Altcoin season delayed as Crypto Fear and Greed Index remains in red

The much-anticipated altcoin season remains elusive as the Crypto Fear and Greed Index remains in the fear zone and Bitcoin Dominance continues.

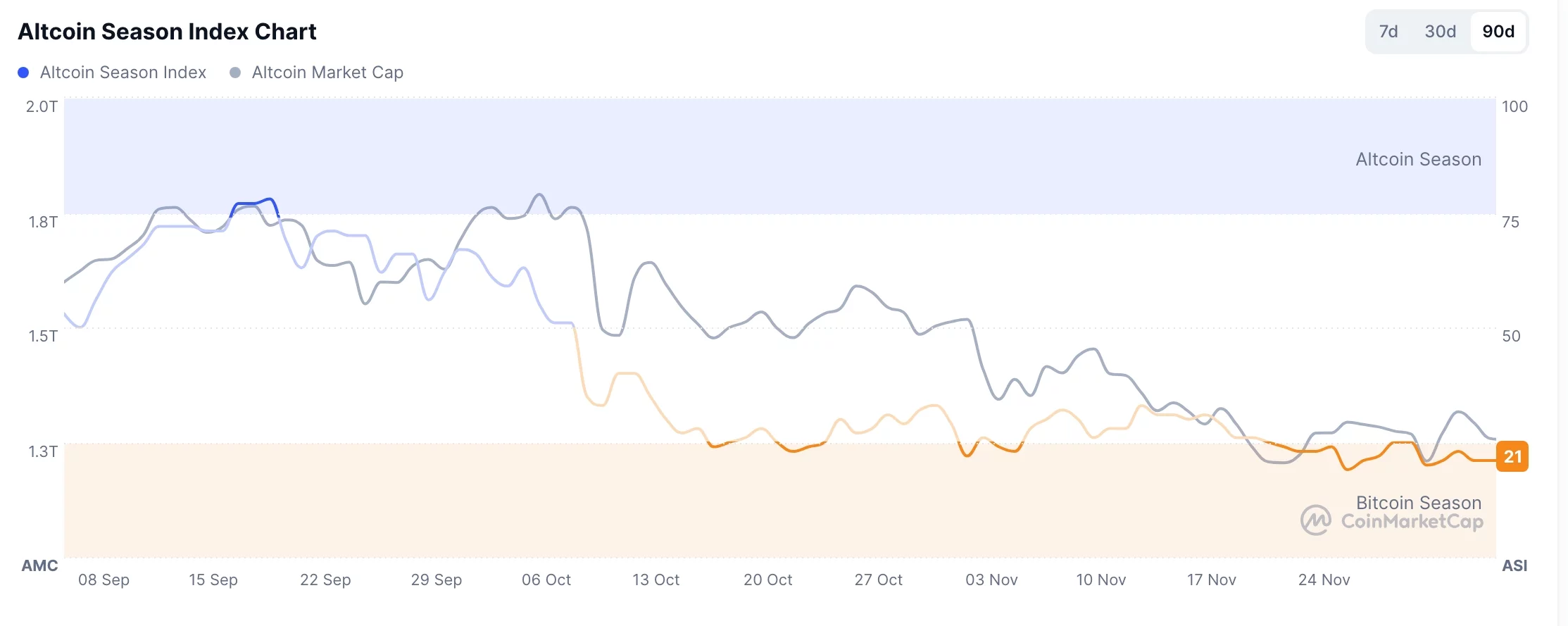

- The Altcoin Season Index has slumped in the past few months.

