South Korea’s Crypto Scene Shrinks As Traders Flock Offshore: Report

South Korean crypto trading is shifting overseas as domestic exchanges see big drops in fiat deposits and trading activity, according to reports. While user numbers have risen, the money parked in won and the size of local markets have shrunk, signaling that more capital is finding its way to foreign platforms.

Capital Flight Accelerating

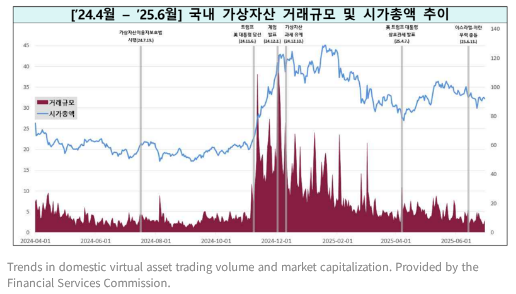

According to Fnnews, KRW deposits held on local exchanges fell by 42% to about ₩6.2 trillion compared with the end of last year. Daily average trading volume also slipped to ₩6.4 trillion, down 12% from the prior half-year.

Domestic crypto market capitalization was reported at roughly ₩95.1 trillion, a decline of 14% over the same period, while the global market cap fell by about 7%.

At the same time, outflows of crypto reached ₩101.6 trillion overall, with ₩78.9 trillion routed to registered foreign operators — that channel rose by 4%. These figures point to large sums moving beyond Korea’s trading venues.

Kimchi Coins Face Listing Pressure

Reports have disclosed that exchanges are tightening which tokens they list. The number of unique crypto assets listed domestically is 653, up by 55, but many of those assets trade only on a single platform.

There are 279 single-listing assets and about 43% of them have market caps of ₩100 million or less. That level of concentration leaves small tokens exposed to sharp price swings and to delisting risk if liquidity dries up or regulators press for stronger disclosure.

User Growth But Smaller TradesUser accounts are up to about 10.77 million, an increase of 11% from the prior year-end. Yet average capital per user appears lower, given the fall in KRW deposits and daily volume.

Average losses from peak prices have also deepened; the mean maximum drawdown rose to about 72% from 68% previously. In short: more people hold accounts, but less money is staying on local platforms and risk for small holders has increased.

Regulatory And Banking Frictions Come Into PlayBased on reports, stricter rules and tougher bank partnerships are part of the story. Some exchanges struggle to keep real-name bank accounts or to meet new oversight criteria.

When fiat rails are weak, users turn to overseas venues that offer broader token lists and larger pools of liquidity. That has created an incentive for both traders and projects to look beyond the domestic market.

Featured image from Unsplash, chart from TradingView

You May Also Like

Why is OKB Price Rising Today? $25B ICE Investment in OKX Sparks Massive Rally

Why DOGEBALL Could Lead as the Best Crypto to Buy Under $1 Over Bitcoin Hyper ($HYPER) & Blazpay (BLAZ)

![Zcash [ZEC] price prediction – Here’s what traders can expect over the next few weeks](https://i1.wp.com/ambcrypto.com/wp-content/uploads/2026/03/FI_PA-PP_ZEC_05-03-2026-1000x600.webp)