Bitcoin and Ethereum Show Bullish Strength—But Ozak AI Forecast Steals 2025 Headlines

Crypto markets are entering a decisive acceleration phase, and the two giants—Bitcoin and Ethereum—are displaying some of their strongest bullish structures in years. Investors are rotating back into large caps as momentum builds, and long-term projections for both assets continue to rise.

Yet despite Bitcoin’s dominance and Ethereum’s expanding influence, analysts say Ozak AI is capturing the biggest share of 2025 attention. With early-stage affordability, rapidly expanding AI utility, and one of the most aggressive upward forecasts in the market, Ozak AI is emerging as the standout narrative of the next cycle.

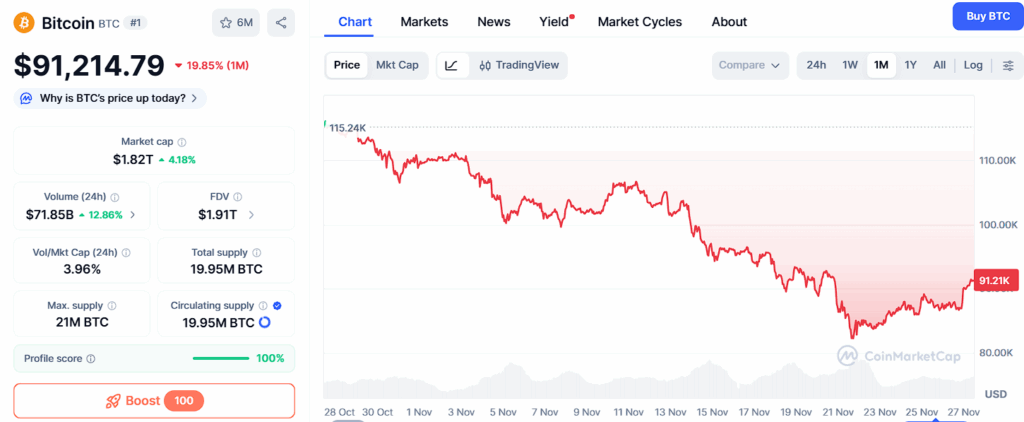

Bitcoin (BTC)

Bitcoin (BTC), trading around $91,214, keeps reinforcing its function as the macro leader as institutional inflows and strong holder conviction help its long-term rally. BTC stays firmly bullish above aid at $89,100, $86,750, and $84,320, areas wherein institutional bidders continually gather for the duration of pullbacks. This strong foundation keeps Bitcoin’s upward trajectory intact even in the course of short-term volatility.

For BTC to push toward higher 2025 targets, the price must break through resistance at $93,480, $96,220, and $99,840. Historically, these zones have served as gateways to major breakout phases, often followed by rapid multi-week expansions. With global adoption rising and ETF flows staying strong, Bitcoin’s long-term path toward six-figure valuations remains firmly in play.

However, while Bitcoin’s outlook is strong, its massive market size limits the potential for extreme exponential returns—especially compared to newer high-upside tokens.

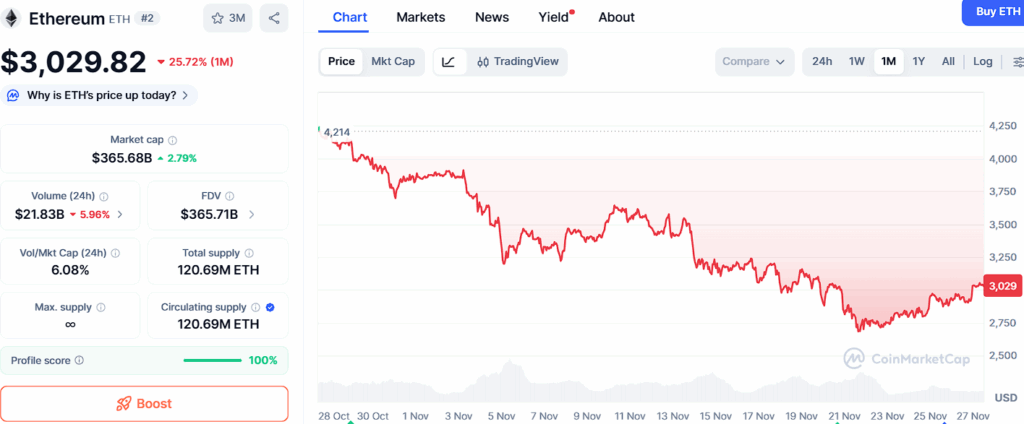

Ethereum (ETH)

Ethereum (ETH), presently around $3,029, continues to dominate smart agreement infrastructure and remains one of the most technically sound altcoins heading into 2025. ETH continues a sturdy bullish framework above support at $2,885, $2,740, and $2,610, stages that are again and again defended by means of staking individuals and long-term traders.

