Ethereum Faces Mixed Signals at This Critical Price

Ethereum price is attempting once again to break free from the long-standing $3,000 barrier, but the effort has stalled. After briefly moving higher, ETH slipped back toward this support range, signaling that the market remains divided.

While bullish momentum is slowly returning, investor impatience could weigh on recovery if a clear direction fails to emerge soon.

Ethereum Investors Could Sell Their ETH

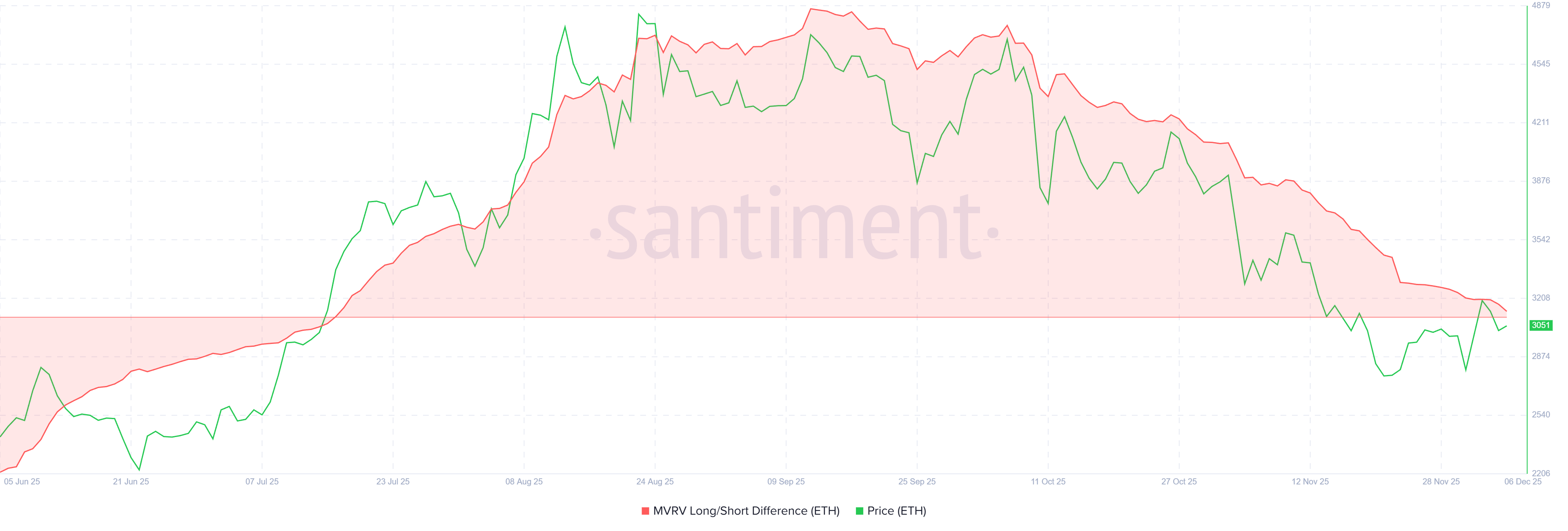

The MVRV Long/Short Difference is nearing the neutral line, signaling a potential shift in profit dominance between long-term and short-term holders. This metric tracks whether long-term holders (LTHs) or short-term holders (STHs) are realizing more gains. For Ethereum, a drop below the neutral line would mean STHs hold the majority of unrealized profits.

This shift is important because STHs historically sell quickly at the first sign of weakness. If they begin taking profits near $3,000, ETH could face renewed selling pressure. This behavior has often stalled previous recovery attempts, making sentiment fragile despite broader bullish signals.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum MVRV Long/Short Difference. Source: Santiment

