Unleashing Next-Gen Docker Capabilities with Wasm, eBPF, and Serverless Containers

Key Takeaways

- The modern sphere of containerization presents both prospects and difficulties. Technologies like WebAssembly, eBPF, and serverless containers proclaim a new era. These technologies provide amplified speeds, fortified security, and extensibility. Therefore, these are necessities for optimizing workflows in real-time.

- Among these technologies, WebAssembly offers rapid application execution at near lightning speed. The code can be minified for fast and smart rendering. In addition, it allows programs to be executed closer to native speeds. So, these are more compact binary formats than are typical for JavaScript.

- eBPF with its powerful, low-evasive protection and telemetry directly (and immediately) into the inner kernel. Moreover, it improves tracking and safeguarding without any hindrance. As performance stays solid and high, unfettered visibility is granted.

- Serverless containers concentrate exclusively on establishing applications. These are free from maintaining bases and infrastructure. Development aims can target only style, removing architectural administration as a concern. Furthermore, they allow developers to build and run applications without depending upon the servers at all, taking care of all the operational complexity.

- Now is the prime for developers investigating these innovations shaping containers' future. Their early-stage adoption could be pioneering amid tech evolution. Wasting no time could leave you well-situated when these technologies achieve full potential and widespread use.

\ If you’ve deployed containers in production, you’ve probably heard of Docker. It’s a juggernaut, but like all tech, it changes. Today, WebAssembly (Wasm), eBPF , and serverless containers are all the rage for many reasons.

\ These technologies change how we approach performance, security, and scalability. These technologies may appear niche. But they are becoming more and more relevant to everyday developers who are using containers.

\ In this article, we’ll walk you through each technology with an in-depth look. We will discuss why they are important, how you can utilize them in real practice, and the benefits they provide to your containerization workflows.

\

WebAssembly (Wasm) & Docker

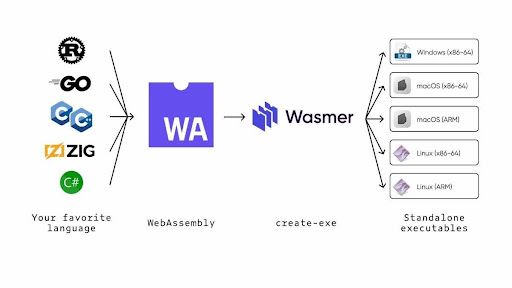

\ WebAssembly (Wasm) has been in use for several years. It primarily serves as a means to execute code in browsers. But its possibilities are far greater than that. WebAssembly is a binary instruction format for a stack-based virtual machine like the Java Virtual Machine that can execute in a safe sandbox environment. At the same time, Docker runs the entire stack, OS runtime, etc. Wasm code runs super lightweight and on any platform.

\

Wasm vs. Docker:

While Docker packages everything into a container, Wasm only includes the binary and its minimal runtime. This means Wasm is smaller and faster to start. Further, it can run anywhere. This makes it a great choice for resource-constrained conditions.

\ Using Wasm Inside Docker You can run Wasm in Docker containers, so you get the combined benefits. In the case of building an edge app, and you want to go towards microservices where we need to deploy microservices, then Wasm can be a perfect fit since it is lightweight and performs under certain conditions. Here’s a quick demo of how you can run a Wasm module inside docker: Build Your Docker Image: Create a Dockerfile that includes your Wasm module.

\

FROM scratch COPY mymodule.wasm /app/ CMD ["/app/mymodule.wasm"] \

- Build the Image:

docker build -t wasm-container. \

- Run the Container:

docker run wasm-container \

Now, you’re running Wasm inside Docker. It benefits from the Docker ecosystem’s deployment capabilities. Besides, it also credits Wasm’s speed and enables lightweight execution.

\

Why Use WASM?

Wasm is quick and starts in milliseconds. Unlike Docker containers, which normally take a longer time to initialize, Wasm is relatively effective.

\ You only need to include the necessary code for operating Wasm. So, it makes Wasm ideal for microservices and edge services.

\ Wasm can work on any platform that supports a Wasm runtime. So, its uses are diverse.

