Beyond MemeCoins: The Crypto Opportunities Hiding in Plain Sight

Most of us have had the experience of feeling floored by a parabolic memecoin chart or a viral tweet igniting an overnight purchase frenzy at some point or other. For a moment, it’s like you’re in on a friendly joke that could eventually end up raking in money.

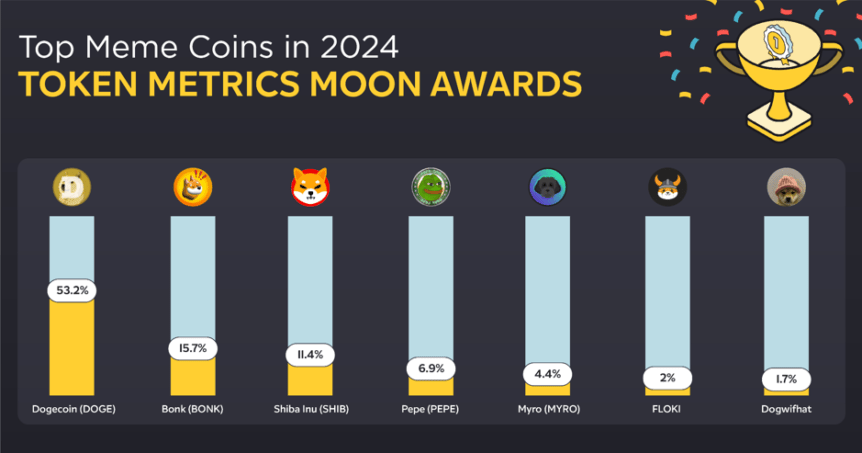

Dogecoin accounts for nearly half of the market, with Shiba Inu, Bonk, and PEPE coins maintaining a billion-dollar presence in the 92 billion-dollar market cap. Their popularity today owes entirely to internet memes, online culture, and sheer virality, currently exploding at over 21% CAGR. But when the hype dies down and prices realign, many holders are stuck with tokens they see little use in.

While memecoins symbolize hype and community-driven speculation, the real opportunity lies in coins that connect blockchain to the real economy; tokens designed with utility, scarcity, transparency, and alignment with real activity. That is a step towards Web3 becoming less of a casino-like environment and resembling rather more of an economic foundation.

The Rise and Shortcomings of Memecoins

No one can deny that memecoins turned into a pop cultural phenomenon. They showed the power online communities could have in affecting markets and how humor could galvanize and organize global attention. In a sense, they democratized participation in crypto.

Yet, their strengths are also their Achille’s heel:

- Limited utility: Most early memecoins had entertainment and speculative reasons behind their creation, not any particular purpose. Some, like Shiba Inu, added ecosystems and features later, but most still rely heavily on emotion.

- Fragile by design: Price fluctuations are usually due to fringe factors like endorsements, whales, or social media trends, thus making them susceptible to sudden surges and catastrophic crashes.

- “Greater Fool” syndrome: Gains usually depend on selling the coins for a higher price to someone, a tenuous cycle where the momentum falls off.

The next stage of crypto is one of depth.

Overall success

Some of the biggest breakthroughs meme coins have had in 2025 specifically are:

- Useless coin: enjoyed a jump of 40% in less than a day

- Startup coin: jumped by 9 times in one month

- Gorbagana: saw it’s value grow by half in 24 hours

Memes are extremely popular and that’s why the market continues to grow like mad overall. The reach that these coins have is massive, with over ten times the reach of Internet ads and 60% more reach. In 2018, memes were shared 500,000 times, in 2020 – over a million.

Maturation Into Meaningful Coins

Forward-thinking investors now opt for coins bearing some sort of precise utility, potent design, and long-term community alignment.

