XRP price forms triangle pattern at $2.00, breakout nearing

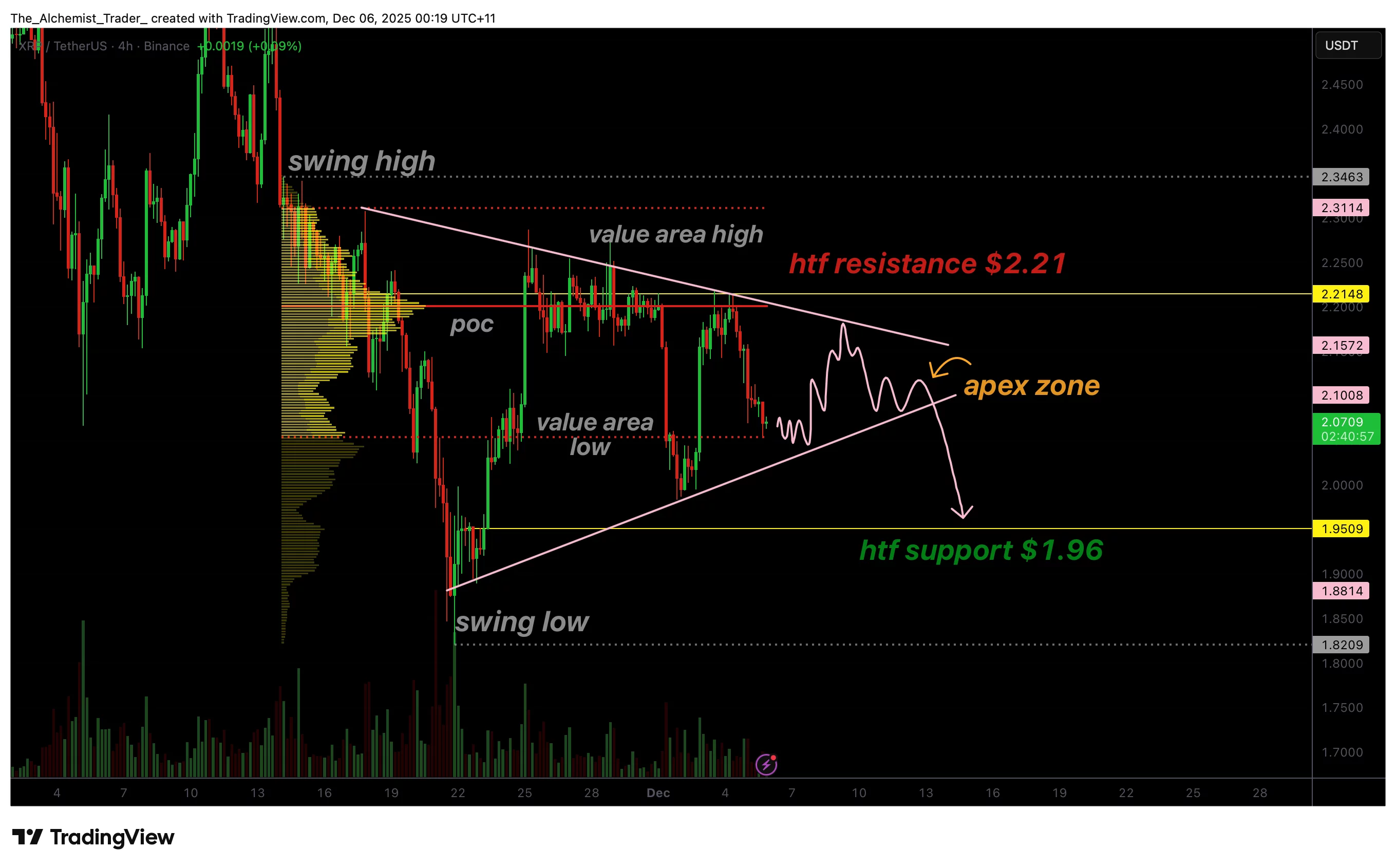

XRP price is compressing within a tight triangle pattern at the key $2.00 support zone as volatility drops. A breakout is approaching, with the bearish macro trend influencing the likely direction.

- XRP forms a tight triangle pattern between $2.00 support and $2.20 resistance.

- Declining volume confirms consolidation toward a breakout apex.

- Macro bearish trend favors downside, unless bulls reclaim $2.20 with strength.

XRP (XRP) price is entering a critical phase of price compression as it forms a clear triangle pattern around the $2.00 region during the U.S. session. The market has tightened significantly over the past several days, creating an apex structure that typically precedes a strong breakout.

With major resistance overhead and weakening volume, the breakout, upside or downside will depend on how XRP behaves as it approaches the apex of this triangular formation.

XRP price key technical points

- XRP is consolidating into a triangle pattern with an apex forming near the $2.00 region.

- Major resistance sits at $2.20, aligning with the point of control and higher-time-frame rejection zones.

- Declining volume indicates compression, signalling a breakout is nearing.

XRP’s recent price action reveals a well-defined triangular consolidation pattern. This pattern has been forming as price repeatedly interacts with significant resistance at $2.20. This level is reinforced by multiple technical confluences, including the point of control, high-time-frame resistance, and the descending trendline forming the top boundary of the triangle. XRP has already faced several rejections from this region, each time pushing price back toward lower levels and tightening the overall range.

Interestingly, even as whales continue accumulating XRP and Bitcoin rallies over 36 percent, many investors are still exploring alternatives like BZHash for more stable and predictable returns, highlighting broader uncertainty around XRP’s near-term direction.

Triangle patterns often signal equilibrium between buyers and sellers before a substantial directional expansion. The declining volume profile reinforces this interpretation, as volume usually contracts significantly during the buildup to an apex.

This decline in volatility is an essential component of the pattern, and once the breakout occurs, the volume profile typically expands sharply. This expansion confirms the breakout’s legitimacy and provides insight into whether the move is sustainable.

At this stage, XRP remains within the bounds of the triangular formation, and its short-term direction will be dictated by how the price behaves as it enters the apex. Because the broader macro trend remains bearish, there is a slightly higher probability that the breakout will occur to the downside. If XRP breaks below the $2.00 value area low with increasing volume, the next support levels will become primary areas of interest for traders.

Market participants are also taking note of broader developments, such as CME’s introduction of new pricing and volatility indices for major assets including Bitcoin, Ether, Solana and XRP, which may influence sentiment as the breakout approaches.

Structurally, XRP remains in a tightening consolidation that typically precedes a decisive move. As long as price continues to respect the boundaries of the triangular pattern, the market will remain in a compressed state. This compression ensures that the eventual breakout can be explosive, regardless of direction.

What to expect in the coming price action

A breakout is nearing as XRP approaches the apex of the triangle. A downside move is slightly more probable due to the macro bearish trend, but an upside breakout remains possible if XRP reclaims $2.20 with strong volume.

You May Also Like

Reddit Adds Global Teen-Safety Tools Ahead of Australia Social Media Ban

RST Hits $16B Market Cap: The Rise of a GameFi 4.0 Giant