Strategic Power Move: Former Uniswap Exec Lindsay Fraser Takes Helm as Blockchain Association CPO

BitcoinWorld

Strategic Power Move: Former Uniswap Exec Lindsay Fraser Takes Helm as Blockchain Association CPO

In a move that signals the cryptocurrency industry’s growing focus on regulatory engagement, the Blockchain Association has made a pivotal hire. Lindsay Fraser, a former executive at decentralized exchange giant Uniswap Labs, has been appointed as the organization’s new Chief Policy Officer (CPO). This appointment marks a significant moment for crypto advocacy, placing a seasoned DeFi insider at the forefront of policy discussions in Washington D.C.

Why is the Blockchain Association CPO Role So Crucial Right Now?

The crypto regulatory landscape is at a critical juncture. With lawmakers worldwide crafting new rules, having a strong, unified voice in Washington is more important than ever. The Blockchain Association CPO position is central to this mission. This leader shapes the organization’s policy strategy, advocates for sensible regulation, and educates policymakers on blockchain technology’s nuances.

Fraser’s appointment comes at a time when the association is ramping up its efforts. Therefore, her experience is not just valuable—it’s essential. She understands the technical complexities of DeFi from the inside, which allows her to translate them into clear policy arguments.

What Does Lindsay Fraser Bring to the Blockchain Association?

Lindsay Fraser is not a newcomer to the crypto world. Her background provides a unique blend of operational knowledge and strategic vision.

- Deep DeFi Expertise: At Uniswap Labs, Fraser was immersed in the world’s largest decentralized exchange. She understands the mechanics, benefits, and potential regulatory pain points of DeFi protocols firsthand.

- Operational Leadership: Her previous role involved navigating the complex, evolving challenges of a leading web3 company. This practical experience is invaluable for crafting realistic policy frameworks.

- Strategic Vision: Moving from a specific protocol to a broad industry association shows a strategic shift towards shaping the entire ecosystem’s future.

This combination makes her uniquely qualified to advocate for policies that foster innovation while addressing legitimate concerns.

How Will This Impact Crypto Regulation and the Industry?

The immediate impact of naming a new Blockchain Association CPO is a stronger, more informed advocacy voice. Fraser’s hiring suggests the association is doubling down on a sophisticated, technically-grounded approach to lobbying.

For the industry, this move is a positive signal. It shows that major players are investing serious talent and resources into building constructive relationships with regulators. The goal is to move away from adversarial standoffs and toward collaborative dialogue. However, the challenge remains immense. Fraser and her team must bridge a significant knowledge gap and navigate a politically divided environment.

What Are the Actionable Insights for Crypto Observers?

This appointment offers several key takeaways for anyone following crypto policy:

- Industry Maturation: Top talent is moving into policy roles, reflecting the sector’s evolution from a niche interest to a mainstream economic force.

- DeFi in the Spotlight: Hiring from Uniswap Labs indicates that DeFi regulation will be a top priority for the association in the coming months.

- Watch the Narrative: Observe how Fraser and the association frame issues like decentralization, consumer protection, and financial innovation. Their messaging will influence the political debate.

Moreover, this hire underscores that policy is no longer an afterthought. It is a core business function for the survival and growth of the crypto ecosystem.

Conclusion: A Strategic Step for Crypto’s Future

The appointment of Lindsay Fraser as Blockchain Association CPO is a powerful and strategic decision. It brings deep industry expertise to the heart of policy advocacy at a decisive moment. Her role will be instrumental in guiding lawmakers toward regulations that protect consumers without stifling the transformative potential of blockchain technology. While challenges abound, this move provides a renewed sense of optimism for a more coherent and innovation-friendly regulatory future.

Frequently Asked Questions (FAQs)

What is the Blockchain Association?

The Blockchain Association is the leading nonprofit organization representing the cryptocurrency industry in Washington D.C. Its members include exchanges, protocols, investors, and other key players. The association advocates for pro-innovation policies and educates policymakers.

What does a Chief Policy Officer (CPO) do?

A Chief Policy Officer leads an organization’s government relations and public policy strategy. For the Blockchain Association, the CPO develops advocacy positions, engages with legislators and regulators, and works to shape laws and regulations that impact the crypto industry.

Why is hiring from Uniswap Labs significant?