For ETH to boost up toward its next main targets, it has to ruin resistance at $3,005, $3,255, and $3,410. A breakout above those levels could propel Ethereum in the direction of the $5K–$7K sector and probably better as Layer-2 scaling solutions expand and real-world tokenization speeds up.

Ethereum remains one of the safest and most reliable performers in the market, but like Bitcoin, its mature valuation limits its ability to produce the massive multiples that early-stage projects can still achieve.

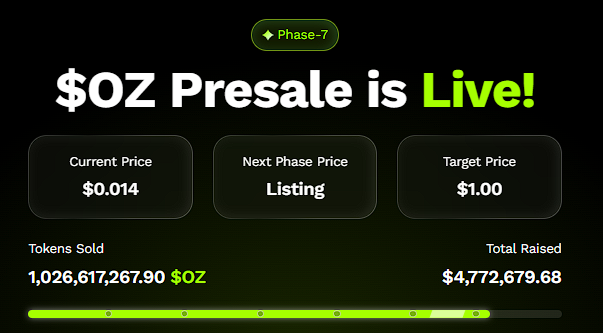

Ozak AI Forecast Steals the Spotlight With Explosive Growth Potential

While Bitcoin and Ethereum provide stability and long-term strength, Ozak AI (OZ) is capturing 2025 headlines for a different reason: its potential for extreme exponential growth. As one of the most advanced AI-driven crypto projects entering the next cycle, Ozak AI sits at the intersection of two of the fastest-growing global sectors—artificial intelligence and blockchain.

Ozak AI’s architecture includes:

- AI prediction agents capable of millisecond-level market insights

- Cross-chain intelligence systems tracking activity across multiple blockchains

- Ultra-fast 30 ms signal processing enabled through its HIVE partnership

- Distributed AI computation via Perceptron Network’s 700,000+ nodes

- SINT-powered autonomous AI agents supporting voice commands and automated workflows

This multi-layered intelligence ecosystem transforms Ozak AI into a functional AI engine for traders, analysts, algorithms, and decentralized applications. Unlike most presale tokens, Ozak AI enters the market with immediate real-world utility.

Its momentum continues to accelerate as the OZ presale surpasses $4.8 million raised with over 1 million tokens sold, reflecting early demand comparable to past cycle winners that ultimately delivered 50x–100x returns.

Analysts now project Ozak AI as one of the strongest 2025 performers due to:

- Early-stage valuation with enormous upside

- High demand for AI-driven tools

- Strong ecosystem partnerships

- No major resistance levels

- A narrative aligned with global AI expansion

Bitcoin and Ethereum continue to show powerful bullish structures, strong liquidity, and rising long-term investor self-belief. Both are located for fundamental profits in the imminent bull cycle.

Yet Ozak AI steals the 2025 highlight, presenting early-stage affordability, deep AI-native software, and explosive growth potential that could some distance exceed what BTC or ETH can deliver at their current scale. For buyers looking for the very best upside in the next fundamental crypto expansion, Ozak AI is rising because of the most compelling opportunity of all three.

About Ozak AI

Ozak AI is a blockchain-based crypto project that offers a technology platform that specializes in predictive AI and advanced statistics analytics for financial markets. Through the machine learning algorithms and decentralized network technologies, Ozak AI allows real-time, correct, and actionable insights to assist crypto fans and agencies in making the correct choices.

For more, visit:

- Website: https://ozak.ai/

- Telegram: https://t.me/OzakAGI

- Twitter: https://x.com/ozakagi

Disclaimer: TheNewsCrypto does not endorse any content on this page. The content depicted in this Press Release does not represent any investment advice. TheNewsCrypto recommends our readers to make decisions based on their own research. TheNewsCrypto is not accountable for any damage or loss related to content, products, or services stated in this Press Release.

You May Also Like

XRP Potential Double Bottom Strengthens Amid Ripple’s 250M Transfer

CME Group to Launch Solana and XRP Futures Options