ZachXBT: British Hacker Linked to $243M Genesis Theft Likely Nabbed in Dubai

A suspected British hacker linked to one of the largest single Bitcoin thefts ever recorded may have been detained in Dubai, according to claims made Friday by on-chain investigator ZachXBT.

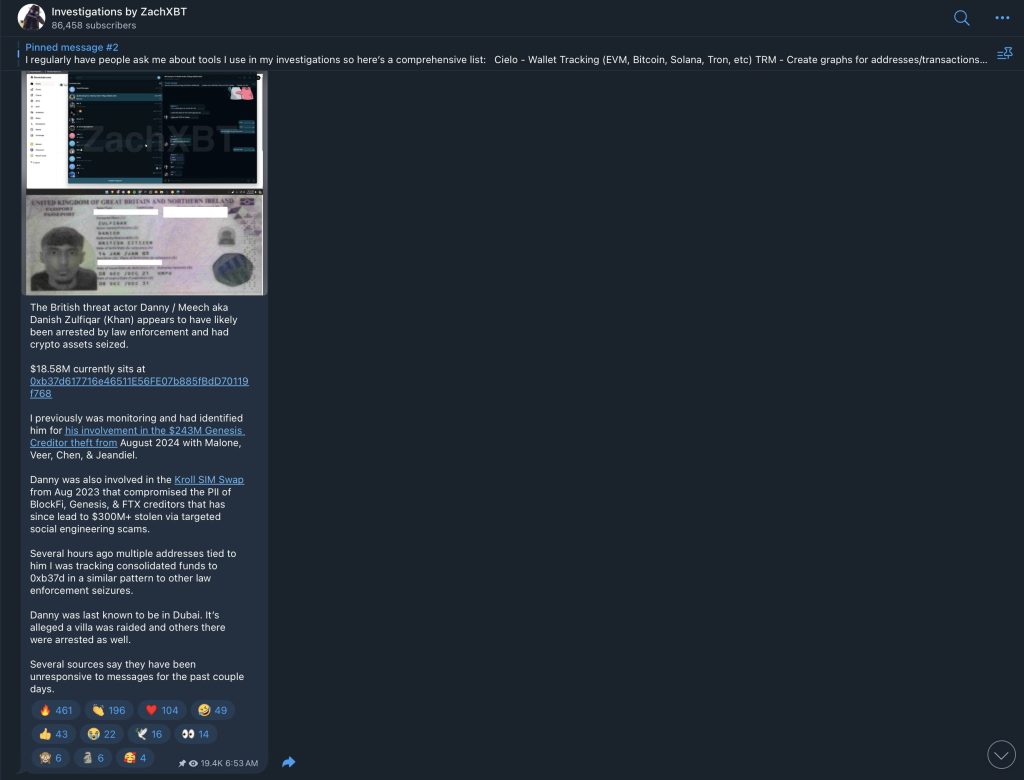

In a post shared on his Telegram channel on December 5, ZachXBT said a man known online as “Danny” or “Meech,” identified as Danish Zulfiqar, appears to have been taken into custody by authorities, with a portion of the stolen crypto allegedly seized.

Source: ZachXBT

Source: ZachXBT

He pointed to roughly $18.58 million in digital assets now held in a single Ethereum wallet that he says is connected to the suspect.

ZachXBT noted that several wallets previously tied to the alleged hacker had funneled funds into the same address in a pattern commonly seen during law enforcement seizures.

He also claimed Zulfiqar was last known to be in Dubai, where a villa was reportedly raided.

According to the investigator, others linked to the suspect have also gone silent in recent days.

So far, there has been no official confirmation from Dubai Police or UAE authorities regarding any arrest, asset seizure, or raid connected to the case.

Local media outlets in the region have also not verified the claims.

The possible arrest follows months of investigation into the August 19, 2024, theft of 4,064 Bitcoin, worth about $243 million at the time. The funds were taken from a single Genesis creditor who accessed assets through Gemini.

ZachXBT made the case public in September, alleging the theft was carried out through a coordinated social engineering attack.

According to his findings, the attackers posed as Google support staff and convinced the victim to reset two-factor authentication.

They then used remote access software to take control of the account. After extracting the private keys, the attackers drained the wallet and moved the Bitcoin through a web of exchanges and swap services in an attempt to launder the funds.

ZachXBT initially tied the attack to three online aliases, “Greavys,” “Wiz,” and “Box”, later naming Malone Lam, Veer Chetal, and Jeandiel Serrano as the people behind those accounts.

He said his findings were shared with law enforcement authorities.

U.S. Charges, UK Guilty Plea, Thailand Arrest Mark New Phase of Crypto Crime Probes

U.S. prosecutors later filed criminal cases connected to related activity. In September 2024, the Department of Justice charged two suspects in a $230 million crypto fraud scheme.

Broader racketeering charges later described an operation totaling more than $263 million, including the Genesis-linked Bitcoin theft. Court documents outlined a mix of SIM swaps, social engineering tactics, and even physical burglaries.

Prosecutors said the stolen funds were spent on high-end cars, travel, and nightlife. One of the defendants, Veer Chetal, was later accused of carrying out another $2 million crypto theft while out on bond.

ZachXBT has also connected Zulfiqar to the August 2023 Kroll SIM swap incident, which exposed the personal data of creditors tied to BlockFi, Genesis, and FTX.

That breach later played a role in more than $300 million worth of crypto thefts through follow-up phishing and impersonation schemes.

The reported Dubai development comes as crypto-related law enforcement activity continues to pick up worldwide.

In October, Thai authorities arrested Liang Ai-Bing in Bangkok over an alleged $31 million crypto Ponzi scheme that ZachXBT had previously exposed.

In the UK, authorities recently secured a guilty plea from Zhimin Qian in a case tied to what officials described as the largest crypto seizure in history, involving more than $6.7 billion in Bitcoin.

Outside of investigations, ZachXBT has also remained active in public disputes.

In November, he clashed with UFC fighter Conor McGregor over comments about Khabib Nurmagomedov’s NFT project, redirecting attention to McGregor’s own failed meme coin venture earlier this year.

You May Also Like

XRP Potential Double Bottom Strengthens Amid Ripple’s 250M Transfer

CME Group to Launch Solana and XRP Futures Options