Crypto News Today: Scammers Reportedly Pose As Australian Police To Rob Victims Of Crypto

Australian authorities are warning that scammers are posing as police through the government’s ReportCyber platform to steal crypto.

Authorities in Australia have warned that scammers are abusing the country’s ReportCyber platform to impersonate police officers and steal crypto.

The Australian Federal Police (AFP) said cybercriminals are using stolen data and fake case numbers to make their scams appear authentic. They then use the cover to convince victims to hand over their digital assets.

How The Scams Start

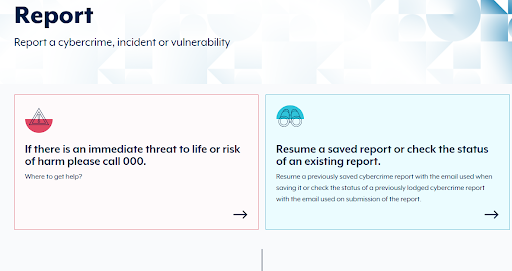

The scam starts when criminals submit fake cybercrime reports through ReportCyber, the official portal where Australians can lodge online fraud or hacking complaints.

After filing these fake reports, the fraudsters contact victims and pretend to be AFP officers investigating a crypto-related breach.

The ReportCyber platform interface

The ReportCyber platform interface

They also sometimes reference the report and provide an official-sounding case number. Victims are told their accounts are under investigation and are then urged to transfer their crypto to a so-called “secure wallet” for protection.

How the Crypto Scam Works Through ReportCyber

AFP Detective Superintendent Marie Andersson explained that the scammers’ tactics are highly convincing because they mimic actual law enforcement procedures. Criminals verify personal details, create urgency and use government channels to seem credible.

“The scammers act quickly and use familiar steps to gain trust,” Andersson said. “They often claim that someone has been arrested and that the victim’s name came up in a crypto breach investigation.”

The scam usually involves two parts. First, the fake officer contacts the victim and provides a fake case reference number tied to a ReportCyber report.

Then, another caller joins in and poses as a representative from a crypto exchange or security firm. This person instructs the victim to move funds into a “safe” wallet.

In one case, the victim was told they were connected to a data breach. They were advised to secure their crypto by transferring it to a wallet managed by the supposed investigators.

The target became suspicious and ended the call before losing any money.

The AFP confirmed that criminals have also used spoofed phone numbers to make calls appear as if they were coming from official AFP lines.

Related Reading: Crypto Scam: SEAL Team Unveils Verifiable Phishing Reports to Expose Scammers

Police Advise Australians to Stay Alert

Authorities are urging Australians to be careful and to verify all unexpected contact related to cybercrime reports.

The AFP stressed that real officers will never ask for crypto transfers, seed phrases or access to personal accounts.

Citizens are also encouraged to call 1300 CYBER1 to confirm whether a contact or case number is legitimate. The AFP’s Joint Policing Cybercrime Coordination Centre is monitoring these scams and reviewing how the ReportCyber platform could be further protected from misuse.

Despite the scam, officials pointed out that ReportCyber continues to be an important tool for tracking cybercriminals and preventing future fraud.

Crypto Fraud Under Tightened Oversight in Australia

The warning about the ReportCyber scam comes as Australia steps up its campaign against crypto-related fraud.

Last month, Home Affairs Minister Tony Burke announced new plans to regulate crypto ATMs and called them “high-risk products” linked to money laundering and other crimes.

The proposal will require operators to register under tighter anti-money laundering standards.

At the same time, the Australian Securities and Investments Commission (ASIC) has been expanding its online scam crackdown. Since July 2023, ASIC has taken down more than 14,000 fraudulent websites and about 20% involved crypto schemes.

These sites include fake trading platforms, phishing pages and social media ads that promote fake investment opportunities. ASIC now tracks around 130 of these new sites every week, in a show of how digital fraud is spreading within the country.

The post Crypto News Today: Scammers Reportedly Pose As Australian Police To Rob Victims Of Crypto appeared first on Live Bitcoin News.

You May Also Like

Crypto Market Cap Edges Up 2% as Bitcoin Approaches $118K After Fed Rate Trim

Vitalik Buterin Reveals Ethereum’s (ETH) Future Plans – Here’s What’s Planned