Stripe’s Stablecoin Issuance Tool Might Be the Future of Finance: Here’s Why

At its latest showcase in New York, Stripe sought to cement its role on that front, unveiling tools that allow companies to issue bespoke stablecoins and transact them via AI agents.

The showcase underscored growing crypto/finance integration and made a powerful case for versatile non-custodial wallets like Best Wallet that are aiming to build DeFi ecosystems inside a mobile app.

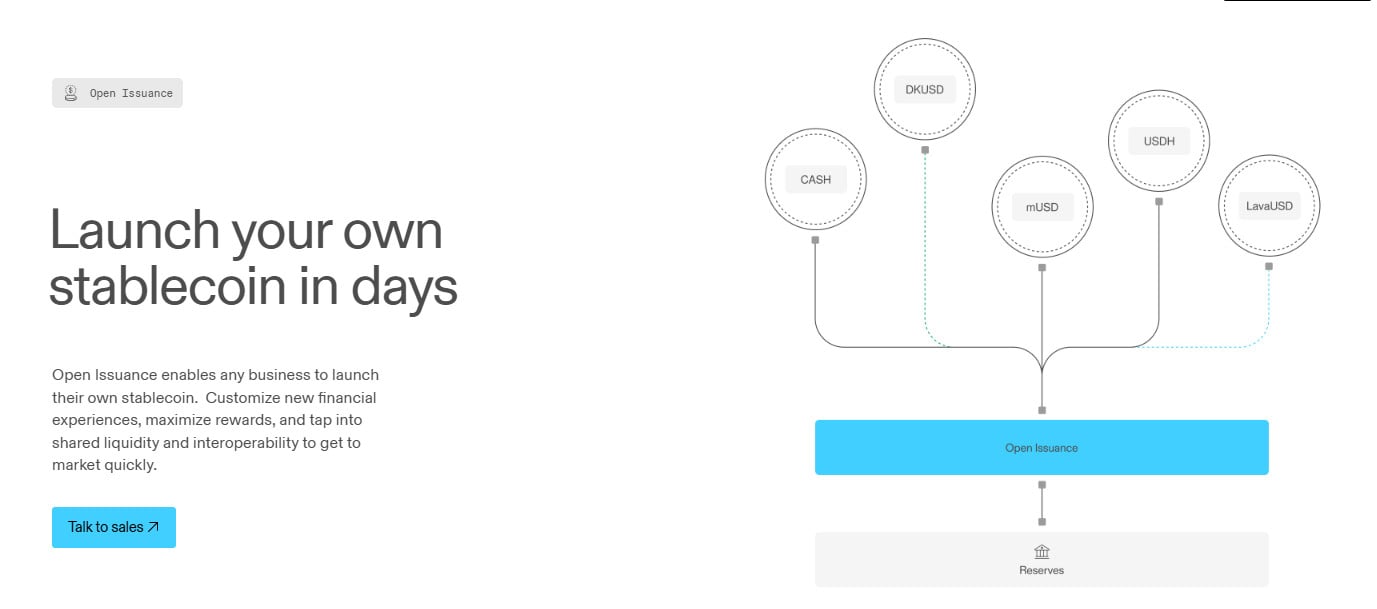

Open Issuance: Customized Stablecoins, Made Easy

One of Stripe’s newest offerings is Open Issuance, a streamlined stablecoin issuance tool that lets companies spin up their own digital dollars with just a few lines of code.

Built on Bridge, which Stripe acquired earlier for roughly $1.1B, the platform promises customized stablecoins.

Stripe has already signed its first cohort of tokens: Phantom’s $CASH will be the inaugural issuance, and other stablecoins – notably Hyperliquid’s $USDH and MetaMask’s $mUSD — are slated to follow.

Issuers on the platform can balance their reserves between Treasuries and cash, with management handled through trusted third parties like BlackRock, Fidelity, Superstate, and Lead Bank.

Stablecoins like $CASH make for appealing utility tokens, to boot. Their value is pegged 1-to-1, making calculating exchange users fees and swapping funds between traders easy and predictable.

And Stripe’s architecture aims to make these tokens interoperable, reducing friction across different digital dollar systems.

