Bitcoin Profitability Reaches Near 2024 Levels—What It Means for Traders

Bitcoin Market Shows Signs of Reset After Price Drop Below $90,000

Recent analysis indicates that Bitcoin has experienced a significant shift in market dynamics, following a decline below the $90,000 mark. Data suggests a “complete reset” of sell pressure, with long-term holders ceasing aggressive sales and a cooling period taking shape after a volatile period of ups and downs.

Key Takeaways

- Bitcoin long-term holders have largely halted their selling activity as the cryptocurrency recovers from recent lows.

- The flagship digital asset’s profit metrics have hit two-year lows, signaling a possible shift in market sentiment.

- Short-term traders reacted sharply to recent price movements, resulting in erratic market behavior.

- Indicators point towards a market cooldown rather than continued distribution by major holders.

Tickers mentioned: Bitcoin

Sentiment: Neutral

Price impact: Negative, as the recent price correction suggests a period of consolidation and uncertainty.

Market context: The recent decline reflects broader trend recalibrations within the cryptocurrency ecosystem amid macroeconomic uncertainties.

Market Analysis and Insights

According to onchain analytics platform CryptoQuant, Bitcoin’s long-term holders, classified as wallets holding BTC for over 155 days, have effectively stopped selling as the price dipped to around $89,700. This pause signals a potential shift towards market stabilization, as these investors typically hold through volatility, indicating confidence in long-term fundamentals.

Bitcoin LTH-SOPR/STH-SOPR (14-period simple moving average). Source: CryptoQuantCryptoQuant highlights a significant decline in the SOPR ratio — which measures the profitability of unspent transaction outputs — to 1.35, its lowest since early 2024. This decline coincides with the recent price correction and suggests a market reset, moving away from the speculative froth that characterized earlier parts of the cycle.

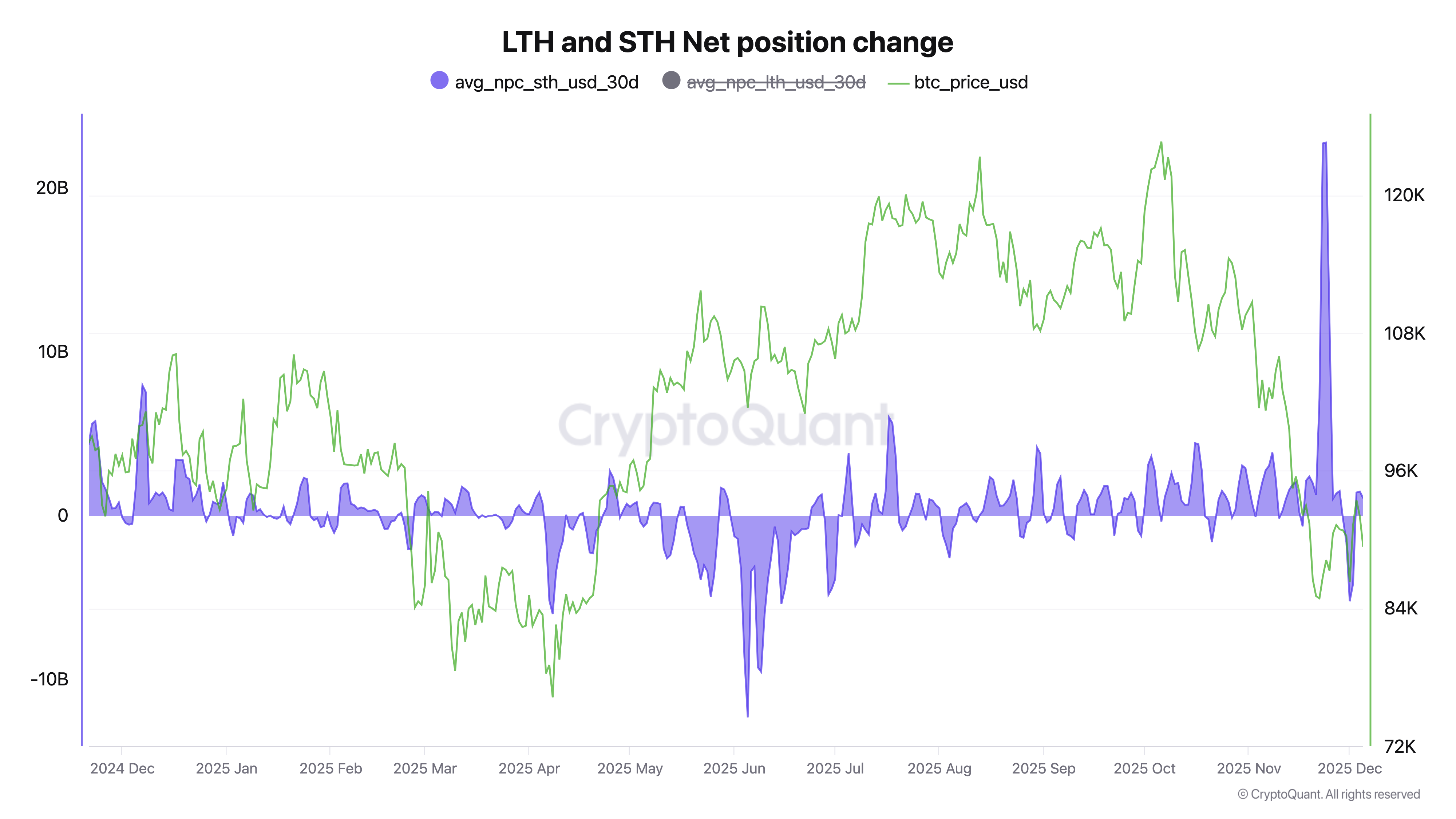

Moreover, traders and short-term holders have responded with heightened volatility. CryptoQuant notes that the net position change for short-term holders saw a notable spike on November 24, but this was followed by a sharp reversal around December 1, as Bitcoin experienced another decline near the start of the month.

Bitcoin STH 30-day rolling net position change. Source: CryptoQuant

Bitcoin STH 30-day rolling net position change. Source: CryptoQuant

While these fluctuations denote typical trading reactions to market corrections, analysts suggest it marks a broader cooling down rather than aggressive distribution by major investors. The recent data underscores a market that might be transitioning from speculative exuberance into a more cautious phase, emphasizing long-term hold strategies over short-term trades.

This evolving landscape indicates that, despite recent volatility, Bitcoin remains resilient, with fundamental investors no longer rushing to sell at lows. As macroeconomic conditions remain uncertain, traders should remain cautious, observing how markets stabilize moving forward.

This article was originally published as Bitcoin Profitability Reaches Near 2024 Levels—What It Means for Traders on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Tether CEO Delivers Rare Bitcoin Price Comment

Litecoin Forms Ascending Triangle: LTC Price Target $90 Breakout