Best Crypto to Buy Now – Terra Classic Price Prediction

After spending nearly an entire year sliding downward, Terra Classic (LUNC) has shocked the market with an unexpected surge, climbing more than 70% in just a single day.

This sudden breakout isn’t without reason, as burn tracker data shows that more than 849 million $LUNC were removed from circulation in the past week. Since May 2022, the community has burned over 426 billion tokens, which is almost 8% of the total supply.

This steady reduction in supply is helping drive renewed interest and strengthen the token’s recent price momentum. With this renewed momentum, analysts are now revisiting their $LUNC price prediction, especially as traders search for the best crypto to buy now.

Why LUNC Is Rallying Again Despite Its Troubled History

Despite its persistent long-term decline, $LUNC continues to draw in short-term traders whenever liquidity surges, and the latest spike in volume has once again pushed the token back into focus.

$LUNC also moved sharply due to concentrated activity on its main legacy trading pair on Binance. The asset remains listed, and that pair is still capable of quickly absorbing bursts of hype-driven trading.

Adding to the excitement, CoinDesk’s Ian Allison appeared at Binance Blockchain Week wearing a retro Terra Luna shirt, and shortly afterward, $LUNC skyrocketed by nearly 100%.

Even with the renewed momentum, $LUNC should still be viewed as a high-risk asset. Analysts emphasize that its reputation as a “token from hell” and its limited liquidity leave it highly exposed to extreme price swings.

If social media chatter fades or the pace of token burns slows down, the token could easily face renewed downward pressure.

Source – Cilinix Crypto YouTube Channel

LUNC Price Prediction

For $LUNC’s near-term price trajectory, current market behavior suggests a rally is possible, but timing is critical.

The asset recently broke above key resistance levels around $0.000028 and $0.000034, yet this breakout occurred during a period of unusually high trading activity where tops tend to form quickly.

With momentum now cooling, a pullback appears more likely before any sustainable upside continues. The most strategic accumulation zones sit between $0.0000345 and $0.000032.

However, entering too early carries risk because heavy volume also appears during local tops, making precise timing more important than usual. A measured pullback followed by a strong reaction in support zones remains the healthiest setup for the next bullish leg.

Crypto analyst Anu on X reported that $LUNC has finally broken its multi-week downtrend with a strong surge. Key liquidity levels have been cleared, market structure has shifted, and the next target appears wide open.

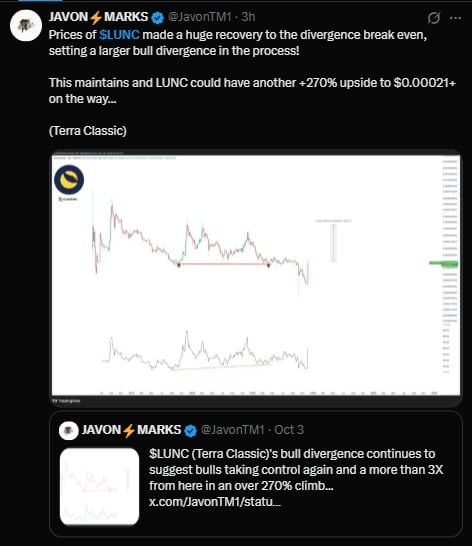

Meanwhile, Javon Marks notes that $LUNC prices have staged a significant recovery to the divergence break-even, forming a larger bullish divergence in the process, with potential upside of around 270%, possibly reaching $0.00021 or higher.

Investors Eye Bitcoin Hyper as a Safer Alternative to LUNC Volatility

Despite occasional bursts of enthusiasm, $LUNC continues to face long-standing drawbacks that push many investors to consider alternatives, and many investors now look toward early-stage meme coins with stronger narratives, such as Bitcoin Hyper (HYPER).

Bitcoin Hyper is being highlighted as one of the most promising crypto presales of 2025, introducing the fastest Bitcoin layer-2 chain designed to offer a playful brand while focusing heavily on utility.

Its layer-2 design enables features that Bitcoin cannot natively support, including near-instant transactions, decentralized applications, lending, borrowing, and high-throughput processing powered by Solana’s virtual machine.

Bitcoin Hyper also maintains strong security by batching transactions, using zero-knowledge proofs, and synchronizing its state with Bitcoin’s main chain. The presale has already raised $29 million with a price of $0.013385 per token.

For traders seeking volatility with a stronger upside-to-risk profile, exploring presales like Bitcoin Hyper becomes a promising alternative to relying on $LUNC’s uncertain attempts at recovery. To take part in the $HYPER token presale, visit bitcoinhyper.com.

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

‘European SEC’ proposal sparks licensing concerns, institutional ambitions

Legal experts are concerned that transforming ESMA into the “European SEC” may hinder the licensing of crypto and fintech in the region. The European Commission’s proposal to expand the powers of the European Securities and Markets Authority (ESMA) is raising concerns about the centralization of the bloc’s licensing regime, despite signaling deeper institutional ambitions for its capital markets structure.On Thursday, the Commission published a package proposing to “direct supervisory competences” for key pieces of market infrastructure, including crypto-asset service providers (CASPs), trading venues and central counterparties to ESMA, Cointelegraph reported.Concerningly, the ESMA’s jurisdiction would extend to both the supervision and licensing of all European crypto and financial technology (fintech) firms, potentially leading to slower licensing regimes and hindering startup development, according to Faustine Fleuret, head of public affairs at decentralized lending protocol Morpho.Read more

BlackRock boosts AI and US equity exposure in $185 billion models