Ethereum MVRV Long/Short Difference. Source: Santiment

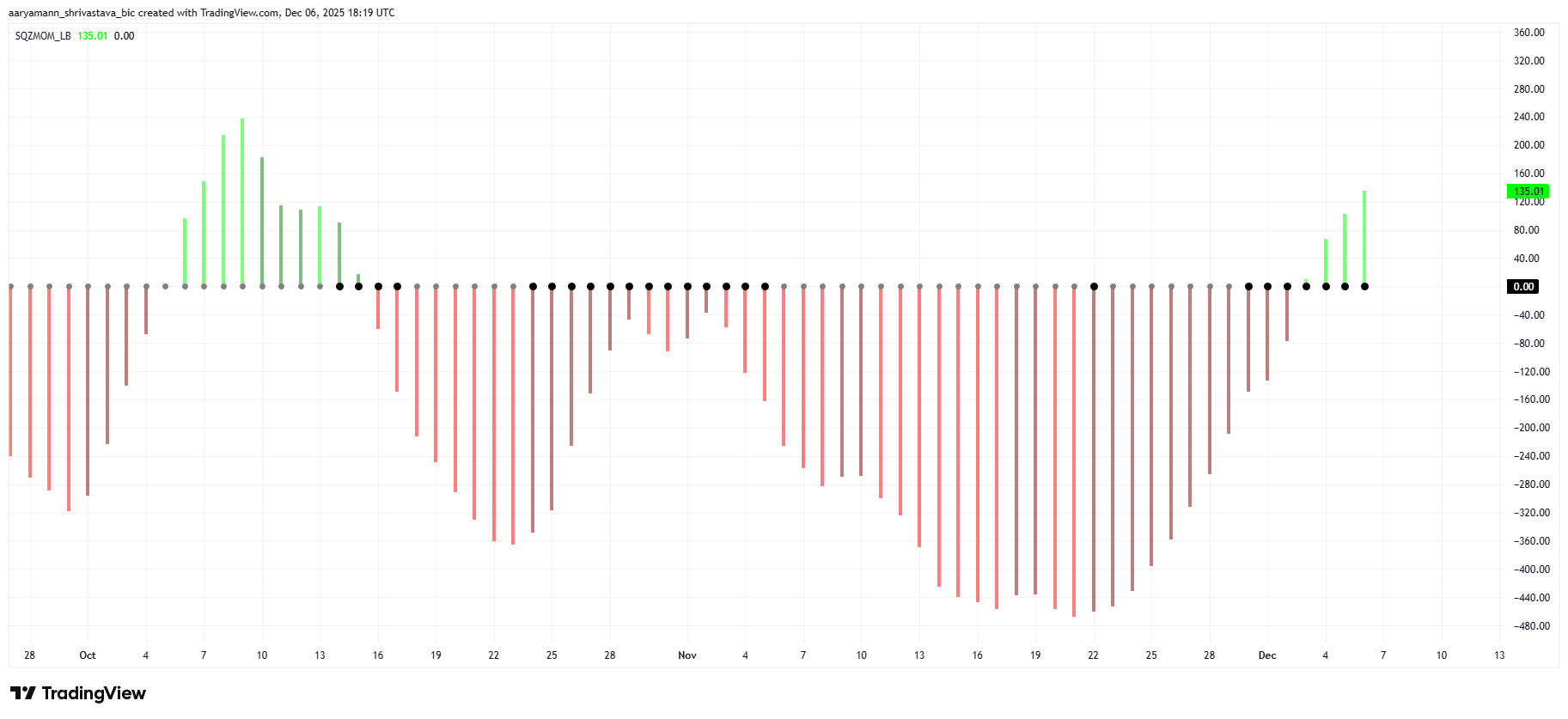

The squeeze momentum indicator adds another layer of complexity. ETH is currently experiencing a squeeze build-up, which occurs when volatility tightens and momentum compresses.

This usually precedes a strong directional move. The histogram indicates that bullish momentum is strengthening, suggesting that once the squeeze is released, price acceleration may follow.

If bullish momentum continues to grow during this period, ETH may benefit from a volatility expansion to the upside. This setup has preceded rallies in earlier cycles, though confirmation depends on market participation and whether buyers step in at $3,000.