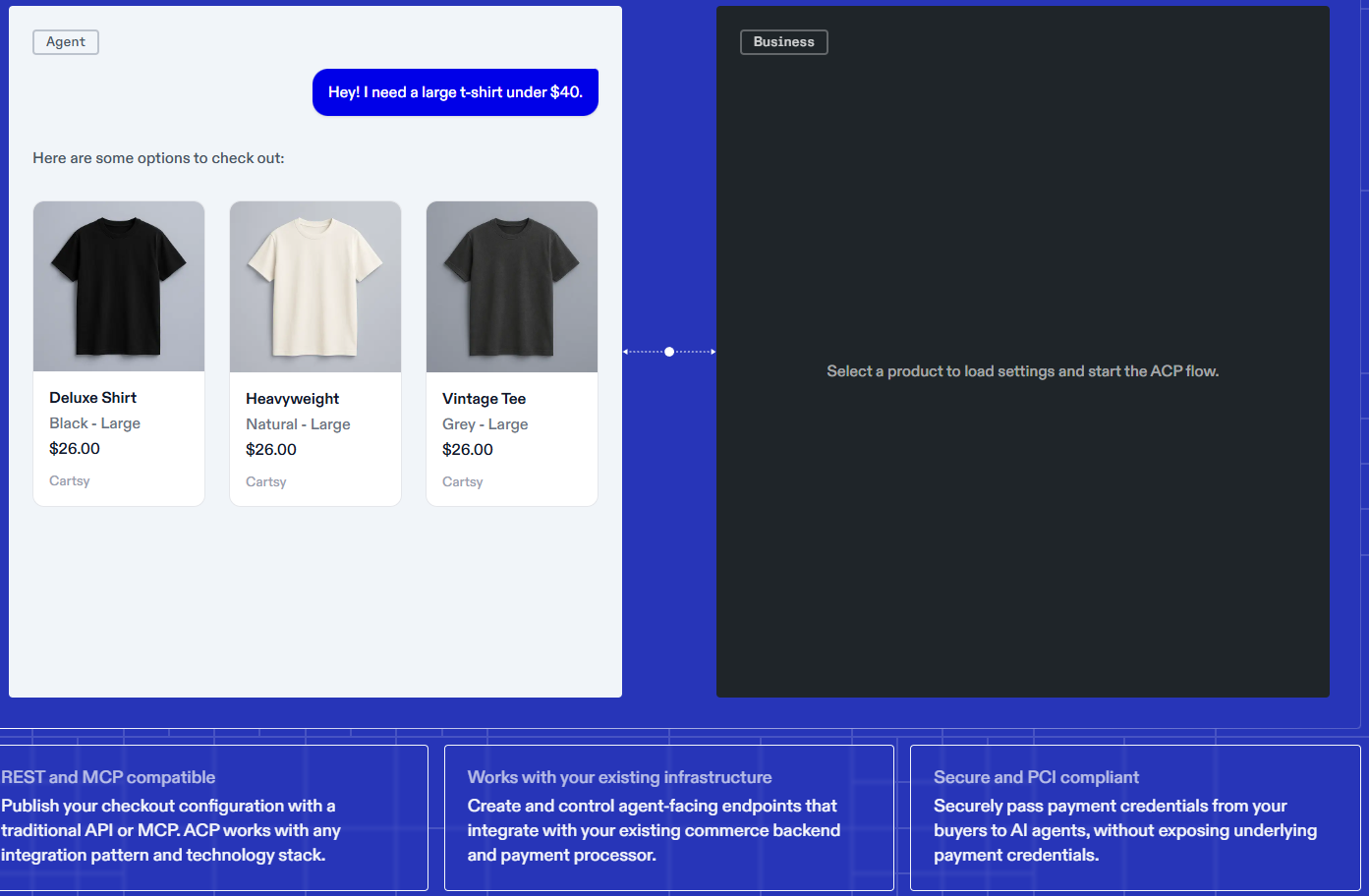

Agentic Commerce: Transacting via AI Agents

Parallel to the stablecoin push is Stripe’s AI commerce ambition. In collaboration with OpenAI, Stripe introduced the Agentic Commerce Protocol, a standard designed to enable transactions mediated by AI agents.

Like stablecoins, the ACP allows businesses to adopt new strategies and standards quickly, without long development cycles, and without in-depth knowledge of coding and development.

Stripe’s new moves aren’t out of thin air. The company has been methodically bolstering its crypto infrastructure:

- It previously acquired Privy, a wallet infrastructure provider;

- Stripe collaborated with the venture firm Paradigm to build Tempo, a payments-oriented blockchain.

Stripe’s vision appears to be one in which stablecoins and AI behaviors are layered squarely into the payments stack. No more niche experiments or nebulous concepts; Stripe sees stablecoins and AI as foundational rails.

A Programmable Money Future

Both stablecoins and the AGP highlight the vast potential of programmable money; digital currency (like stablecoins) that can carry rules, conditions, or automated behaviors embedded within itself.

Stripe is not the only actor in this space. Competitors like Circle’s $USDC, Paxos, and even central banks – via CBDCs – are racing to fully explore the programmable money domain. And adding AI to the mix only deepens the potential.

For retail users, there’s another wrinkle; a future dominated by stablecoins, where financial institutions have the ability to launch their own programmable money, is going to require a crypto wallet powerful enough to handle them all and easy enough for anyone to use.

That’s precisely where Best Wallet comes in.

Best Wallet Token ($BEST) – Non-Custodial Web3 Wallet with Native Token, Card

Best Wallet Token ($BEST) delivers a clean, user-friendly crypto wallet that’s ready for the programmable money future.

The Best Wallet app is non-custodial; you control your own keys; you control your own crypto.The native token – $BEST – provides added utility with cheaper transactions and higher staking rewards.

The upcoming Best Card provides an integrated way to spend your crypto, without worrying about moving funds around.

Together, the wallet, token, and card form a complete ecosystem that gives ordinary investors everything they need to stablecoins, meme coins, and any other aspect of the crypto economy.

The $BEST presale continues to draw investor attention as more people learn what Best Wallet is, and the potential for the $BEST token to appreciate rapidly after launch. The project has raised over $16.2M so far, and major whale buys in the past day continue to boost the totals:

- $12,387.10

- $10,906.02

There’s another benefit to Best Wallet: access to upcoming tokens in the form of the best crypto presales, conveniently gathered in one place on the Best Wallet app.

Directly from within the wallet, you can research and purchase presale token, scouting the best tokens well before they launch.

Learn how to buy Best Wallet token, and see why we think the token could climb from its current $0.025725 to $0.051903 by the end of the year, a 101% increase.

Be future-ready with Best Wallet – check out the $BEST presale page today.

You May Also Like

Change “Waiting for Overnight Surges” to “Daily Deposits”—TALL MINER · 2025: Using Cloud Computing Power to Transform Volatility Into Your Second Cash Flow

Nvidia’s Monumental $5 Billion Intel Investment Set To Revolutionize The Semiconductor Market