will allow the company to sell up to $300 million of its shares over time, adding financial flexibility after posting a record quarter last week.

The shelf program allows HIVE to sell stock through banks like KBW, Stifel, and Cantor Fitzgerald at market prices when it chooses to. HIVE isn’t obligated to use the facility, which runs until the company hits the $300 million limit or decides to shut it down.

The offering comes as HIVE continues to push deeper into AI and high-performance computing infrastructure.

Earlier this month, the company bought a 32.5-acre parcel in Grand Falls, New Brunswick, to build a renewable-powered data center campus capable of hosting more than 25,000 GPUs.

Executives have described the strategy as a “dual-engine” model, using bitcoin-mining revenue to accelerate the buildout of hyperscale-ready compute capacity.

HIVE’s most recent quarterly results reflected that approach. Revenue rose 285% year-over-year to $87.3 million, while bitcoin production jumped 77% from the prior quarter to 717 BTC. The company has said BUZZ HPC, its high-performance computing arm, is becoming a more important growth driver as miners reposition themselves as infrastructure providers for AI workloads.

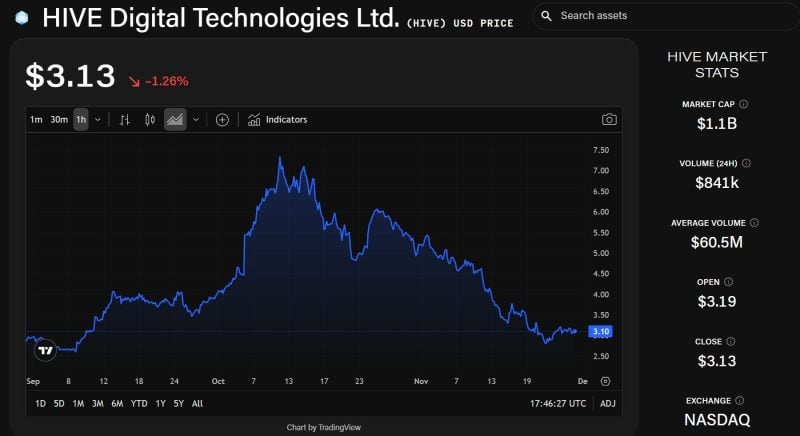

Despite the expansion push, HIVE shares have fallen to around $3.10 after hitting a three-year high above $6.60 in early October, according to The Block’s price page.

HIVE Digital Technologies (HIVE) Stock Price Chart. Source: The Block/TradingView

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

You May Also Like

SHIB Price Prediction: Mixed Signals Point to $0.000010 Target Despite Technical Data Gaps

Rattled retail retreats to Bitcoin, Ether after October crash