CATL (300750.SZ) Stock: Investors Eye Premium Drop Before Earnings Release

TLDRs:

- CATL Hong Kong shares trade at a 30% premium, down from 44% in July ahead of Q3.

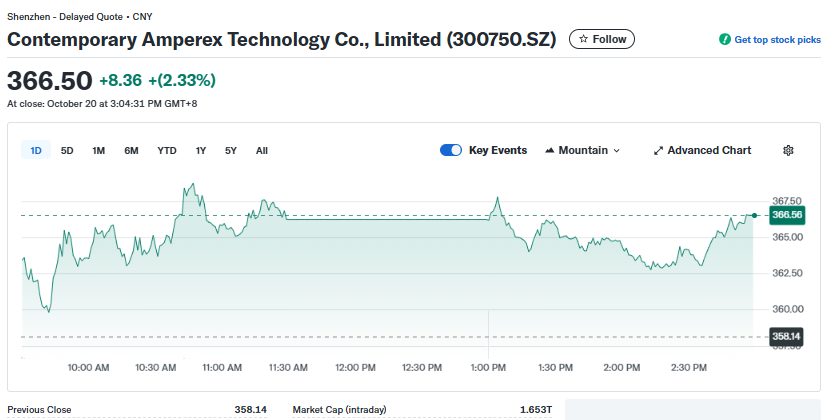

- Shenzhen-listed CATL shares rose 2.33% Monday, signaling investor confidence in battery growth.

- Q3 net profit is projected at 18.8 billion yuan, with power batteries driving most revenue.

- FEOC rules and trade tensions are influencing investor caution and market expectations.

The premium of Contemporary Amperex Technology Co., Limited (CATL) shares in Hong Kong has narrowed significantly ahead of the company’s Q3 earnings report.

After adjusting for currency fluctuations, the Hong Kong-listed shares now trade at a 30% premium to the Shenzhen listing, down from 44% in July. This contraction in premium reflects growing investor caution as market participants weigh the potential impact of global trade tensions and rising expectations for battery demand.

On Monday, CATL’s Shenzhen-listed shares surged 2.33%, closing at 366.50 yuan, up 8.36 yuan from the previous session. The rise follows a period of volatility in the battery sector, driven by supply chain concerns and fluctuating EV sales data. Analysts suggest that the increase demonstrates investor confidence in CATL’s robust order book and the expected quarterly growth in battery shipments.

Contemporary Amperex Technology Co., Limited (300750.SZ)

Contemporary Amperex Technology Co., Limited (300750.SZ)

Q3 Earnings Outlook

Market analysts, including Morgan Stanley, anticipate CATL’s Q3 battery sales volume to rise by over 15% compared to the previous quarter, with projected net profit reaching 18.8 billion yuan (approximately US$2.6 billion).

While overall revenue growth is expected, investors are closely monitoring regional and segment-specific performance. In 2024, CATL generated 30.48% of its revenue, or 110.34 billion yuan, from overseas markets, a slight decline from 32.67% in 2023. Most of the company’s revenue continues to come from power battery systems, primarily EV battery packs, which accounted for 69.9% of total revenue in 2024, while energy storage contributed 15.83%.

Regulatory Pressures Influence Market

Beyond financial performance, regulatory frameworks, particularly the US Foreign Entity of Concern (FEOC) rules, are shaping investor expectations.

The FEOC rules, effective in 2025–2026, impose sourcing restrictions on US power and storage projects involving prohibited foreign entities. These guidelines could limit tax credits unless traceability of materials and components is verified.

Battery makers, including CATL, are likely to accelerate sourcing and compliance efforts ahead of these deadlines, creating short-term opportunities for software and data vendors in provenance tracking.

Investor Caution Amid Trade Tensions

The narrowing premium and heightened market attention also reflect broader macroeconomic concerns. Renewed trade tensions between China and other major markets have prompted some investors to exercise caution despite CATL’s historically strong earnings.

Earlier in October, CATL’s shares reached highs that may now be moderating as investors anticipate earnings details and the company’s ability to navigate geopolitical risks.

Looking Ahead

As CATL prepares to release its Q3 earnings later today, investors will focus on several key indicators: quarterly sales volume, gross margins, and regional performance.

Q4 trends, especially in overseas markets, will provide further insights into whether CATL can sustain growth amid regulatory and geopolitical headwinds.

The market is also watching how power battery and energy storage segments perform relative to expectations, which could significantly influence the stock’s trajectory in the coming months.

The post CATL (300750.SZ) Stock: Investors Eye Premium Drop Before Earnings Release appeared first on CoinCentral.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

White House Post Sends Solana Memecoin PENGUIN From $387K to $94M