XRP ETF Inflows Beat BTC and ETH ETFs, Signaling Rising Institutional Trust

- Spot XRP ETFs attracted $12.84M in a day while Bitcoin and Ethereum ETFs recorded net outflows.

- 21Shares’ TOXR fund began trading, adding a new U.S. spot XRP vehicle to existing BTC and ETH products.

Spot XRP exchange-traded funds booked a combined daily net inflow of $12.84 million on Dec. 4, according to data from SoSoValue. The flows came as total net assets in the products reached about $881.25 million, with XRP trading near $2.11 that day.

Franklin Templeton’s XRPZ ETF led the net inflows, adding about $5.70 million. Bitwise’s spot XRP ETF followed with $3.76 million, while the remaining inflow split across smaller issuers, the data shows. The figures point to steady demand for XRP exposure through regulated fund vehicles rather than direct token purchases.

XRP ETF Daily Net Inflows Chart. Source: SoSoValue

XRP ETF Daily Net Inflows Chart. Source: SoSoValue

Trading activity was also strong across the main XRP funds, based on numbers from XRP Insights. Bitwise’s XRP ETF recorded about $10.10 million in daily volume, while Canary’s ETF turned over $6.86 million. Franklin Templeton’s XRPZ product traded roughly $5.60 million, REX-Osprey’s ETF saw $3.67 million, and the Grayscale XRP fund reported $2.57 million, bringing total daily volume to $28.80 million.

Taken together, the inflow and volume data show that spot XRP ETFs are attracting fresh capital and active trading interest in the early phase of their launch.

Bitcoin and Ethereum ETF Flows Show Weakness as XRP ETFs Post Gains

Bitcoin and Ethereum ETF flows turned negative on Dec. 4, underscoring a sharp contrast with the positive inflows recorded by newly launched spot XRP products. The day’s data shows outflows across several major BTC and ETH issuers, even as XRP ETFs drew $12.84 million in net inflows.

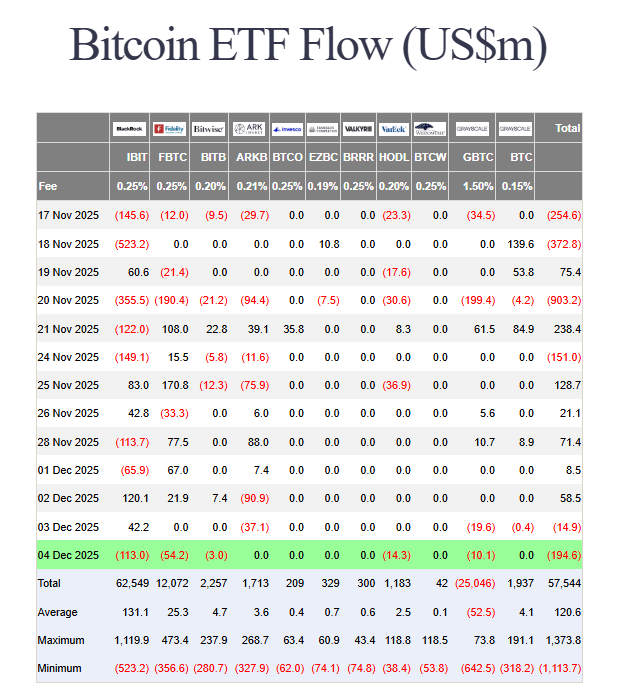

Bitcoin ETFs recorded a combined outflow of about $194.6 million on Dec. 4. BlackRock’s IBIT added $113 million, yet the gains were outweighed by sizable redemptions from Fidelity’s FBTC, which saw $54.2 million in outflows, and Grayscale’s GBTC, which lost $10.1 million. The broader BTC group ended the session in negative territory, continuing a multi-day pattern of uneven demand.

Bitcoin ETF Daily Flows Table. Source: Farside Investors

Bitcoin ETF Daily Flows Table. Source: Farside Investors

Ethereum ETFs followed the same direction. The category reported a total outflow of $41.5 million on Dec. 4, led by redemptions from Fidelity’s FETH fund, which saw $17.9 million leave. Grayscale’s ETHE and EZET also posted withdrawals of $31.0 million and $21.0 million, respectively. Even with modest inflows into smaller issuers, the group remained net negative for the day.

Ethereum ETF Daily Flows Table. Source: Farside Investors

Ethereum ETF Daily Flows Table. Source: Farside Investors

Against this backdrop, XRP ETFs stood out with clear net inflows and consistent early trading volume. The figures highlight a shift in investor flows across the three largest digital asset ETF categories, with XRP products gaining momentum while Bitcoin and Ethereum ETFs experienced renewed pressure.

21Shares U.S. Spot XRP ETF Debuted After SEC Green Light

21Shares’ U.S. spot XRP ETF began trading on Monday after the SEC cleared its 8-A filing dated Nov. 7, as previously mentioned in our report, which became effective following the standard review period. The fund, listed under the ticker TOXR, carried a 0.50% management fee and targeted $500,000 in initial capital.

It tracked the CME CF XRP–Dollar Reference Rate (XRPUSD_NY), calculated by a regulated benchmark provider, so investors gained direct exposure to XRP’s spot price through regular brokerage accounts.

]]>You May Also Like

Metaplanet 50M Bitcoin Loan and BTC Relief Rally

XRP Price Target Of $19.20 Within Six Months Still In Play, Says Analyst