Whale Buying Is No Longer a Bullish Signal—BTC Drops Below $90K Despite Heavy Accumulation

The post Whale Buying Is No Longer a Bullish Signal—BTC Drops Below $90K Despite Heavy Accumulation appeared first on Coinpedia Fintech News

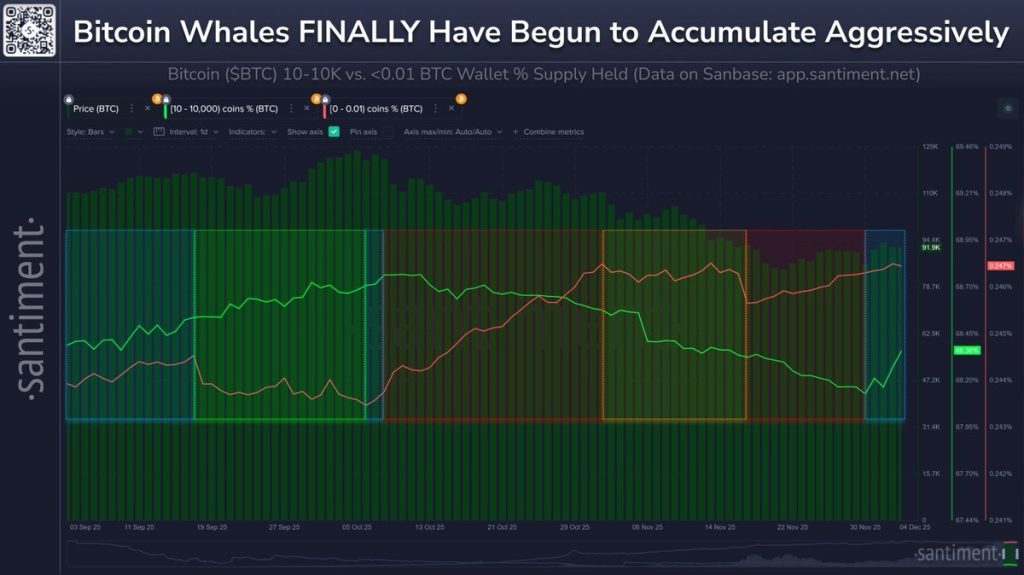

Whales and sharks have accumulated Bitcoin for nearly a month, yet the BTC price has broken below $90K—showing the market is no longer treating whale activity as a leading bullish signal.

This divergence suggests structural weakness: accumulation is happening, but it’s being absorbed by broader sell pressure, thinning liquidity, or leveraged unwinds.

Whales Are Accumulating Bitcoin—But the Market Doesn’t Care Anymore

Bitcoin’s latest correction has revealed an uncomfortable truth for traders: whale buying is no longer functioning as a bullish leading indicator. For nearly a month, whale and shark wallets (10–10,000 BTC) have steadily increased their holdings, as shown in the Santiment chart. Under normal market conditions, this kind of behavior foreshadows a trend reversal or at least stabilises the downside.

But this time, BTC has broken below the $90,000 mark despite continuous accumulation, signalling a major narrative shift.

Why is the market ignoring whale optimism? Because the structural forces pulling the market down are stronger than the inflows. Liquidity has thinned out across major venues, derivative markets are overloaded with high leverage, and each downside move triggers cascading liquidations. In this environment, even aggressive accumulation simply gets absorbed rather than translated into price strength.

This tells us two things:

- The market is not in a position where “smart money buying” automatically signals a bottom.

- Whales may be accumulating due to long-term confidence, not short-term expectations of a pump.

In other words, whale buying may still matter—but it is not a major bullish signal now.

Where Could Bitcoin (BTC) Price Head Next?

Bitcoin has slipped below $90,000 and is now trading in a wider pullback zone. The chart shows one clear message: BTC is still in a cooling-off phase, not a confirmed trend reversal. The next major area to watch is the $82,000–$85,000 support zone, where a lot of previous buying took place. If Bitcoin drops into this range and holds it, the market gets a chance to stabilize.

Structurally, BTC is moving inside a broad descending range, with lower highs and increasing volatility compressing toward a potential inflection point. Besides, the price has entered a consolidation phase as the Bollinger bands tighten, a similar occurrence seen in early November before the breakdown from $110,000 range.

If the current structure continues:

- A sweep of the $82,000–$85,000 liquidity pocket is still highly probable.

- This zone overlaps with major spot buyer interest and previous consolidation shelves.

- A reclaim of $92,000–$95,000 would be the first sign that downside momentum is weakening.

From a longer-term lens, nothing in the current price action invalidates Bitcoin’s broader expansion trajectory. But the timeline has likely shifted.

End-of-2025 Outlook

- Base Case (Most Probable): $110,000–$135,000

- Bull Case (Requires strong macro + ETF inflows): $150,000–$170,000

- Bear Case (If liquidity remains tight): $70,000–$85,000 range-bound market

Conclusion

Bitcoin’s renewed weakness shows that accumulation without confirmation is noise, not a catalyst. Whales may be positioning for long-term gains, but until BTC reclaims key levels and leverage resets, their activity alone cannot reverse a structurally heavy market. The path into 2025 hinges on liquidity, ETF flows, and macro stability far more than wallet behavior.

If the BTC price can defend the mid-$80,000 zone and reclaim $92,000–$95,000, the next major expansion phase remains intact. Fail to do so, and volatility may persist. Either way, price—not whale wallets—will determine when the next real breakout begins.

You May Also Like

Pi Network Speeds KYC Using New AI Validation Tools