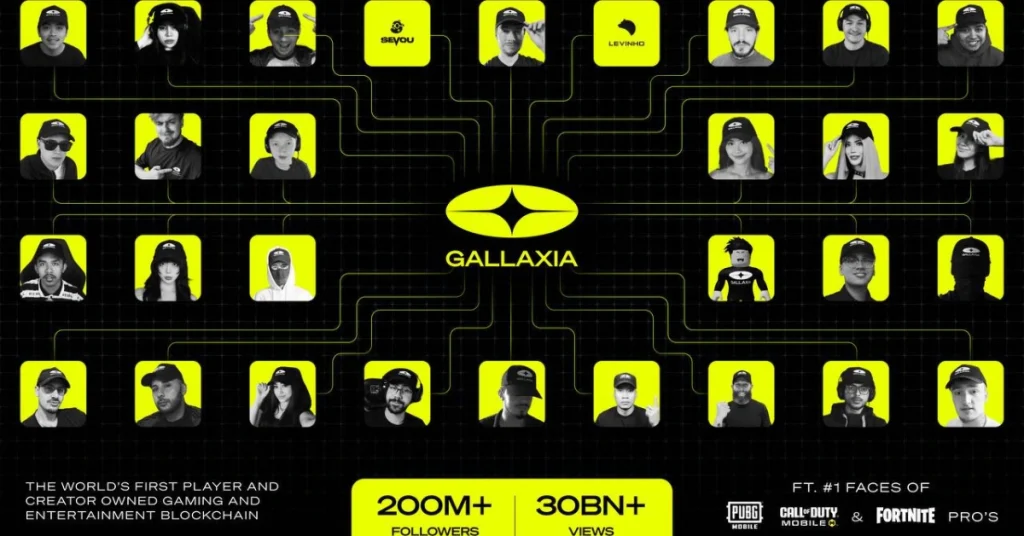

Panda, iFerg, Levinho and 50 Other Top Creators Launch Gallaxia, a Player-Owned Gaming Studio

The post Panda, iFerg, Levinho and 50 Other Top Creators Launch Gallaxia, a Player-Owned Gaming Studio appeared first on Coinpedia Fintech News

The 200M-follower collective behind Gallaxia is fusing creator ownership, AAA gameplay, and entertainment infrastructure to redefine how games are built, owned, and distributed.

In one of the largest creator-led movements in entertainment history, 50 of the world’s most influential gaming creators have joined forces to launch Gallaxia, the first player-owned gaming and entertainment studio, built to merge creator influence, global distribution, sports and entertainment partnerships, and AAA-level gameplay under one ecosystem.

Gallaxia merges viral game-loops AAA-grade gameplay, creator ownership, and cross-platform entertainment distribution under a single ecosystem, reshaping how games and digital content are built, owned, and monetized in the new creator economy.

Co-founded by the biggest PUBG Mobile creators in the world, Panda, Levinho, and Sevou, and former Chelsea FC footballer James Ashton, Gallaxia represents a paradigm shift in creator-led gaming — an interactive studio built by its creators. Together, the group commands over 200 million followers and 30 billion social media views, forming the largest creator-led collective in the history of interactive entertainment.

Panda, co-owner of Gallaxia & one of the world’s most-watched mobile gaming creators, said:

While many creator-led gaming and entertainment ventures collaborate with top creators for short-term campaigns, Gallaxia flips the model, turning some of the world’s biggest gamers and creators into long-term owners and builders within the ecosystem. Each creator holds ownership benefits via Gallaxium Bars — limited digital assets tied to revenue from every game and product released on the network.

Levinho, co-owner of Gallaxia, said:

iFerg (left) and James Ashton (right), co-owners of Gallaxia, during the Planet-X launch shoot in the Dubai desert.

iFerg (left) and James Ashton (right), co-owners of Gallaxia, during the Planet-X launch shoot in the Dubai desert.

Sevou, co-owner of Gallaxia, said:

Migrating soon to the Gallaxia chain, Planet-X will serve as the flagship game, a treasure-hunt shooter where players compete daily for real-world prizes. The game has already achieved 300,000 verified sign-ups and over $500,000 in early sales before its official marketing push. Planet-X integrates live creator events, digital item ownership, and real-world rewards — positioning itself as the perfect model for Gallaxia’s creator-driven distribution model.

Early test campaigns have already proven Gallaxia’s built-in network effect: a single stealth post by three co-owners generated 2.4 million views and 10,000 new followers within 48 hours. With 50 creators cross-promoting across platforms, each major event is projected to reach tens of millions of players in real time.

James Ashton, co-owner of Gallaxia, said:

Gallaxia is also teaming up with global superstars to deliver one-of-a-kind prizes and experiences money can’t buy. They’re kicking things off with 2025 NBA Champion Isaih Joe who’s dropping signed jerseys into Planet-X and GO-hunt the virtual AR treasure hunt experience.

About Gallaxia

Gallaxia is the world’s first player-owned gaming and entertainment studio, co-owned by over 50 of the most recognized gamers and creators on the planet who have driven over 30 billions views collectively online. With unmatched built-in distribution from day one, Gallaxia focuses on viral, mass-appeal game concepts designed for effortless content creation and engagement.

Unlike most creator-led gaming projects that struggle to attract top talent or reach mainstream audiences, Gallaxia has achieved both, becoming the first chain to successfully onboard globally recognized talent while pioneering a true co-ownership model.

The Gallaxia Foundation is the creator of $GLX protocol, an ecosystem utility token that powers the games on Gallaxia and the chain.

About Planet-X

Planet-X is a free-to-play mobile treasure-hunt shooter where players compete daily for real-world prizes. Imagine a fusion of The Hunger Games and Ready Player One, where players compete in a giant game-show-style experience, and when they successfully extract prizes in-game, those rewards are delivered straight to their homes in real life.

You May Also Like

⚡ Real-Time Scoring API Integration — <3-Second Updates for Fantasy & Betting Apps

Why Tom Lee’s BitMine Is Buying Ethereum (ETH) Aggressively Despite Market Fear