Uniswap is the largest decentralized exchange (DEX) in the world. Hiring an executive from this background means the Blockchain Association now has direct, high-level insight into the operational realities and challenges of DeFi, which is a major focus for regulators.

How might this affect everyday crypto users?

Effective policy advocacy can lead to clearer regulations, which reduces uncertainty for businesses. This can result in more secure, innovative, and widely available products and services for users. It also helps protect users by promoting standards for security and transparency.

What are the biggest policy challenges facing crypto now?

Key challenges include defining regulatory jurisdiction between agencies, creating clear rules for DeFi and stablecoins, establishing tax treatment, and balancing innovation with consumer and investor protection.

Can one person really change crypto policy?

While no single person dictates policy, a skilled CPO can have enormous influence. They can frame debates, correct misconceptions, build coalitions, and provide the technical expertise that lawmakers often lack, thereby steering the conversation in a more informed direction.

Found this analysis of the new Blockchain Association CPO insightful? The fight for sensible crypto regulation affects everyone in the space. Help spread the word by sharing this article on Twitter or LinkedIn to keep your network informed about this critical leadership change.

To learn more about the latest trends in crypto regulation, explore our article on key developments shaping blockchain policy and institutional adoption.

This post Strategic Power Move: Former Uniswap Exec Lindsay Fraser Takes Helm as Blockchain Association CPO first appeared on BitcoinWorld.

You May Also Like

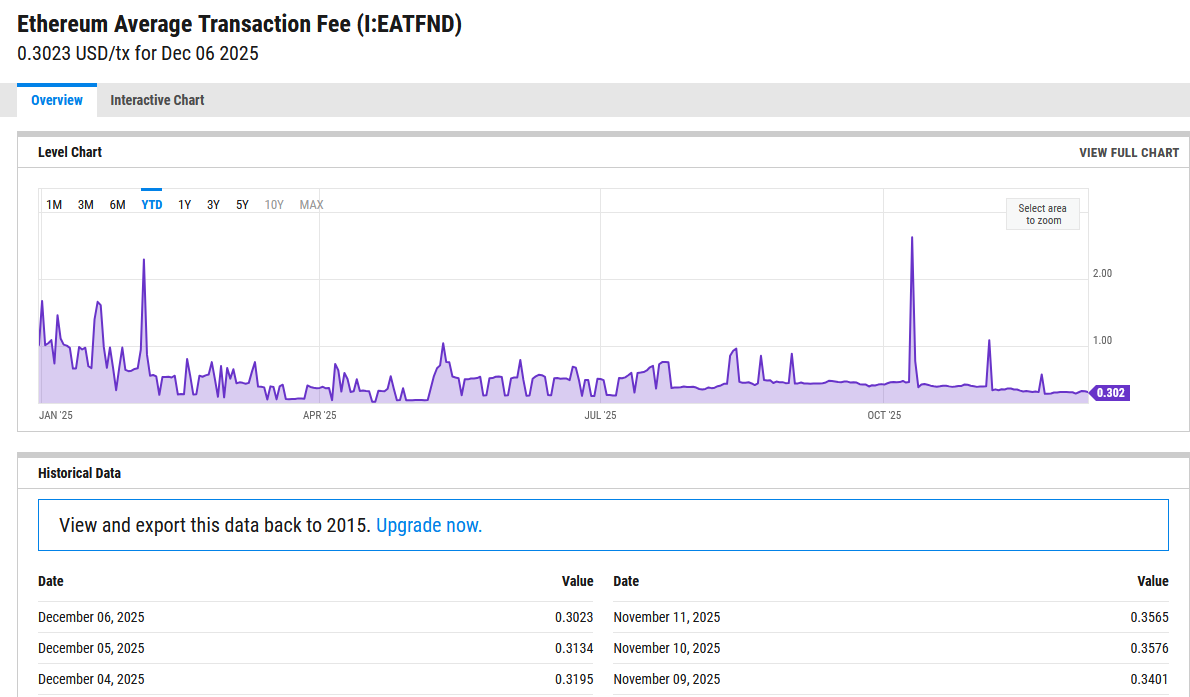

Vitalik Buterin Proposes Onchain Gas Futures to Stabilize Ethereum Fees

Trading Moment: Markets Enter a Key Week Ending the Year, Bitcoin Holds Key Level at $86,000