ETH Squeeze Momentum Indicator. Source: TradingView

ETH Squeeze Momentum Indicator. Source: TradingView

ETH Price Might End Up Falling Again

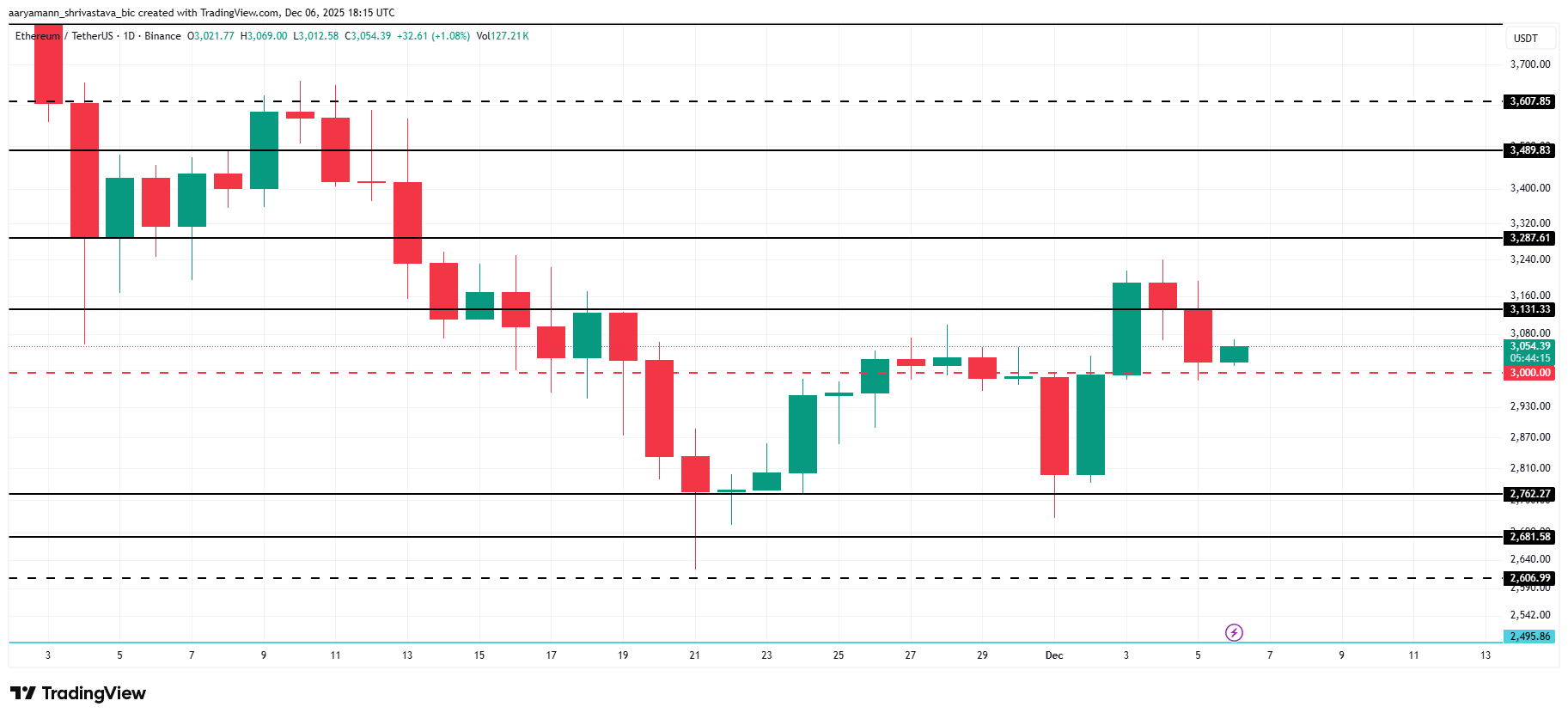

Ethereum is trading at $3,045 and remains above the critical $3,000 support level. Over the last several days, ETH has hovered tightly around this zone, signaling indecision among traders as market cues shift.

The mixed signals suggest that ETH may continue to move sideways near $3,000 in the short term. A breakdown triggered by STH profit-taking or broader market skepticism could push Ethereum toward $2,762 before stabilizing.

ETH Price Analysis. Source: TradingView

ETH Price Analysis. Source: TradingView

However, if bullish momentum strengthens alongside favorable macro conditions, ETH could climb past $3,131 and target $3,287. A clean break above these levels would invalidate the bearish outlook and set the stage for a broader recovery phase.

You May Also Like

Turning Points in the Bitcoin Market: A Deep Dive into Future Price Moves

‘Alien Earth’ Composer Jeff Russo Dives Into Score For FX Series