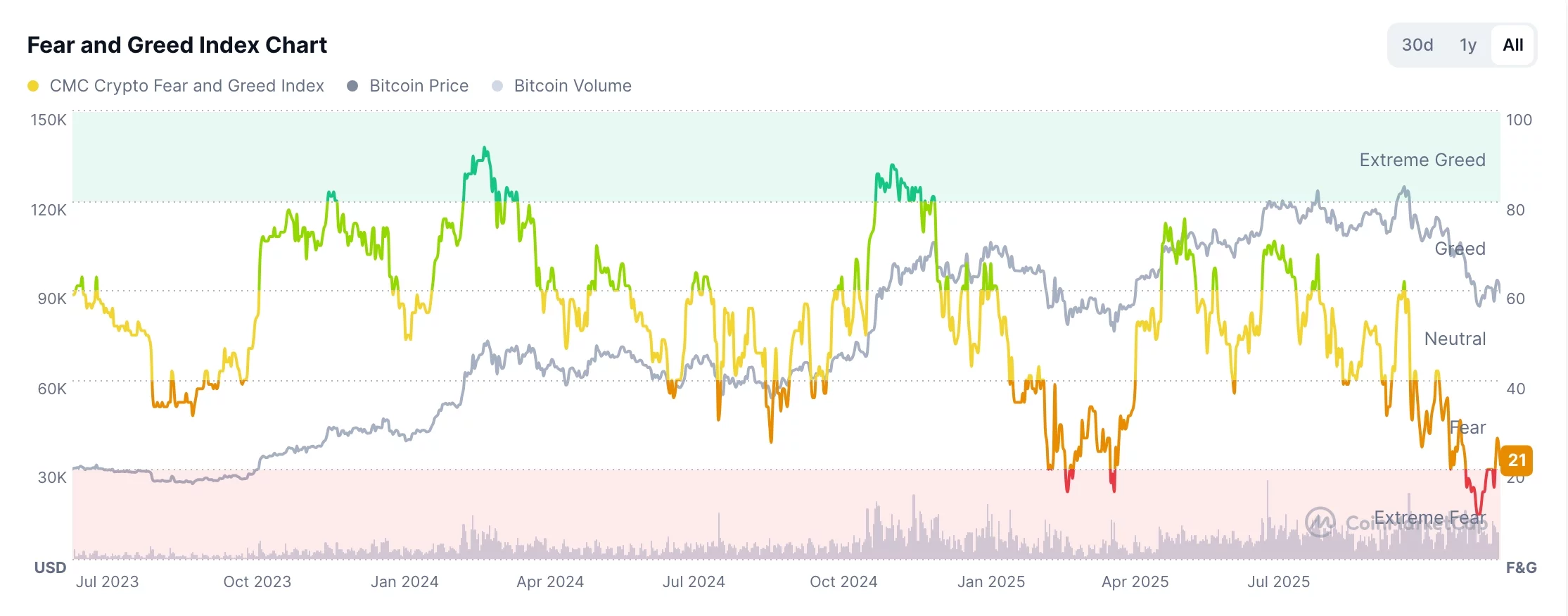

- Similarly, the Fear and Greed Index has moved to the fear zone.

- The crypto industry may benefit from the upcoming rate cuts and Santa Claus rally.

Altcoin Season Index remains in the red

CMC data shows that the closely-watched Altcoin Season Index has moved to 21, down from a high of 55 in July this year. This drop happened as most altcoins continued to underperform Bitcoin (BTC) during the ongoing crypto market crash.

The top laggards in the altcoin market in the last three months are tokens like Double Zero, Story, Celestia, Ethena, Pudgy Penguins, Cronos, Aptos, and Arbitrum. All these tokens have slumped by over 60% in this period.

With altcoins tumbling, the Bitcoin Dominance Index has continued rising, moving from a low of 37% in January to 58% today. Ethereum (ETH) dominance, on the other hand, has dropped to 11% from the year-to-date high of 20.

The main reason why the Altcoin Season Index has remained elusive is that Bitcoin has moved to a correction after falling by double digits from the year-to-date high of $126,200 to the current $89,000. In most cases, altcoins do well when Bitcoin is in a strong uptrend.

Crypto Fear and Greed Index is in the fear zone

Meanwhile, there is a sense of fear in the crypto market, especially after the large liquidation event that happened on October 10, when over $20 billion was wiped out from the market. Since then, investors have largely moved to deleveraging, with the futures open interest plunging from $225 billion in October to the current $122 billion. The funding rate of all tokens has also flattened, while the Crypto Fear and Greed Index has moved to 21.

Many investors have also remained cautious about altcoins, with Kevin O’Leary warning that most altcoins are worthless and that only Bitcoin and Ethereum will survive in the long term. Indeed, data shows that most meme coins like Shiba Inu and Pepe have all slumped harder in the past few months.

Still, there are some positive signs that may help to boost the crypto market. For one, most altcoin seasons emerge when the Altcoin Season Index is deeply in the red. Also, they normally happen when the Crypto Fear and Greed Index is in the fear zone.

Additionally, the crypto market may receive a boost from the upcoming Federal Reserve interest rate decision, in which and official expect it to cut rates. Finally, there is a likelihood that the Santa Claus rally will happen and boost stocks and cryptocurrencies.

You May Also Like

House Judiciary Rejects Vote To Subpoena Banks CEOs For Epstein Case

Top 6 Crypto Coins: Why Analysts Call BullZilla the Best Crypto to Buy Right Now?