Some features of such “meaningful crypto coins” are:

|

Features of meaningful coins | |

|

Functional roles |

A coin that facilitates lending, governance, or access within its ecosystem. Its utility depends on usage, not speculation. |

|

Rational scarcity |

Some projects employ token burning or fixed issuance in place of an infinite supply to control availability. This supports value, especially when acceptance occurs. |

|

Interconnected incentives |

To boost trust and deter dumping, newer schemes utilize targeted rewards (like retroactive drops for active participants) as opposed to massive giveaways that flood markets. |

Why Token Design Matters

Token distribution can potentially affect trust in a project. Consider two competing models:

- Random airdrops: These distribute tokens to many wallets, typically to entice bots or inactive accounts as a means to create short-term selling pressure.

- Retroactive drops: These reward actual early adopters based on their use and activity. It places tokens in the possession of people who already understand and are using the platform, promoting longer-term stability.

Many projects also set up formalized community programs on platforms such as Zealy or Galxe, where effort measuring and rewarding are more explicit than simple giveaways.

This shift from hype to utility is already underway. It’s a big reason why memecoins proved the biggest phenomenon in crypto last year, racking up 1313% growth in the past year’s first quarter. Picking a winner still isn’t easy, though it doesn’t stop users from trying as Solana currently hosts 11.4 million active wallets.

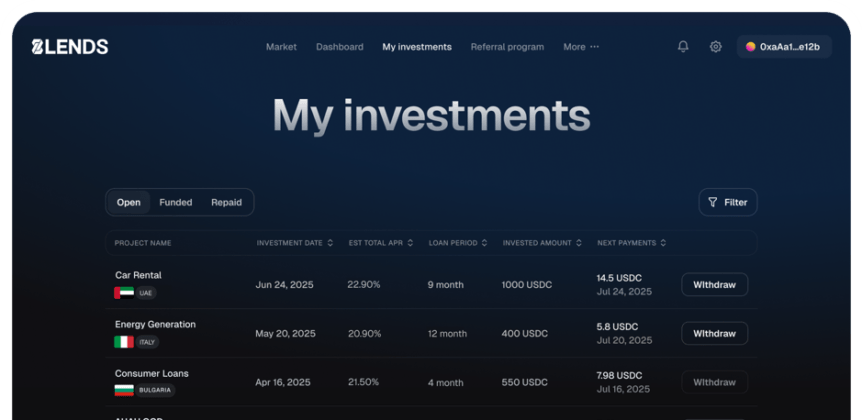

Case Study: 8lends

One of such projects involved in this maturation is 8lends, a real-world asset lending platform. Internal documents state that the 8lends token features designs for scarcity and long-term growth like:

- Fixed Supply: The total number of tokens is capped, ensuring built-in scarcity – similar to Bitcoin’s 21 million model, instead of leading it expand indefinitely.

- Quarterly Burns: Tokens are permanently removed from circulation based on platform performance, reducing supply as the platform grows.

- Phased Distribution: Instead of a large drop, tokens are released in batches under a spaced-out schedule, thus reducing volatility, surprises, and sell-off pressure.

- Utility Token: Within the platform, tokens are used to access loan credits and earn holders rewards for active participation.

Participants in the 8lends retrodrop earn bonuses by completing community tasks and referral missions through Zealy and Galxe – popular platforms used to reward genuine user engagement and track on-chain activity.

Final Thoughts: Fun Is Okay, but Foundations Matter

The memecoin mania isn’t fading. Speculation and satire will always have a place in the crypto world. Still, most investors are increasingly hungry for projects that combine community with sustainability, where tokens stand for something more than casino chips.

The more enduring opportunity lies in assets that bridge blockchain innovation to the actual economy, exchanging utility for long-term design. Tokenomics, scarcity, and community alignment can help, but are no guarantees; long-term value will always be about the actual usage, demand, and regulatory surety. Enjoy the memecoins, but think about what will remain when the hype eventually dies down.

This article was originally published as Beyond MemeCoins: The Crypto Opportunities Hiding in Plain Sight on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Japan-Based Bitcoin Treasury Company Metaplanet Completes $1.4 Billion IPO! Will It Buy Bitcoin? Here Are the Details

Building a DEXScreener Clone: A Step-by-Step Guide