Zcash Recovery Begins: Will the Bulls Push ZEC Price To $500 This Weekend?

The post Zcash Recovery Begins: Will the Bulls Push ZEC Price To $500 This Weekend? appeared first on Coinpedia Fintech News

Zcash (ZEC) price is witnessing a sharp shift in sentiment as traders quickly flip bullish following a wave of short liquidations that hit the market over the past few hours. The sudden unwind of bearish positions has injected fresh upside momentum into ZEC, lifting expectations that the privacy token may be preparing for a short-term price recovery.

With volatility rising and liquidity improving across the ZEC derivatives market, analysts are now watching whether the token can reclaim its pivotal support zone before the weekend.

Short Liquidations Trigger a Bullish Shift

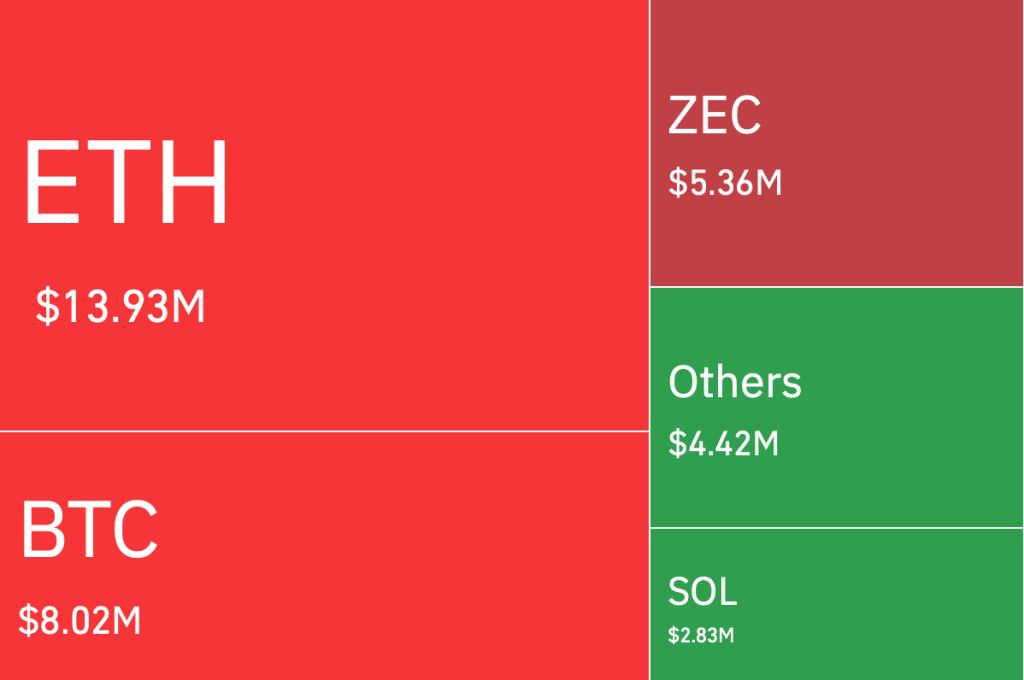

In the past 12 hours, the Zcash price has faced the third-largest short liquidations after Bitcoin and Ethereum. Zcash’s latest upswing began when a cluster of short positions was wiped out within a tight trading window, creating a classic short-squeeze effect. This forced bearish traders to exit their positions at market price, adding buy-side pressure and accelerating the reversal.

The ZEC liquidations have hit over $5.36 million in the past 12 hours and over $7.39 million in the past 24 hours. The liquidation spike also sent open interest lower—a sign that speculative shorts are being flushed out. Historically, such phases often mark the beginning of a relief rally or a momentum shift in mid-cap altcoins like ZEC.

Following the squeeze, ZEC’s momentum indicators have begun to stabilize and turn higher:

- Buying volume has increased across major spot exchanges

- RSI is recovering from oversold zones, hinting at renewed strength

- Short-term EMAs are beginning to flatten, reducing the downside slope

- Market depth shows improved bid-side liquidity compared to earlier in the week

Together, these signals suggest that Zcash may be entering the early stages of a bullish reversal rather than just a temporary bounce.

Key Levels to Watch: Can ZEC Reclaim Its Pivotal Support?

The next major test for ZEC will be whether bulls can push the price back into its critical support-turned-resistance region. Reclaiming this zone would confirm a stronger reversal and open the door for further upside.

If bullish momentum continues:

- ZEC could retest the immediate resistance

- A confirmed breakout may fuel a fresh impulse rally

- Market sentiment would shift decisively away from the downtrend narrative

If momentum stalls:

- ZEC may fall back into its lower consolidation range

- Loss of volume could limit any sustainable upside

- The market may remain neutral until stronger catalysts emerge

For now, bulls are showing stronger control than earlier in the week, but the follow-through in the next 24–48 hours will be crucial.

The ZEC chart shows a strong rebound from the 0.5 Fibonacci retracement at ~$392, signalling buyers defending a key level. Price is forming a potential double-bottom structure near the 0.382 Fib zone after a prolonged correction. MACD shows decreasing bearish momentum with a possible bullish crossover forming, while the RSI has rebounded from oversold territory, indicating improving strength. Volume spikes on green candles confirm renewed accumulation, suggesting ZEC may attempt a move toward the 0.618 Fib at ~$475 if momentum is sustained.

The Road Ahead: Weekend Movement Will Be Key

If the Zcash (ZEC) price maintains its current momentum, the token stands a solid chance of reclaiming its key support zone before the weekend. Doing so would strengthen the case for a broader trend reversal and could set the stage for more bullish price action heading into next week.

However, traders should remain cautious: the reversal is still in early stages and requires stronger confirmation through volume and higher highs.

You May Also Like

Tether CEO Delivers Rare Bitcoin Price Comment

Litecoin Forms Ascending Triangle: LTC Price Target $90 Breakout