Morgan Stanley Opens the Crypto Gates

Until now, the Wall Street giant only let high-rollers — the kind with over $1.5 million in assets and a taste for risk — dabble in digital assets. But that’s changing. Financial advisers across Morgan Stanley’s massive wealth network will soon be able to offer Bitcoin and crypto funds to everyday investors, including those with 401(k)s and IRAs.

That’s a big shift — not just symbolically, but numerically. The U.S. retirement market alone is worth around $45.8 trillion, with IRAs holding $18 trillion and 401(k)s $9.3 trillion. Even a tiny sliver of that money flowing into crypto would be monumental.

Morgan Stanley’s wealth arm employs 16,000 advisers managing $6.2 trillion in assets and 19 million client relationships. If even a fraction of those clients allocate a few percent to Bitcoin, that’s serious institutional capital heading toward digital assets — the kind that makes markets move.

“We’re entering the mainstream era”, said Hunter Horsley, source: X

Guardrails and Gatekeepers

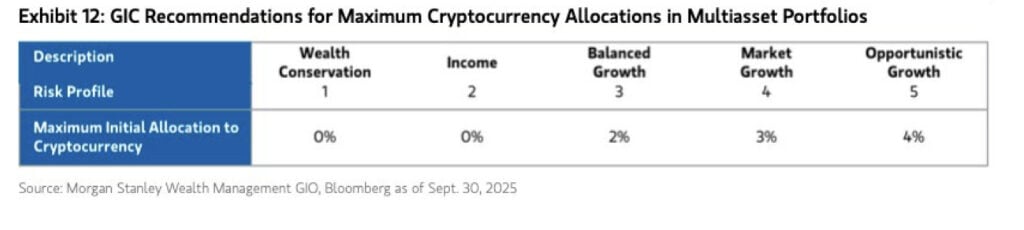

Don’t expect free-for-all crypto YOLO-ing just yet. Morgan Stanley plans to keep things tight. For now, advisers can only offer Bitcoin funds managed by BlackRock and Fidelity, and allocations will be capped by automated systems that monitor exposure limits. The bank’s Global Investment Committee still advises caution — suggesting 4% max exposure in aggressive portfolios, 2% in balanced ones, and none for conservative investors.

Wall Street’s Slow Dance with Crypto

This isn’t happening in isolation. The big asset managers are circling crypto like sharks that smell opportunity.

- Fidelity rolled out crypto retirement accounts earlier this year, including IRA options that let Americans buy Bitcoin with near-zero fees.

- JPMorgan started accepting crypto ETFs as loan collateral, effectively legitimizing digital assets within the bank’s own risk framework.

- BlackRock, whose spot Bitcoin ETF became its most profitable fund ever (raking in $245 million in fees), is now exploring tokenizing ETFs on public blockchains — making them tradable 24/7 and usable as DeFi collateral.

This convergence of TradFi and DeFi is blurring the old boundaries. As Jeff Feng, co-founder of SEI Labs, told Cointelegraph: “Institutions are beginning to see digital assets not just as speculative bets, but as an investable asset class with structured access points.”

The line between “crypto” and “finance” is starting to fade — and Morgan Stanley just gave it another shove.

The Bigger Picture

This is more than a policy tweak — it’s a statement. When a $6 trillion institution decides crypto belongs in retirement portfolios, it’s effectively saying: digital assets aren’t fringe anymore. They’re infrastructure.

And as traditional finance tokenizes itself — ETFs on-chain, securities going 24/7, and loans collateralized by crypto — the rest of Wall Street will have little choice but to follow.

For decades, banks told retail investors that Bitcoin was risky, speculative, or worse. Now, they’re selling it to them — with a management fee attached.

You May Also Like

Is Doge Still The Best Crypto Investment, Or Will Pepeto Make You Rich In 2025

WLD Price Prediction: Worldcoin Eyes $0.42 Recovery Amid Technical Consolidation