\

eBPF and Its Significance For Container Security

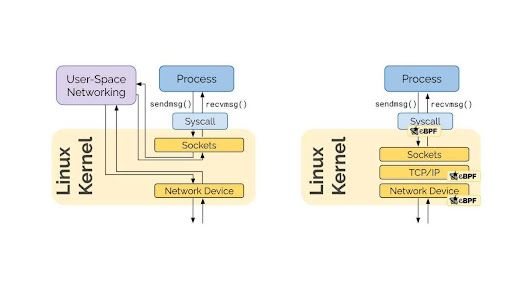

To secure your containers, conventional methods can be cumbersome. That’s where eBPF comes in. The technology allows you to run custom code inside the Linux kernel. Moreover, it gives better observability and security without the overhead of traditional monitoring tools.

\

What is eBPF?

\ eBPF enables you to write short programs that usually run inside the kernel. It can be used to filter network packets, trace system calls, and monitor container activity. To simply explain, eBPF is a mechanism to extend the functionality of the Linux kernel safely. Furthermore, these improve container security by monitoring system calls, enforcing network policies, and performing runtime anomaly detection.

\

How does eBPF Work with Docker?

Tools like Cilium and Falco influence eBPF to provide improved container security. Cilium uses eBPF for networking security. On the other hand, Falco uses it for real-time security monitoring of your containers.

\

:::info Example: Setting Up Falco for Real-Time Threat Detection

:::

To integrate Falco with your Docker setup, you’ll need to install it and start monitoring.

Install Falco (on your host machine):

curl -s https://falco.org/repo/falco.asc | sudo tee /etc/apt/trusted.gpg.d/falco.asc sudo apt-get install -y falco \ Run Falco to Monitor for Suspicious Activity:

falco -A \ With this setup, Falco will immediately alert you if something suspicious happens. For example, unauthorized network access and changes to critical system files.

\

Why eBPF?

-

eBPF provides continuous, real-time monitoring of containers. So, it lets you detect threats in a minimal timeframe.

-

Unlike traditional tools, eBPF operates within the kernel. Therefore, it minimizes overhead and allows for more efficient monitoring.

-

Deep Insights: eBPF gives you visibility into system calls, network activity, and container behavior. Thus, this is a huge win for container security.

\

Serverless Containers

Serverless has become indispensable nowadays. The concept of not having to manage servers is great, but what if you could run Docker containers without considering infrastructure? Enter serverless containers.

\ AWS Lambda, Google Cloud Run, Knative: run your containers as a serverless function. The best part? You are still using Docker, but you are outsourcing the scaling and infrastructure management to your cloud provider.

\

How Serverless Containers Work?

Running serverless containers means you package your application in a Docker container. Then, you need to push it to a serverless platform. These platforms automatically scale your containers up and down based on demand, and you only pay for the computing resources you use.

\

:::info Example: Deploying a Serverless Container on Google Cloud Run

:::

\ Let’s talk about deploying a container to Google Cloud Run

Build Your Docker Image:

Docker build -t my-serverless-app. \

- Push to Google Container Registry:

docker push gcr.io/my-project/my-serverless-app \

- Deploy to Cloud Run:

gcloud run deploy --image gcr.io/my-project/my-serverless-app --platform managed \ Cloud Run will handle everything. For example, scaling, load balancing, and security. If there’s no traffic, your container goes idle, and you won’t be charged. When traffic spikes, Cloud Run will scale your container automatically.

\

Why Serverless Containers?

-

You don’t have to worry about servers. The cloud provider handles it.

-

You only pay for the time your container is actively running.

-

Whether you get a sudden surge in traffic, serverless containers scale up and down automatically.

\

What Are The Challenges and Adoption Barriers of These New Technologies?

As new container technologies are all the rage, they have their challenges as well:

Wasm shines for lightweight workloads. However, it probably won’t handle complex, resource-intensive apps.

eBPF is not for the faint-hearted, and it requires a lot of understanding of Linux kernel internals. So, it definitely can be a steep learning curve.

On-demand activation for serverless containers is convenient, but a cold start delay can be experienced when a container is not used for some time.

However, keeping all these in mind, the advantages outweigh these challenges. As these technologies mature, they will become commoditized and simplified.

\

추천 콘텐츠

Whales keep selling XRP despite ETF success — Data signals deeper weakness

Top Solana Treasury Firm Forward Industries Unveils $4 Billion Capital Raise To Buy More SOL ⋆ ZyCrypto